This post is a contribution from Mr. Jojo Salas, Director – Pinnacle Research and Consulting.

The Association of Southeast Asian Nations (ASEAN) Economic Community or “AEC” shall start some steps of integration by December of this year. While regional integration typically has four main pillars, namely: political and security; socio-cultural; financial integration; and economic integration, it is only the economic pillar that is being targeted, hence, the AEC.

Various sectors have been voicing opportunities as well as challenges. It is but apt to review the competitive advantage of the Philippine economy and real estate market with the impending economic integration.

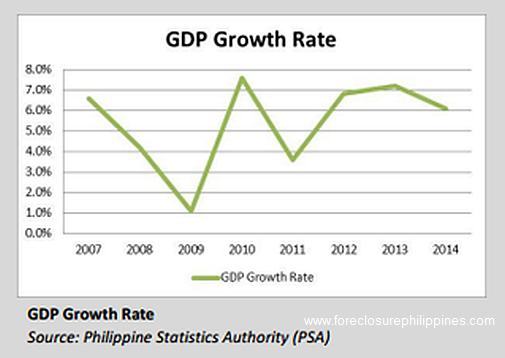

Macroeconomy

The country’s gross domestic product (GDP) for the fourth quarter of 2014 grew by 6.9%, and the annualized growth rate is 6.1% that is only second to China in the entire Asia. The National Economic and Development Authority (NEDA) is projecting a growth of 7% for 2015 and 8% for 2016, and identifying the projected growth in the industry sector and the robust services sector as the sources of this growth.

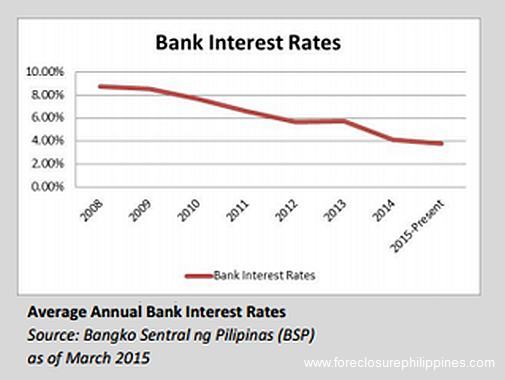

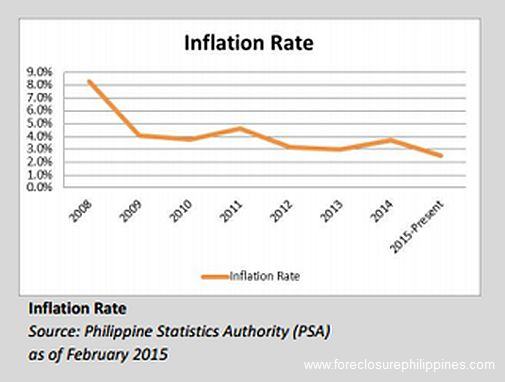

Based on Bangko Sentral ng Pilipinas (BSP) statistics, the average bank interest rate eased to 3.82% as of February as compared to 4.11% by the end of 2014. The inflation rate is also on a downward trend.

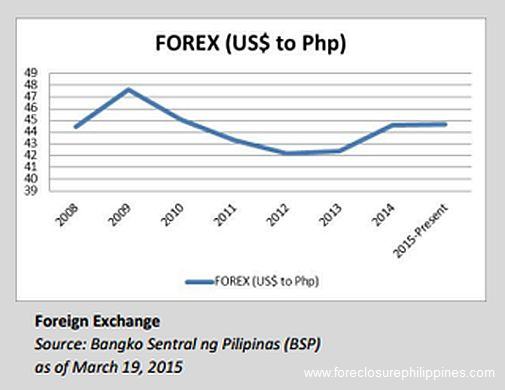

The Philippine Peso to US Dollar exchange shows a relatively stable conversion, Php 44.69 in March from Php 44.582 in December of last year.

Dollar remittances from overseas Filipinos continue to increase on a yearly basis. Remittances for 2014 reached US$24.348 billion as compared to US$22.984 billion for 2013, or an increase of 5.93% according to BSP. For January 2015, total dollar remittance is pegged at US$1.813 billion or a slight increase from US$1.804 billion for January 2014.

BSP reported that cumulative foreign direct investment (FDI) for 2014 reached US$ 6,201 million. FDI for the same period in 2013 reached only US$ 3,737 million.

According to the Department of Tourism, the total Visitor Arrivals for 2014 reached 4.833 million as compared to 4.681 million in 2013, or an increase of 3.25%. Visitors from South Korea, United States and Japan are the top three countries of origin. It is noteworthy that visitors from China have been increasing over the years, and the total number is almost at par with the total visitors from Japan, which is ranked third highest.

