The City Treasurer of Pasig City has recently announced the first notice for tax delinquent properties that will be sold through public auction. The tax foreclosure auction has been slated on November 13, 2012, at the Real Property Tax Building Lobby, Pasig City, Philippines.

The notice of delinquency and public auction is by virtue of Sections 260 and 263 of Republic Act 7160, otherwise known as the Local Government Code of 1991.

The notice of delinquency states that delinquent property owners can avoid the inclusion of their properties in the tax foreclosure auction through payment of real property tax arrears, surcharges, interest, and penalties. Furthermore, owners of the properties sold during the public auction have the right to redeem their properties within one year from the date of sale.

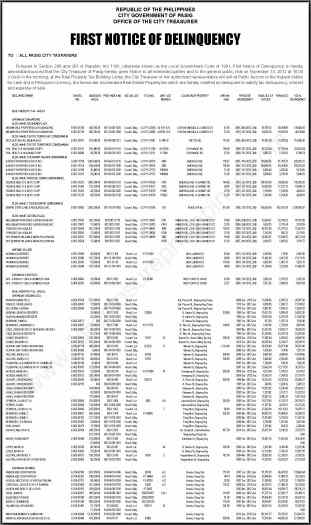

Download the list of Pasig City Tax Delinquent properties

The complete list of Pasig City’s Tax Delinquent Real Properties that are scheduled for public auction on November 13, 2012 can be downloaded below, just click on the image…

… or just click the following link to download the list:

Source: Philippine Star, September 18, 2012 edition, page B-11 to B-13

Frequently asked questions about tax delinquent properties

Question: Are the minimum bid prices for the tax delinquent properties really just equal to the total delinquency on the list?

Answer: Yes.

Question: If the property is redeemed, does the winning bidder get his money back?

Answer: Yes, plus interest, which is usually 2% per month of the winning bid amount.

Question: Can the tax delinquent properties be purchased through a Pag-IBIG Housing Loan or Bank Financing?

Answer: No. Foreclosure auctions require cash payment.

Question: Can I buy any of the unsold tax delinquent properties after the auction?

Answer: No, unsold properties become properties of the Local Government. Only the delinquent property owner can redeem the property within one year from the date of sale.

Question: Where can I find more information with regard to properties on the list as part of due diligence?

Answer: You may visit or call the Pasig City Treasurer’s office DIRECTLY!

Got more questions about tax delinquent properties?

Please go ahead and ask your questions now, just leave a comment below.

For further reading

If you want to learn more about investing in tax delinquent properties, checkout past articles I have written which contain tax delinquent property investing tips through the following link:

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License No. 3194

Connect with us:

Facebook | Twitter | Blog RSS | Google +

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2012 All rights reserved.

Full disclosure: Nothing to disclose.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Mailbox getting full? Subscribe through my RSS Feed instead.

tanong ko lang po ,, nag bayad po kase kami dati sa lupa at ang nakalgay po na tx declaration no. is 9468

then after a year pinagbayad nila kame ule then nakalagay naman na tax declaration no is E-016-00143

bakit po ganun magkaiba na ng tax declaration ???

Hi,

I would just like to ask what remedy, if the delinquent tax payer still has, after the expiration of the 1 year redemption period? What if the winning bidder agrees to sell back the property to the delinquent tax payer? what would be the procedure and effects? And what should be the preoper steps then?

Thanks so much! Hoping for you response.

Pingback: Property Hunting 101: Things to Consider before Buying Property in the Philippines

Hello everyone, I just called the secretariat of the Pasig City Land Tax division (Tel# 628-0095) and it turns out that out of the list above, only seven (7) tax delinquent properties remain with taxes unpaid as I write this comment. It seems the notice above was effective because most of the delinquent taxes were settled before the auction. The auction will push through though, but I won’t be attending anymore.

Anyway, I would like to apologize for the delay in answering the questions above. The past 3 weeks have been very busy and emotional for me so I ask for some patience. I will answer your questions as soon as possible…

Kapag nag execute po ba ng waiver of interest (redemption rights) yung previous owner ng foreclosed property pwede na po bang matransfer yung title sa new owner without waiting for the 1 year redemption period? Thanks. 🙂

upon reading all the articles i got interested and willing to take the risk. im planning to attend this coming auction in pasig city. i just want to ask po what are the basic requirements that i need to bring on auction day.. what do i need to qualify?…

Do you have a dated master list of properties which will be auctioned on nov. 13?

