No real estate tax relief is in sight for tax delinquent property owners in Quezon City as the Office of the City Treasurer shall be conducting a public auction on December 12, 2013.

This is unlike the real estate tax relief accorded to residents of Paranaque (ended last November 15, 2013) and Muntinlupa (up to December 31, 2013).

Details for the Quezon City tax foreclosure auction can be found below.

Date, time, and venue of Quezon City tax foreclosure auction

The auction of Quezon City tax delinquent real properties shall be on December 12, 2013, Thursday, 10:00am, at the Ground Floor, Taxpayer’s Assessment and Payment Lounge, City Hall Complex, Quezon City, Philippines.

If you need help with property taxes…

If your property is listed on the notice below, and need help with your property taxes (it’s hard to believe but some people are just unaware that property ownership requires the payment of real property taxes, or they don’t know they have properties to begin with… sounds crazy but true), it would be best to seek assistance directly from the Quezon City Office Of The City Treasurer before the auction. This would help you avoid unscrupulous individuals out there whose intention is to scam you and take advantage of your situation.

Anyway, please refer to the list below to double check if your property is on the list.

Notice of Delinquent Real Property – Quezon City

If you were to go to the Quezon City Taxpayer’s Assessment and Payment Lounge, you will see the list of delinquent real property units scheduled for auction on December 12, 2013 posted just outside.

You don’t need to go there to get your copy, I already scanned the list and posted it below. Just click on the image preview to download the list… just think of this as my birthday gift to all of you. 🙂

You can also click on this link to download the list:

What is the legal basis for this auction?

This auction shall be conducted by virtue of sections 260 and 263 of RA 7160, otherwise known as the Local Government Code of 1991.

In summary, Section 260 gives an overview of the process on how the local treasurer will advertise and conduct the sale of delinquent real properties. This is done within 30 days of the warrant of levy. “Levy” refers to the seizure of real property to satisfy a debt, which in this case is the unpaid real property taxes and the related interest and costs of the tax foreclosure sale.

Section 263 on the other hand states that the local treasurer conducting the sale shall purchase the property in behalf of the local government unit, just in case there are no bidders or if the highest bid is insufficient to pay for the unpaid real property tax and related interest and costs of the tax foreclosure sale. In other words, unsold properties shall become properties of the local government unit, but will still be subject to the mandatory one (1) year redemption period.

To access the complete text, please refer to this post: Sections 260 and 263 of RA 7160

Real estate tax relief for other cities in Metro Manila

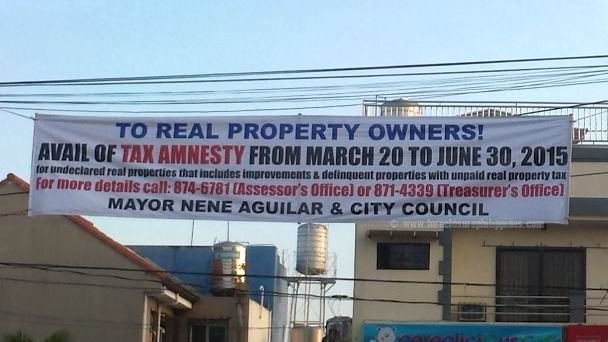

As mentioned earlier in this post, the Local Government of the City of Paranaque gave their residents some breathing room through a tax amnesty that ended just last month. Although the amnesty has ended, they are giving residents up to 20% discount for early bird payments of real property taxes up to December 15, 2013. Details can be seen in the tarp below.

Muntinlupa city residents can still take advantage of the tax amnesty offered to residents which will be up to December 31, 2013. Check out the following article for more details: Muntinlupa Gives Real Estate Tax Relief Thru Amnesty For Real Property Owners Until December 31, 2013

Hi Sir Jay,

We are renting a vacant lot in which the caretaker and I had an agreement to build a house. And it came to my knowledge that they are not paying the real property tax. Would it be possible if we would report this to the authorities that it would be evaluated for auction?

Pingback: Notice To The Public For Quezon City Tax Delinquent Properties - Auction Slated On May 15, 2014

Hi! I am interested in buying a property on the auction list; however, I found about the list just now, and the auction’s over. How do I know if somebody has already bought the property? And, assuming that nobody bought the property at the time it was up for auction, can I still buy it?