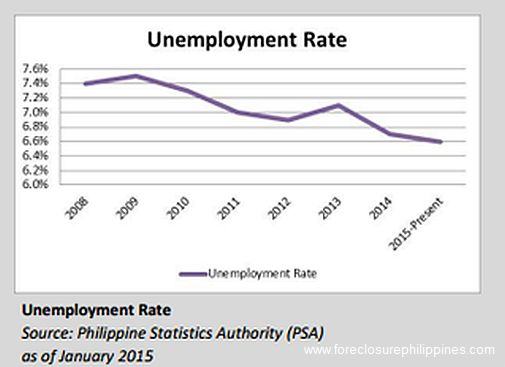

The latest unemployment rate data is pegged at 6.6% as of January of this year, which is slightly lower than the 6.7% in July 2014.

Slow infrastructure development has long been identified as the limiting factor of growth. With the ASEAN economic integration and with the projected growth of the industry sector, sustained government investment in infrastructure is key in maintaining the influx of investments.

National Economic and Development Authority (NEDA) approved 12 infrastructure projects costing about Php 184.4 billion late last year, and recently approved six more projects.

The Senate is lining up Php 890 billion of infrastructure projects especially in the transportation sector, as disclosed by Sen. Paolo Benigno “Bam” Aquino III.

Enlarging the plate

For the top real estate developers, the influx of ASEAN investors and tourists means they can enlarge the plate to accommodate the expanding pie.

The Ayala Land Group is leading the way by increasing its target capital expenditure to Php 100 billion this year as compared to Php 70 billion last year, or an increase of 43%. This is also coming from a very positive profitability last year, based on the reported figures in the third quarter of 2014 at Php 10.8 billion that increased by 35% year-on-year.

Apart from increasing their usual residential developments catering to all segments of the market, including the socialized housing, the Ayala Group is boosting its office, shopping center and hotel portfolio. It is even embarking on education venture as well.

SM Prime disclosed its capital expenditure for 2015 at Php 66 billion to open more shopping malls, residential projects, office buildings and hotels. While the SM Group is very much known for its ubiquitous malls and massive residential condominiums, it has steadily increased its hotel operations.

At present, SM Prime has four hotels and it targets to open its Park Inn by Radisson in Clark, Pampanga and Conrad Hotel Manila at the Mall of Asia by the fourth quarter of this year. The SM Group reported a solid net income of Php 13.5 billion as of the end of third quarter of last year.

The Megaworld Group buoyed by its total net income of Php 19.03 billion for the first three quarters of 2014, a phenomenal 192% growth, is sustaining its township developments to service various segments and sectors in the real estate market.

Megaworld together with its subsidiaries Suntrust Properties, Inc., Empire East Land Holdings, Inc. and Global-Estate Resorts, Inc. shall launch five new townships: two in Luzon, two in the Visayas and one in Mindanao, with a total land area of around 400 hectares. This will bring Megaworld’s total township land area to 3,100 hectares by year-end. Based on earlier reports, the Megaworld Group is targeting to invest more than Php 230 billion till 2018.

While the abovementioned developers are enlarging their plates based on their capacities, other players are busy carving for their market share. Robinsons Land Group recently acquired the 18.5-hectare Mitsubishi property along Ortigas Avenue extension, where it would build a major township. In addition, it would expand its residential, office, hotel and mall portfolios nationwide.

Vista Land and Puregold Groups, on the other hand, are intensively exploring their core competence. The Vista Land Group has been penetrating tertiary cities where other national brands are still contemplating on, and has been expanding its commercial retail investments. The Puregold Group has been solidifying its position in the retail sector.

Other major players are also expanding into other sectors such as transportation and toll ways. DMCI, Filinvest. Metrobank/Federal Land Groups have been steadily beefing up their investments in the power sector as well.

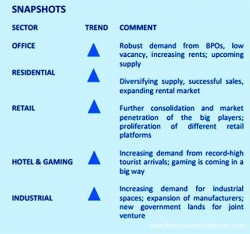

Snapshots of real estate sectors

Office Market

The Business Process Outsourcing (BPO) industry shall continue to drive the demand for office spaces across all major business districts.

The Business Process Outsourcing (BPO) industry shall continue to drive the demand for office spaces across all major business districts.

The office market in the Makati Central Business District is the most developed, where the buildings are classified as Premium Grade A, Grade A, or Grade B&C.

Office buildings in Makati CBD have vacancy rates of 1%, 0.5% and 2%, respectively.

