Do you want to know your rights as a real estate investor, or simply as a real estate buyer who is making installment payments?

The first logical step would be to know what law applies and what that particular law contains, which in this case would be the full text of Republic Act No. 6552, which is more popularly known as the Maceda Law.

The full text of RA 6552 follows.

REPUBLIC ACT NO. 6552

REALTY INSTALLMENT BUYER PROTECTION ACT

AN ACT TO PROVIDE PROTECTION TO BUYERS OF REAL ESTATE ON INSTALLMENT PAYMENTS

Section 1. This Act shall be known as the “Realty Installment Buyer Act.”

Sec. 2. It is hereby declared a public policy to protect buyers of real estate on installment payments against onerous and oppressive conditions.

Sec. 3. In all transactions or contracts involving the sale or financing of real estate on installment payments, including residential condominium apartments but excluding industrial lots, commercial buildings and sales to tenants under Republic Act Numbered Thirty-eight hundred forty-four, as amended by Republic Act Numbered Sixty-three hundred eighty-nine, where the buyer has paid at least two years of installments, the buyer is entitled to the following rights in case he defaults in the payment of succeeding installments:

(a) To pay, without additional interest, the unpaid installments due within the total grace period earned by him which is hereby fixed at the rate of one month grace period for every one year of installment payments made: Provided, That this right shall be exercised by the buyer only once in every five years of the life of the contract and its extensions, if any.

(b) If the contract is cancelled, the seller shall refund to the buyer the cash surrender value of the payments on the property equivalent to fifty per cent of the total payments made, and, after five years of installments, an additional five per cent every year but not to exceed ninety per cent of the total payments made: Provided, That the actual cancellation of the contract shall take place after thirty days from receipt by the buyer of the notice of cancellation or the demand for rescission of the contract by a notarial act and upon full payment of the cash surrender value to the buyer.

Down payments, deposits or options on the contract shall be included in the computation of the total number of installment payments made.

Sec. 4. In case where less than two years of installments were paid, the seller shall give the buyer a grace period of not less than sixty days from the date the installment became due.

If the buyer fails to pay the installments due at the expiration of the grace period, the seller may cancel the contract after thirty days from receipt by the buyer of the notice of cancellation or the demand for rescission of the contract by a notarial act.

Sec. 5. Under Section 3 and 4, the buyer shall have the right to sell his rights or assign the same to another person or to reinstate the contract by updating the account during the grace period and before actual cancellation of the contract. The deed of sale or assignment shall be done by notarial act.

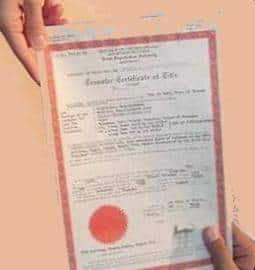

Sec. 6. The buyer shall have the right to pay in advance any installment or the full unpaid balance of the purchase price any time without interest and to have such full payment of the purchase price annotated in the certificate of title covering the property.

Sec. 7. Any stipulation in any contract hereafter entered into contrary to the provisions of Sections 3, 4, 5 and 6, shall be null and void.

Sec. 8. If any provision of this Act is held invalid or unconstitutional, no other provision shall be affected thereby.

Sec. 9. This Act shall take effect upon its approval.

Approved: August 26, 1972

Up next: Maceda Law salient features

Of course, this post will not be complete without covering the salient features of the Maceda Law. This will be covered in the next part of this series. Please watch for it.

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker Registration No. 3194

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines Facebook Page

Text by Jay Castillo and Cherry Castillo. Copyright © 2011 All rights reserved.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Mailbox getting full? Subscribe through my RSS Feed instead

![R. A. 9510 [Credit Information System Act (CISA)] 3 Credit Report](https://www.foreclosurephilippines.com/wp-content/uploads/2015/07/Credit-Report-2-432x378.jpg)

Pingback: How To Proactively Prevent Foreclosures (and NOT lose everything)

hello po

need ko lang po ng help

kumuha po kame ng rent to own house & lot pero hnd n po namen kaya ituloy pero more than 24months n payment n nabigay nmen sabi naman nila n marerefund namen yung 50% percent binigyan po kme ng computation pero nakalagay po dun,tinangal muna yung mga deductions bago nag apply ng maceda law tama po ba un..ang nakalagay po sa maceda law dapat ung 50% ng laht ng binayad ung hahatiin sa 50%

ito po ung mga deduction at computation.

