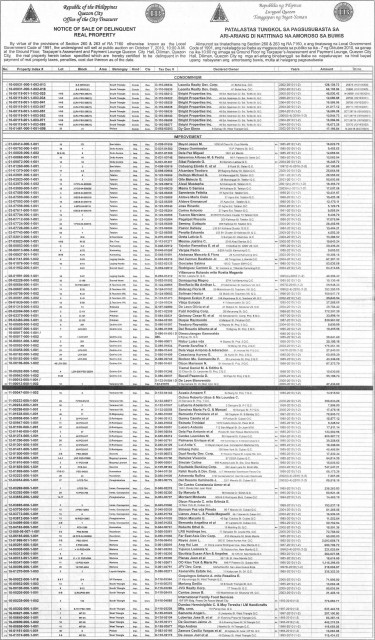

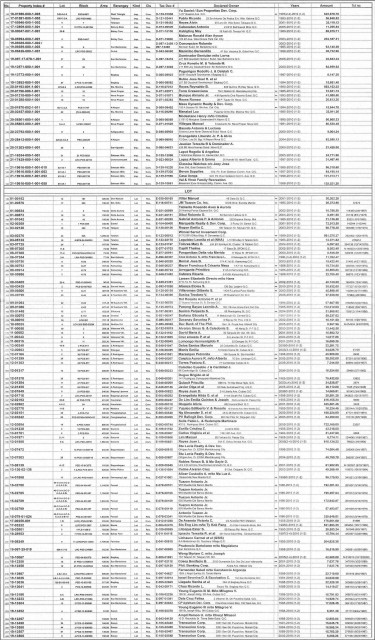

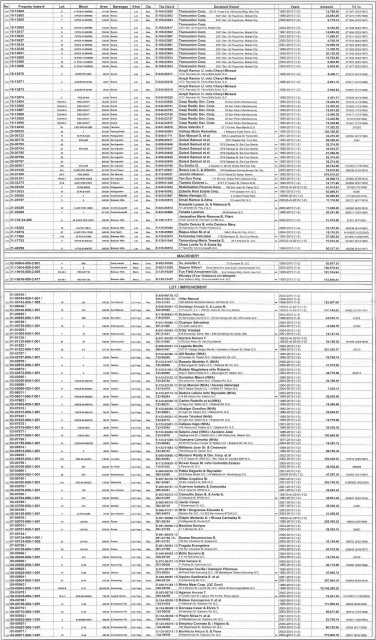

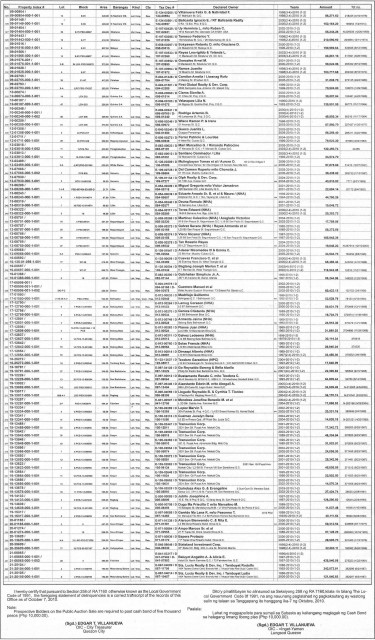

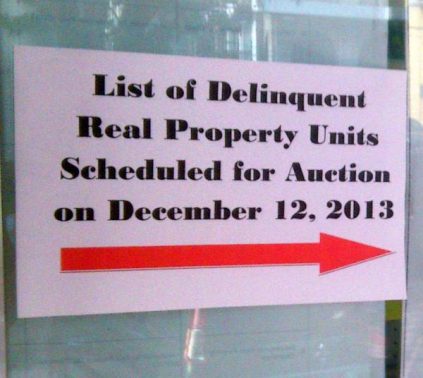

As a follow-up to my previous post on the notice issued by the Quezon City Treasurer’s Office, this post contains the complete list of tax delinquent properties for sale through public auction on October 7, 2010, by virtue of Section 260 and 263 of RA 7160, otherwise know as the Local Government Code of 1991. The venue of the auction shall be the Ground Floor, Taxpayer’s Assessment and Payment Lounge, Quezon City Hall, Diliman, Quezon City, Philippines. The tax foreclosure auction starts at 10:00am.

Checkout the complete list of tax delinquent properties for sale below, as published last September 20, 2010. Just click on the thumbnail to download each page.

Source: Philippine Star, September 20, 2010, pages B-10 to B-13

Don’t forget to read my previous post to get more information if you are interested in this tax foreclosure auction of delinquent real property in Quezon City

Happy hunting!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter:http://twitter.com/jay_castillo

Find us in Facebook:Foreclosure Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Are you a new visitor? Click here NOW to start learning more about foreclosure investing in the Philippines

PPS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Inbox getting full? Subscribe through my RSS Feed instead!

SINCE THE ADDRESS POSTED IS THE OWNERS ADDRESS AND NOT THE LOT ADDRESS, CAN YOU PLEASE ADVICE ME AS TO HOW I CAN BEGIN TO CHOOSE WHICH LOTS TO CHECK THE TCT?

DOES IT COST MONEY TO CHECK THE TCT FOR THE ADDRESS?

DOES IT TAKE A LONG TIME TO CHECK THE TCTs?

mORE POWER TO YOU

need to talk to you asap re properties….cel no…0917 8822207 thanks

That is correct. the registered/declared owner or any person acting in his behalf has one year from the date of sale within which to redeem the property by paying the amount of delinquent taxes, cost of sale, other charges and interest equivalent to 2% per month computed from the date of sale up to the time of redemption.

If you are outside the country, you may bid through a representative, specially authorized to cast bid in your behalf.

If you are interested, i can help you.

does this mean that even if we win the bidding, there is no assuarance that the property would be ours even if we have paid for the full amount already? How do we bid if we are out of the country

Pingback: Tweets that mention Complete list of Quezon City delinquent real property for public auction published

Hi Sir Jay,

I’m mike and thanks for building a foreclosure webby like this one. Very much appreciated specially for beginning investor like me. May i know po, what are delinquent properties? how is it different from foreclosed properties? what is more cheaper and better to invest with among the two? thanks and 100 thumbs up to your site.

Hi Mike, your welcome and thanks for the kind words!

Tax delinquent properties are properties that are to be foreclosed by the local government due to the owners failure to pay their real property taxes. Tax delinquent properties are cheaper but you earn up to a maximum of 24% only and you have to pay in full if you win on your bid. You also have to wait for 1 year in order for the owner to redeem the property, afterwhich you get your money back plus interest, unless the owner fails to redeem the property. If it is not redeemed, the property becomes yours.

Thanks Sir Jay for the inputs,

Is it the same scheme with bank foreclosed properties, 10%DP and 90% bank finance?

In terms of the 10%DP, normally how many days should i pay the winning bidder both when applied in bank and government bidding?

Thank you

This is an entirely different scheme. After you were declared as the winning bidder, you have until the end of the day within which to pay the bid price in full.

Unless the City Treasurer agrees to accept payment on the following day, he has the right/authority to cancel your bid and declare instead the second higest bidder as the winning biider.

Even if the property is not redeemed within the redemption period, that is not an assurance that the property is yours.

That holds true even if the city treasurer already issued the final bill of sale.

The provision of the local government code respeceting the auction sale should be read in conjunction with the provision of the property registtration law.

Do you mean that if I win a bid and has registered it and have waited for a whole year, the property can still be redeemed by the owner?