While the Grade A vacancy is at its all-time low, four buildings are expected to be finished with a total leasable area of approximately 150,000 square meters.

Rents of Premium Grade A buildings have a weighted average of Php 1,250 per sqm per month; for Grade A buildings, the weighted average is Php 825 per sqm per month; and for Grade B&C Buildings, the weighted average is Php 625 per sqm per month.

Office vacancy in the Bonifacio Global City slightly increased to 4% due to the opening of Panorama Building. The weighted average rent remains unchanged at Php 825 per sqm per month.

New stock, however, is expected to open this year and next year with a combined leasable area of approximately 500,000 square meters. While some of these buildings have pre-commitments, the succeeding quarters would test the absorption of the market based on the demand of the BPOs.

Office buildings in Ortigas and Alabang business centers have a vacancy of 4%. Alabang vacancy increased from 1% by end of 2014 due to the recent opening of Aeon Center that offered 20,000 sqm of additional space. The average rent of Grade A office buildings in both Ortigas and Alabang business districts is pegged at Php 600 per sqm per month.

Quezon City Grade A buildings are practically fully leased out with a vacancy of less than 1%. Average rent is Php 625 per sqm per month. The Grade A buildings in Bay Area recorded a vacancy of 1% from 2% by the end of 2014. The average rent is Php 550 per sqm per month, while asking rents are now at Php 600 per sqm per month.

Residential Market

Based on the full year Housing and Land Use Regulatory Board (HLURB) figures, total license to sell (LS) issued for 2014 reached over 200,000 residential lots/units, including condominium units. More than half of this, approximately 105,000 units are in the socialized and low cost housing categories. Mid-income housing units account for approximately 28,000, while residential condominium units account for 76,000.

Leasing activity is still strong in the residential condominium market. The usual practice has been quoting the total monthly rent of these residential units rather than the rent on per square meter basis used in office and commercial spaces.

High-end and upper-mid market condominium units have dominated the rental market with leasing rates from Php 50,000 to Php 100,000 per month for upper-mid condominium units, and over Php 100,000 per month for high-end, depending on the sizes.

Luxury condominium units can command rents at Php 300,000 per month-level, even breaching the Php 400,000 per month-rent. Leasing of studio and one-bedroom units ranges between Php 15,000 to Php 30,000, and may reach the Php 50,000 per month-level, depending on the location, furnishing, and amenities of the condominium unit.

For the Makati CBD, Rockwell and BGC residential condominium market, rents may now be subjected to the per square meter rate just like the office rents.

The Makati CBD has a more varied rental levels, ranging from Php 575 per square meter per month to Php 1,100 per sqm per month. One has to multiply the floor area to compute for the approximate monthly rent.

Rockwell condominium units have a higher base of Php 700 per sqm per month, but have the same upper range of Php 1,100 per sqm per month.

Bonifacio Global City units have a lower range of Php 600 per sqm per month, and an upper range of Php 1,000 per sqm per month.

Retail Market

Everyone knows that the SM Group dominates the retail market, which shall have 53 malls in the country and six malls in China by end of the year. These malls have a total leasable area of 7.8 million square meters. The group will continue to be busy in opening its “Savemore” and “Hypermart” brands to cater the different needs in the market. Overall, SM Retail has a total of 171 outlets and reported total sales of Php 107.5 billion for 2014. This figure does not reflect the rental income.

The Robinsons Land Group, with its 37 malls, is also busy expanding. It targets to open seven malls and expand three existing malls in the next two years. Overall, the Robinsons Group has a total of 91 outlets and reported total sales of Php 312 billion last year.

The Puregold/Cosco Group has been accelerating expansion, not only through organic expansion, but also through acquisitions. It recently acquired nine malls in Nueve Ecija. It also has a joint venture with Lawson, the third largest convenience store chain in Japan. The Ayala and Rustan Groups, who are currently in-charged with the operations of approximately 100 Family Mart outlets, have also partnered with the Puregold Group.

The Villar/Vista Land Group is also gearing up in expanding its Starmall platform, as well as its convenience shopping “All Day Mart”. The group has built over 250,000 housing units in 31 provinces and 64 cities and municipalities around the country in the decades. The Vista Land Group shall integrate their retail platforms in their housing projects.

The Wilcon Group, the country’s largest one-stop shop for construction and design materials, recently opened its 15-storey Wilcon IT Hub building in Pasong Tamo, Makati City. The group now has 33 stores all over the country.

HMR Philippines is quietly expanding its retail operations. Known for its public auctions, its products are not directly competing with the traditional retail malls. HMR now has 15 stores offering discount shopping of brand new as well as used items. From its humble beginnings of auctioning chattels, it is now operating 10 businesses including construction, metal fabrication, waste management and recycling, and the “Tasty Tucker” restaurant.