Hi!

Thank you for this very useful entry 🙂

I’d like to ask, if ever the property is redeemed again in one year, what is the ruling in return of payment and interest? Is it the government paying me back? And, has there been any instances wherein the government did not pay the buyer back?

Hope to hear from you before the bidding date! I will be there at least for experience.

Thanks!!!

Follow up po, if the property is occupied by a tenant, and I win the bid & original owner did no exercise to redeem on the period allocated, this tenant will be transferred to me? Thanks po.

hi, can i ask a question? can a property be redeemed by a relative other than a delinquent taxpayer? or anybody for as long as authorized by a delinquent taxpayer?

Hi Jay,

I’d been read all your blogs for the last 10mos that gives me interest on tax delinquent property but have not started yet as I worked oversees (no time for my due diligence).

I have some few questions:

1. In case the property is on a mortgage (e.g. still in developer’s name (seller/lender)), Is the responsibility to pay real property tax is already in the buyer (debtor)? Then if this buyer actually defaulted his payment to the developer and still want the property, If I win the bid, then the developer or debtor will have to settle with me within 1 yr so I can take over the ownership?

2. If the property is occupied illegally, I can still take the ownership if I win the bid & after the redemption period?

3. Some individual/corporation have delinquent tax on building, does it include the lot? or some both for lot & improvement, do I have to bid to both?

4. If lot is tax deliquent and win the bid without due deligence, then, there’s an improvement, can you ask them to leave? or just offer the lot for lease?

Hope to hear from you soon. Thanks!

So after I bid and in case nakuha ko what is the next step? I’m a little confused how does it work.

Hi Sherry, please refer to the auction guidelines from Marikina as reference. The Pasig guidelines should be very similar.

https://www.foreclosurephilippines.com/wp-content/uploads/2012/10/MarikinaAuctionGuidelinesNov132008.pdf

What services do you offer in cases like this. I’m interested in bidding and I have not done it before.

Thank you and more power!

Mac Chan

Hi Mac, in this case I am also attending as a bidder so i guess we can attend as a group.

Hi Jay,

What a wonderful site. If I may ask, do you have to add the assed value and the delingquencies to get the total price?

Thanks!

Mac

Hi Mac, thanks for the compliment! The total price is just the total delinquency, which is also the minimum bid price. If there are no other bidders, a property can really get sold for just the total delinquency. Take note however that the actual selling price can end up significantly higher if there are other bidders and a bidding war happens.

Thank you for the valuable lessons and advice that you’ve been providing on your website. I’m going home soon from Saudi Arabia (retiring) and thinking of investing in foreclosed properties. May you continue to educate a neophyte like myself. Best regards!

Hi Ferdinand, you’re welcome and thank you too for the kind words… happy investing!

Sir Jay,

kamusta po, kapag bumili ka ng foreclose na lupa, mag papatuloy parin ba ang tubo sa bangko?

jhem.

______________________________________________________________

(link removed by admin as per comment policy)

Hi Jhem, tigil na siyempre yung interest once na foreclose na. Pag binili mo, and payment is through financing, may interest na ulit yung bagong loan.

Great! Will wait for your reply then. TY!

You’re welcome and thank you again!

I JCV, unfortunately, I really don’t see any way we can act as your broker during foreclosure auctions like this one, based on past auction guidelines, where the seller will compensate us as brokers (which is the standard practice for real estate brokerage). However, qualified and duly authorized individuals can represent you if you will provide them a special power of attorney or SPA. I suggest you ask a trusted relative to attend for you.

Do I have to bid in person or can I bid through a broker? Do you offer such service (brokering for buyers for public auctions) yourself? Thank you.

Hi JCV, I actually act as a real estate broker for bank foreclosed property auctions, I haven’t thought of doing that for tax delinquent properties as I attend as a bidder myself. But thanks to you, I’ll check if that’s also possible, I’ll get back to you asap. Thanks for asking!

