Here’s a heads-up for both Quezon City taxpayers who might be delinquent in paying their real property taxes and for real estate investors who may want to help. I accidentally found this notice on the same issue of the Philippine Star where I got the complete listing of tax delinquent properties from the Province of Rizal which was recently auctioned in Antipolo City.

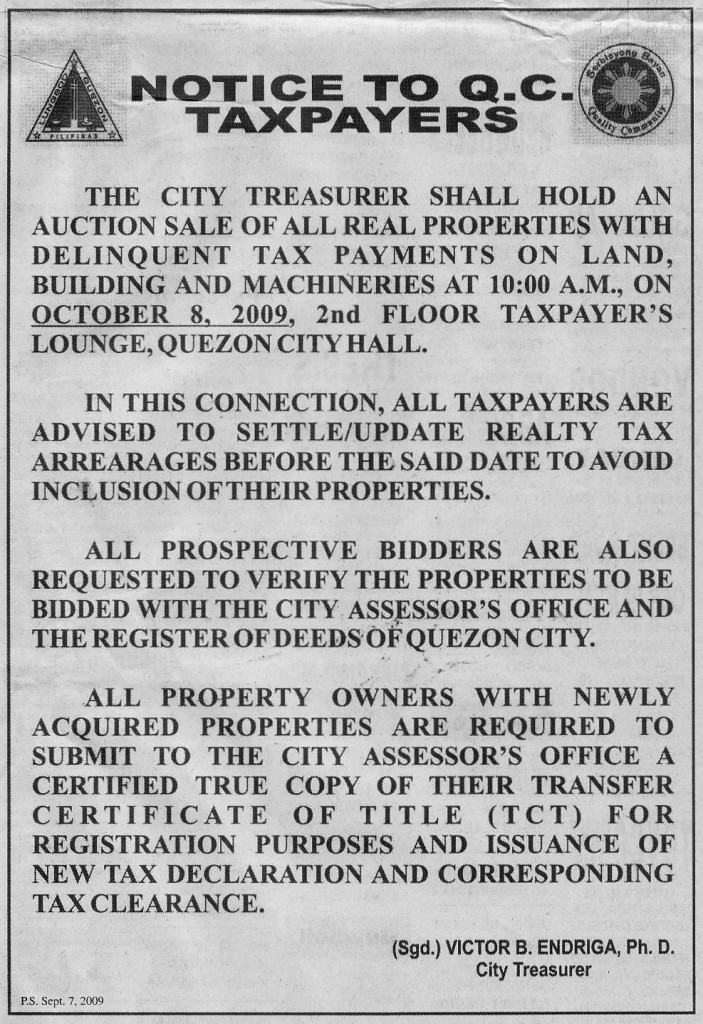

Anyway, before I explain how real estate investors can help those delinquent in paying their real property taxes, let me share more details about the tax foreclosure auction sale to be held in Quezon City. The Quezon City Treasurer shall be holding the auction sale of real properties with delinquent tax payments on land, building, and machineries on October 8, 2009, 10:00 A.M., at the 2nd floor of the Taxpayer’s Lounge, Quezon City Hall. Furthermore, all Quezon City taxpayers who may be delinquent in paying their real property taxes are advised to settle/update their realty tax arrearages before the date of the auction sale (October 8, 2009) to avoid inclusion of their properties.

(Source: Philippine Star, September 7, 2009 issue, page B13)

Time for Due Diligence

As usual, all prospective bidders are also requested to do their due diligence and verify the properties they may want to bid on at the Quezon City assessor’s office and the Register of Deeds of Quezon City. In summary, you can do this by:

- Get the updated list of tax delinquent properties for auction at the Quezon City Treasurer’s Office

- Get the tax declaration number and other important details that you will bring to the tax mapping section

- Give the property details you got in step 2 above to the tax mapping section so that they can give you property details like the exact address, location, Transfer Certificate of Title (TCT) number, etc. You can also ask for more details that they may know about the property (ex. if it will be affected by a road widening project in the future, etc.)

- From the information you got from step 3 above, you can then proceed to Quezon City register of deeds which is located in East Avenue to get a certified true copy of the TCT.

- You can then inspect the property if you want along with other due diligence tasks.

How can real estate investors help?

As I have mentioned in the beginning of this post, real estate investors can help those Quezon City taxpayers who might be delinquent in paying their real property taxes. This can be done by paying the arrears in real property taxes, penalties and other costs (all of which are equal to the minimum bid price) for the property owner through a winning bid. This basically buys some time for the property owner (12 months to be exact and is referred to as the redemption period) to settle his/her arrears.

As an incentive, the winning bidder earns an interest of 2% per month and he/she will receive this once the property owner is able to settle his tax arrears within the 12 month redemption period.