Hotel and gaming market

The City of Dreams Manila, a joint venture between the SM Group and Lawrence Ho of Macau’s Melco Crown Entertainment (MCE), recently opened the 940-room hotel, 380 gaming tables, 1,700 slot machines and 1,700 electronic table games.

It consists of three towers to cater to these brands: Nobu Hotel, Crown Towers and Hyatt Hotel. At first glance, this massive gaming destination would “cannibalize” the existing gaming market. Melco Crown Philippines President Clarence Chung said they will promote and cross-market City of Dreams Manila with their customers, and will provide its overseas customers with an “additional choice.”

It should be noted that MCE is the only Macau-based company that received a Philippine Amusement and Gaming Corporation (PAGCOR) license. Macau has lost its steam and posted a revenue drop last year after a decade of expansion. Some industry players are attributing this to the Chinese government’s high-profile anti-corruption drive that spooked the high-rollers, which account for bulk of the gaming revenues of Macau.

Providing more options to the market is said to be the formula of Las Vegas and Macau.

Bloomberry Resorts Corp.’s Solaire Resort and Casino opened in Entertainment City in 2013. In addition, Japanese billionaire Kazuo Okada and the joint venture of Philippine billionaire Andrew L. Tan and Genting Hong Kong Ltd. are expected to open their casino resorts between 2016 and 2018.

City of Dreams generated 60,000 visitors on its opening day, and 15,000 daily visitors. The entertainment center was designed by DreamWorks Animation, creator of films Shrek and Kung Fu Panda.

Industrial Market

Pinnacle Research monitored that the remaining leasable land in Clark Special Economic Zone and Subic Bay Freeport Zone has a total combined area of less than 150 hectares as of last year. This total area is just the remaining available space out of the thousands of hectares in the past two decades.

Cognizant of the increasing demand for industrial spaces and special economic zones, the Bases Conversion and Development Authority (BCDA) is now bidding out at least 200 hectares in the Clark Green City by way of joint venture.

Based on an announcement of the BCDA, the partnership shall be in the form of a JV Corporation to be owned forty-five percent (45%) by BCDA and fifty-five percent (55%) by the Winning Bidder. The Winning Bidder shall infuse the total initial paid-up capital of the corporation in the amount of Two Billion Five Hundred Million Pesos (Php 2,500,000,000.00).

In addition, Philippine Economic Zone Authority (PEZA) Director General Lilia De Lima noted that the country is looking at single-digit growth this year at around eight to nine percent. PEZA’s forecast for investment pledges this year is faster than the slight uptick in 2014 when commitments rose only by 1.2% to Php 279.48 billion from Php 276.13 billion in 2013.

The best example of industrial expansion is the Php 2.5 billion-investment of Toyota Motor Philippines to improve car assembly operations and accommodate full-model change of locally-built units, and the Php 2 billion-investment of Mitsubishi Motor Philippines for its new plant in Sta. Rosa, Laguna. Mitsubishi is also investing Php 500 million for a new multi-color paint shop.

Conclusion: Slicing the real estate market in the Philippines

The real estate market in the Philippines remains to be strong across all sectors. The top developers are expecting that the pie will expand due to the sustained growth of the Philippines as well as the impending ASEAN economic integration.

They are enlarging their plates by partnering with international investors and enhancing their capabilities. The top players are comfortable in slicing their markets, by focusing on their core competencies, by servicing various segments and sectors, and by building townships.

For the not-so-big players, it is important to identify opportunities and inefficiencies in the market, then servicing them decisively. Since the pie is expanding, small players do not need big market share, but rather a profitable niche in the market.

Small players should take advantage of their nimbleness and ability to service smaller projects. Market intelligence and due diligence are the two important equalizers in the maturing and expanding Philippine real estate market.

Back to you…

Since you are reading this at ForeclosurePhilippines.com, you are obviously a real estate investor in the Philippines (or you want to be one!). So what are doing (or plan to do) to get a “slice” of the growing real estate market?

Pinnacle Real Estate Consulting Services, Inc. provides a full range of services to buyers, real estate lenders and investors. A team of experienced professionals is dedicated to enhancing the value of clients’ investments throughout the Philippines.

I love contributions like this as I get to make a comment. 🙂

For me, I just want to focus and continue being “in the game” by always being on the lookout for worthy real estate deals. Right now I’m obsessed with finding and analyzing as many properties/ listings as I can within my niche. Of course, I share all the listings to everyone here.

Obviously, finding deals is my highest and best use, which is what I want to focus on, which means time for other things will become less and less.