Sir Jay, sana po dito ay masagot nyo na ako kc nagiging “stalker” nyo na ako kahit sa twitter hahaha!!

same with Ryan, OFW din ako na gusto ng magkabahay. with JVC’s question, ganun din po ang sa akin, baka nmn po pwede ng kau ang mag act as our broker. pero i have to keep on reading pa your blogs so as to educate myself sa mga ganito. maraming salamat sir jay 🙂

Thanks Jay for all your help. I’m glad there are people like you out there =)

You’re welcome Miel, just paying it forward. 🙂

Hi Jay,

If ever first time ko magaattend ng bidding, so cash upfront sa winners right? automatic ba turnover sayo ang rights or ang titulo? kasi may 1 year to redeem ang owner di ba? iniisip ko kasi, other than the 2% interest, what’s in it for me if I buy it now, kasi putting myself in the original owner’s shoes, i’ll definitely find a way to get it back within the year. Thank you for your help

Regards,

Miel

Hi Miel, yes, cash upfront ang payment. In some cities, personal checks are allowed, though I’m not sure for Pasig, sorry I can’t remember. They also might have a non-refundable cash bond of Php500 per bidder, just like the last auction I attended in Pasig several years ago, I’m glad I still remember this. 🙂

Once you win your bid, you can get a certificate of sale which you can annotate on the title, but you can only transfer the title to your name after the redemption period expires. If the property is unoccupied, I don’t see any reason why the winning bidder cannot take possession.

For me the 2% per month (up to a maximum of 24% for the whole 1 year redemption period) is enough reason to invest, expecting that the delinquent owner will redeem the property. I believe this is “win-win” because the delinquent owner is given another year (or more, pwede naman pag usapan yon) to settle his arrears and avoid foreclosure, the local government gets the funds they need which they can use for their operations (I hope), and the winning bidders gets up to 24% return-on-investment secured by real estate.

I hope I can drop by the Pasig City Hall one of these days to get a copy of the bidding rules and guidelines and post it here for reference…

Hi sir Jay, I’m sure a lot of people wants to know about this (including myself) : What will happen once you buy from auctioned Tax Delinquent Properties? Can one have a total ownership of the property? Please enlighten us…Thanks

Hi Joanne, as mentioned to Miel, you can only transfer the title to your name after the one year redemption period. If it is unoccupied, I believe you can already take possession, although you have to respect the rights of the delinquent owner and you will have to give possession back if he/she redeems the property.

Thanks Sir Jay!

Ilang announcement yan, Jay? Tatlo?

Usually 2 notices lang, pero the listing shrinks significantly in the next notice as a lot of delinquent taxpayers have already settled their arrears. Attend ka?

sir jay,

cenxa n po ha kung madami akong tanong. xa nga po pala isa akong young ofw with 1 baby. madami po sa properties na napapaloob po sa site ninyo like BFS or some other foreclosed property na nakakuha ng attensyon ko po. Pero po base po sa experience nyo po kung ung property na nakalagay ay ranging to 300-350 thousand po magkano po kaya abutin nun kasama na po lahat?. Foreclosed po ha.

Sana po matulungan nyo po ako. Dream ko po kasi maka-bili ng bahay habang ayos pa po ang kita. Alam nyo naman po ang kagaya namin walang kasiguraduhan ang trabaho. Follower po kasi ako ng blog ninyo since last 3 months. ^____^ madami po ako natutuhan dito po. Natatakot po kasi ako sa ibang kwento na after po nila bilhin ung foreclosed na property ay hindi naman po nila nakuha ung title po.

God Bless po ng marami at sana magtagal pa po itong blog nyo po.

Salamat,

Ryan

sir,

ask lang po sana aq kung ano po benefits if kuha po aq ng assumed balance po? ano po b maganda assumed balance or foreclosed nlang po kunin ko?..

thanks,

ryan

If assumed balance, malamang mas malaking part ng payments mo papunta sa principal, less sa interest. Kasi nga usually sa umpisa mas malaki ang interest kesa sa principal pero kung nag assume ka lang ng loan ng iba, sila na yung nagbayad sa umpisa. Isa lang yan sa naisip kong benefits kung assumed balance.

Hindi pwedeng mageneralize kung alin ang mas advantageous between assumed balance at foreclosed, case to case basis pa rin, depende sa numbers kung alin ang mas profitable.