Cost of money : 80,800 Admin charges : 20,000 Marketing Expenses : 80,800…Option money 7,500

total deductions : 189,100

total principal payment: 670,242

total amount: 481,142

Maceda law : 240,571

tanong ko lng po kung tama ung pag apply ng Maceda Law at mga deductions?

thank you po malaking tulong po samen yung answer nyo..

thanks po.

Hello po. This is Grace ofw po ako dto hk. Kumuha po ako haus n Lot sa pinas.bali 1.4M total payment.tapos nkabayad na po ako 2months plng don sa equity amounting P44,600. Ngayon pong month hindi na ako mgbabayad mgback out na po ako dahil sa financial problem.ask lng po my right pa po ba ako marefund yung nabayad ko? San po ako pwd humingi ng tulong? Kasi sabi nla sa contrata na pinirmahan ko no refund policy sila.

hi po…ask ko lang po ung maceda law po b iaapply after ng deductions..kukunin muna ung mga deductions like admin, oppurtunity cost at iba pang cost. or dapt po ung buong nabayad kasama ung downpayment hahatiin 50% tapos malinis n makukuha ni buyer ung 50% ng walang kaltas ano po b ung dapat.. really need your help.. hoping for your response thank you po…

hi po…ask ko lang po ung maceda law po b iaapply after ng seduction..kukunin muna ung mga deductions like admin, oppurtunity cost at iba pang cost. or dapt po ung buong nabayad kasama ung downpayment hahatiin 50% tapos malinis n makukuha ni buyer ung 50% ng wlang kaltas ano po b ung dapat.. really need your help.. hoping for your response thank you po…

Good day po sir ask lang po ako tungkol po sa Bank financing 2 months na po ako hind naka payment mga ilang buwan po bago nila bawiin yong bahay hind pa po namin natirhan yong bahay pero yong balance po namin babayaran ko lang pag akoy nakabalik ng work sa australia po kasi ako nakabase anu pong advice nyo sir thanks po

Hello po maaari papo ba namen marefund binayad namen sa house ganito po kse un kumuha po kame ng house sa isang subdivision una ngbayad po kame ng reservation fee 10000 then nkalagay sa contract eh need namen mgbayad ng down payment ng 380000 para malipatan na bhay eh after po namen mabayadan un umabot papo ng 600k plus bayad namen diparin gawa bahay nung una po eh nanghinge sila ng requirements nabigay namen then after nun kung ano ano na po dinadagdag nila na need daw ng checking account na wala naman sa napag usapan nung una ska sa contrct po eh 1800000 lng price ngaung huli po umaabot na sa 4.4 m price dahil pumasok naraw po sa inhouse ung payment sa bhay eh gang ngaun po di gawa bhay then ng decide po kme ipullout na lng bhay sbe nila matagal nadaw na pending bhay samen eh dinga po gawa bhay ni di kme nkalipat ask din sila ng request pull out letter help me po

anong developer po ito Profriends ba? kilalang notorius na developer yan pagdating sa realty scam. join PROFRIENDS REFUND, PROFRIENDS PROBLEMS VICTIMS advocacy community page. lahat ng may problema doon basta pagdating sa realty scam kahit anong developer pa basta may kabalbalan kinakalaban ng lahat.

Good morning Sir Jay, ask ko lang ho if the seller gave me 48 months to pay for 30% down payment & I already pay 41 months & I need to settle the turn-over balance & then I will pay na daw 4% every month of the TCP pero di ko pa ho siya na occupied, should I pay the 4% since they gave me 48 months to pay for the downpayment & I’m single parent na my husband died last 2013, I want to cancel na ho nahihirapan na ho ako sa monthly how much can I get from my cash out, thank you very much Sir Jay Castillo

hi maybe u cud help me…nag bayad ako ng half cash ng dp ko last mar. 01 for RFO then i decided to pullout my payment.. marrefund ko po b ung bnyad ko? kc ang inexplain lng smin is not refundable ung reservation ngaun umabot n kmi ng months for f/up ng status then bglang cnbi n according to maceda law nde daw refundable ung dnown ko… ibig b sbhin lht ng magbback out nde n nabbawi ung pera nla..so pano nmn ung skin almost half million ung dinown ko tpos ssbhin nla n nde n dw refundable

Good day!

My wife and I are both seafarer and most of the time is out of the country. We purchased a 64 sqm 2BR condo unit, it is on a 5 years 0% interest scheme with the developer. We have been paying all dues diligently and already payed more than 3 years. All sorts of communications was thru email, and every time we are on vacation we visit the show room which is very closed to the condo.