As I have often said in the past, it would be better to invest in real property tax foreclosures without the intention of actually getting the property. I believe this is a win-win solution for everyone – the owner gets another 12 months to come up with enough funds to settle his arrears, the local government gets to collect the taxes they need to fund their operations and local projects, and the real estate investor gets to earn 2% per month or up to 24% for 12 months by buying some time for the property owner and also for helping the local government collect taxes. By the way, I stumbled upon the comments section of an article I found in philfaqs.com which explains this very well, please do check it out here: http://philfaqs.com/phils-business/make-money-at-home-free-education-know-what-donald-trump-knows/#comment-14895

Sorry if I am unable to post an updated list of the Quezon City delinquent properties for public auction. Ever since our house was devastated by the floods last week, we have been very busy picking up the pieces and relocating to a place we can temporarily live-in while our house is being repaired and becomes livable again. A big thank you goes out to all of those who gave words of encouragement and prayers. Let’s continue praying for and helping those that were affected by the recent typhoons.

By the way, it’s nice to be back!

—–

To our financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Social Network: http://foreclosurephilippines.ning.com

Mobile: +639178843882

E-mail: ph.investor [at] gmail [dot] com

Text by Jay Castillo.Copyright © 2009 All rights reserved.

P.S. – If you are a new visitor, please start here to learn more about foreclosure investing in the Philippines.

P.P.S – If you feel that anyone else you know might benefit from this post, please do share this to them and don’t forget to subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. If your inbox is getting full, you may subscribe instead to my RSS Feed.

where can i find the list of delinquent property in September 2009?

You should find a copy at the treasurer’s office.

Pingback: City Treasurer of Quezon City to auction tax delinquent properties on December 10, 2009

Jay,

The auction was yesterday, mauulit pa ba yun? If ever, where can we get the list of these properties? How does it work if the investor would pay the arrears? Does he talk to the houseowner and they make a contract? What happens after one year and the houseowner is not able to settle?

Good to know you and your family are safe. Thanks Jay!

Liza

Hi Liza, yes, mauulit pa yan for sure. For Quezon City, they normally hold this on a quarterly basis. You can get the list when they publish on a national broadsheet or you can go to the Quezon City Treasurer’s office directly. The investor pays the arrears through a winning bid during the auction, the investor does not interact with the houseowner. If after one year the houseowner is not able to settle, then the winning bidder becomes the owner of that property.

Thank you also Liza!

HI Jay, Just to let u know that i joined the Rizal Public auction last september 30, 2009. There were 4 bidders during that day including me, that is why i was able to bid 8 properties just for a minimum bid price only. Fortunately 7 of them are clean titles but One property i bid has a mortgage of Php 54M from a closed bank. It was inscripted or annotated dated 1983. Do u think after the redemption period had lapsed i can consilidate the property and remove the annotation?

Regards

Jun

Hi Jun, congratulations! Hmmm, since the bank had already closed, you should first check if another bank had taken over the property like the Banko Sentral.

Sigh, I wish I was able to attend that auction in Rizal. Oh well, I guess it wasn’t meant to be but I’m sure there will be more auctions for me in the future.

Hi Sir Jay,.

Kamusta po,.,.Iive been reading books on real estate investing. Thanks for this blog I learn something new. Gusto ko pong maginvest sa real estate hopefully next year, sana po ay matulungan niyo ako,,

Keep up the good work.

Hi Sheryl, that’s great! Of course I am willing to help, that’s why this blog exists. 😉

That is what they get for not paying their taxes.

.-= Palabuzz´s last blog ..Richard Gutierrez, scandal on NAIA =-.

Hi Palabuzz, there may be a good reason for most people to miss paying their real property taxes. However, one really has to pay and I guess this is one way investors can help out.

Pingback: Twitted by familysafety

Hi Jay,

I’m glad that you and the family are safe and sound. I’ve been reading your blog for a while and its been very informative and helpful, as the other books I’ve bought are meant for US real estate players. I’m a lawyer and maybe I can help out on some legal issues. I’m also interested in real estate investing and would appreciate starting an email correspondence with you.

God Bless!

Hi Jack, thanks! Wow, I would be more than glad to work with a lawyer like you who is also interested in real estate. Thank you also for taking time to read my blog. As they say, two heads are better than one and I would go further in saying that the more the merrier when it comes to sharing legal opinions about real estate. If you have any questions, etc. just drop me an e-mail anytime. By the way, I am going to change my e-mail address soon due to spam problems so if there are others who are wondering why I have not yet responded to their e-mails, they may have been buried under spam. I just found out this morning that I am missing reading e-mails sent to me since March hence I think changing e-mail addresses would solve this.