Hi Jay,

I´ve been a long time reader of your blogs and just wanna ask a question which answer i am not sure of..We have purchased a foreclosed lot with Metrobank in which we have seen here at Foreclosure last November 2013 for a total purchase price of P260,000 payable in 2 years.Now the bank is asking us to pay for a witholding tax amounting P62,000 including the notarial fee.Is this legal and correct as they have not mentioned this in the CTS before.Also we have purchased a foreclosed property with RCBC savings bank and we have not encountered such tax claims that needs to be paid,unlike the case here with Metrobank where we were surprised at the huge amount of witholding tax that they claim needs to be paid for a purchased property amount of P260,000?Please help.

Thank you..

Ace Ramos

Sir Jay, good day! If a final notice has already been issued this month (February) and scheduled the auction in May, what would be best thing to do so that the property will not be included in the auction. If the delinquent amount is about 100k, but right now, I only have about 40k, can I pay not the whole amount and pay in full later of the year? Thanks!

MrLeo, QC

Hi Leo, how about paying the 40K and then asking them not to include the property in the auction. It’s worth the try.

Yes Sir Jay, good advice! I talked to the Treasurer’s Ofc re the matter, and agreed with the arrangement to pay partial and the balance on a staggered basis within the year 2014. Thanks and more power!

That’s great news Leo, thanks for letting us know! I’m glad you reached an amicable agreement and I’m happy for you!

Hello Mr. Castillo. Please enlighten me with this matter. A friend of mine bought a real property in an auction sale. A Final Deed of Purchase was already issued by the City Treasurer considering the fact that one year has lapsed without the delinquent taxpayer redeeming the property. Now, the City Assessor’s Office would not honor the Final Deed of Purchase because it was found out recently that there was another declared owner. The City Assessor’s Office would not issue a New Tax Declaration and it ordered a new public auction? Is the action of the City Assessor’s Office correct in ordering a new public auction?

Huh?! Where did the other declared owner come from? Thanks Ms. Melissa.

Something to share – it was announced during the auction that beginning next year, there will only be two auction dates per year instead of the quarterly auctions previously being done. No specific dates yet, but they currently planned in the months of May and November.

Makes one wonder:

a. Fewer properties are delinquent since property owners are becoming more aware of their tax responsibilities

b. Will the treasurer’s office be tweaking the procedures such that they will ensure all properties put up for auction have valid titles?

Hi John,

Thanks for sharing these important info. I wasn’t able to attend, Quezon City just keeps getting farther and farther because of the heavy traffic, especially during the Christmas season.

I really hope that less auctions mean more owners are paying their real property taxes, which translates to responsible home-ownership. If you will notice, I have been posting these listings of tax delinquent properties aimed at homeowners, not really for investors.

As for the procedures, I believe the direction of the treasurer’s office (in alignment to the Mayor’s) is to raise awareness so that homeowners will not become delinquent, and I don’t see any effort to make it easy for would-be buyers do their due diligence.

For Mr Jay. If for example the tax delinquent amount for a 200 sqm lot is P50,000 and a bid of the same amount meets all the requirements, will bidder get the property for amount of his bid? Are all listed properties covered by clean title, meaning, not mortgaged or still currently under installment sales? If still under mortgage or installment sales, what happens? Thanks.

Hi Jane,

Yes, the winning bidder will get the property for the winning bid amount, but is still subject to the 1-year redemption period.

You have to do your due diligence to check if they have clean titles or are currently mortgaged. Please see this post for some tips in case you find a property that is mortgaged: https://www.foreclosurephilippines.com/2008/11/marikina-public-auction-of-real.html

To get a sample copy of the auction guidelines for Quezon City, please check out this link: https://www.foreclosurephilippines.com/wp-content/uploads/2009/10/QUEZON-CITY-RULES-REGULATIONS-AND-CONDUCT-OF-THE-REAL-PROPERTY-TAX-AUCTION-SALE-JULY-2-2009.pdf

the amount stated in the pdf is the tax deliquent amount right? not the selling price..

The selling price and the tax delinquent amount is the same. The final selling price can go up as bidders try to outbid each other.