Main problem is when we got back from vacation May of 2014, we were advised that there were changes in the unit. the developer combined our unit with another unit without our consent and the unit became 94sqm. Only option given to us is 1.) pay the difference or 2.) move to a different unit. since we are on a budget, we allowed them to show us new computation for available unit same location. from 32nd floor they offered us 29th floor, But what’s funny is the 29th floor is almost the same price as the 32nd, (P1000 difference). so we refused. It took them about 5 months to produce us new offer which at this time we are already pissed, so we decided to demand what we have been paying for for the last 3 years which is 32nd floor 64 sqm unit.

We have met with the senior documentation officer last October and been promised to be contacted within a week, but did not get anything from her. I contacted the office, through phone calls, cellphone calls, sms and email but to no reply. Finally by chance I have met the President of the company and spoke to her, but only passed me to a different person. and so its gone in full circle.

to this date we have not sort anything yet, turnover should be December 2014 with 6 months grace period, i have sent an email requesting to hold payment (cc my bank) until we settle the shortcomings of the developer but they keep on depositing the checks (3 months now) which I now being charge of penalty by the bank (bounce check).

I have also contacted the HLURB through their contact us form but failed to get a response.

Can you kindly assist us on what we can do and should do? if you are in our shoe.

Thanks and more power!

John

Hi, sir! I have a question…. Kumuha po ako ng house and lot sa isang subd dito sa bulacan… Nakahulog na po ako ng 4 months plus reservation fee, toal po ng nahulog ko na is PHP86,000… I decided to cancel it na lang and get another one na mas mura ang terms of payment… May makukuha po ba akong refund for this? Thank you very much. Wala pa naman ko akong nasa-sign na kahit ano. I am an OFW po.

I have a house and lot agrrement as rent to own. I am the buyer, amounting 350,000 after i have down worth 217k they decided to increase the amount at 400k but i refused. The owner decided to find another buyer and will guve the full amount to me once the property be sold to another buyer. Almost 50 percent i gave to the buyer, can i fight for my right to stick to the original agreement?

Sir Jay magandang araw!

Aware po ba kayo sa Community Mortgage program ng Gobyerno? Nagtry po kasi kaming mag-avail nito dahil mayroon pong nag-ooffer dito sa aming lugar. Kami po ay nagbayad ng initial P12, 680.00 para sa 1 year advance para sa lupa at iba pa pong paper works(ang halaga po ng lupa ay 80, 000 at payable po up to 25 years ito po ay 40sqm). Wala pa po akong pinipirmahan na mga dokumento galing sa mobilizer(Greenfields po ang pangalan ng mobilizer). Subalit dahil po sa aking pagreresearch ukol sa nasabing programa dito sa aming lungsod ay nag-udyok po para di ko na ito ituloy pa. Ngayon po nakausap po namin ang MKTG Officer ng Greenfields at sinabi po na dapat nga daw ay di na ito pwede pang i-refund. Subalit sinabi ko po na wala pa naman po akong pinipirmahan na dokumento regarding doon. Sinabi po niya na mababawasan na ito ng P4000.00 plus para sa engineering at paperworks daw po. Hiningi ko po ang opisina kung saan doon daw po nai-forward ang aming ibinayad. Ang opisina po ay Social Housing Finance Corporation. Akin pong tinawagan ang help desk at nakakuha naman po ako ng mga kasagutan, isa nga po doon ay 3 months advance lamang daw po ang kanilang sinisingil para sa mga qualified applicant. Iba naman sa greenfields dahil sa kanila po ay 1 year advance.

May karapatan po ba akong mabawi ng buo ang aking ibinayad?

Salamat po. Sana po matulungan nyo ako.

Good day!

Ask lang po ako ng legal advice. Nag file po ako ng verified complaint sa HLURB then umabot po ako sa mediation process.Ito po ay under sa Maceda Law, nag cancel po kasi ako ng contract dahil di ko na po mabayaran yung monthly obligations ko. Nakapag bayad po ako sa loob ng 5 years and 3 months. Nung unang hearing po nag karoon po kami ng agreement ng developer na babayaran po nila ako sa kaukulang halaga sa tinakda naming araw/petsa. Nung second hearing namin di po sumipot yung developer or kung sino po mang representative ng developer. Ang tanung ko po ay pwede ko po bang sampahang ng additional na kaso yung developer? halimbawa po ay breach of contract at humingi ng additonal fine for damages? Anu pa ba ang maipapayto nyo sakin?

Marami pong salamat!

Dear Atty. Jay:

Paano po kung ayaw makipag-cooperate ng developer na i-refund ang 50%, kanino at saan po kami pwede magreklamo?

Salamat po.

Good day po, HLURB po ang makakatulong sa inyo.

Hi Sir Jay would you know if the law on insurance on installment sale applies to memorial lots?