A very important metric that is more applicable to income generating properties like multi-door apartments, is Net Operating Income or NOI. What exactly is NOI? And why is it so important? Please read on to find out.

Note: In my previous posts, I covered Maximum Allowable Offer (MAO), After Repair Value (ARV), and Cost Factor (CF), which are for properties that we intended to flip for a profit. You might want to read those articles if you are also interested in flipping.

What is Net Operating Income or NOI?

NOI is basically what remains of the actual or projected annual income of a property, after all operating expenses have been deducted. Operating expenses include real property taxes, property insurance, property management, maintenance reserves, vacancy rates , collection losses, etc.

Costs related to debt servicing (in case a property was purchased through financing), are not yet deducted, when calculating for NOI. Furthermore, NOI can be before or after taxes. For this post, we will be computing for the NOI before income taxes are deducted.

Sample income generating property: A 10-door apartment

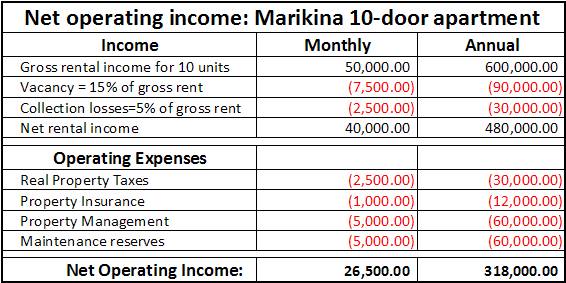

Example: You have found a promising 10-door apartment in Marikina City and the current rental income per unit is Php5,000. Determine the NOI. (Keep in mind that this is just a hypothetical property which shall be used to better illustrate how we to determine NOI)

Assumptions: Let’s assume that Real Property Taxes would amount to Php30,000 per year, property insurance would be around Php12,000/year, and property management would be Php5,000/month or Php60,000/year. The property also has a vacancy rate of 15%, and you also set aside Php5,000/mo for your maintenance reserves. Lastly, let us also make an assumption that there will be a collection loss of 5%, meaning you won’t be able to collect rents from your tenants 5% of the time (these are caused by your tenants from hell).

The NOI would then be as follows:

Why do we need to compute for NOI?

Let me give you 3 good reasons why you need NOI:

- You need the NOI to determine if a property has potential as a “good investment”. Most people are offered/think of buying income generating properties without considering operating expenses. If you compute for the the NOI, you will have a pretty good idea if a property will be a worthy investment. If you know the NOI, and you are going to buy a property through bank financing, you can easily estimate the cashflow it can generate. In our example above, if you bought it through bank financing and your monthly amortization is less than Php26,500/month, then you can already say that it’s a self-liquidating property.

- You need the NOI to determine a property’s cash-on-cash return. This gives you an objective way to compare your projected returns from an income generating property with other investments like stocks, bonds, mutual funds, etc. This will be tackled in my next post which should be ready by next week.

- You need the NOI, along with the capitalization rate or cap rate to determine a property’s market value using the income method. For income generating properties, the income method is the recommended way to calculate for the property’s market value or After Repair Value. This will be tackled after my post on how to determine the cash-on-cash return. Please watch for it.

Things to remember about NOI

Obviously, the accuracy of the NOI greatly depends on the accuracy of the rental income and operating expenses that you will use. My advice is to use actual values as much as possible.

It would be easy to get actual rental rates by going around the immediate vicinity of the property you are evaluating.

Real property taxes can be checked by getting a copy of a property’s statement of account or SOA for real property taxes at the office of the City/Municipal Assessor’s office or Treasurer’s office.

For maintenance reserves, I have read a lot of books that say setting aside 10% of the gross rent would be good enough, but it still depends on you. Depending on the age of a property, maintenance reserves might need to be bigger, especially if repairs and maintenance needs to be done sooner.

I suppose estimates for vacancy rates, and collection losses, can come from landlords or property managers that operate in the same area.

By the way, more than 2 years ago at the time I wrote this, I asked around and found out that during that time, property managers usually charge anywhere between 8% to 15% of gross rents. I’m not sure if these figures are still accurate so I will have to ask around again.

Conclusion: Before you buy a rental property…

If you are evaluating a rental property, make sure you include NOI as one of the numbers you need to determine as part of due diligence. Remember, without NOI, you really won’t know for sure if you will have any positive cashflow/passive income, and it will help you stay away from properties that are really just money pits.

Happy investing!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License #: 3194

Text by Jay Castillo and Cherry Castillo. Copyright © 2018 All rights reserved.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips.

![Why invest in foreclosed properties in the Philippines? + Top things to consider [Video] 6 Why invest in foreclosed properties in the Philippines? + Top things to consider [Video]](https://www.foreclosurephilippines.com/wp-content/uploads/2023/03/video-how-to-invest-in-foreclosed-properties-in-the-philippines-v3-728x410.jpg)

Good day Jay!

Is it wise to buy foreclosed properties from a Realty company?

Should be okay as long as the company is legit.

Pingback: Are Foreclosed Properties Good Deals?

Hi Jay, could you write a part 2 by applying your example to filing income tax? It would be nice to see the net profit of the investment. Also, could you consider adding amortization because most of the time deals are acquired thru bank finance?

Thank you!

Pingback: Money Summit and Wealth Expo 2011 Pre-registered rates extended until July 15, 2011!

Pingback: FIP’s best of 2010 to help you get started in 2011

Sir,

Just wanted you to know that this is gold right here! I’ve been looking for a clear and concise explanation of how to measure the profitability of rented properties via NOI, and you explained it so well! As far as vacancy rates, do you have an average figure? I read somewhere that 7-10% is standard.

On a related note, do you have an article that ties together NOI and present/future value of a property? I’d like to know how the income approach can be associated with the present value to arrive at a better decision of whether or not to buy an income-generating property such as apartments or condos for rent.

Thanks much!

To clarify, I’d like to understand how to come to an amount to determine if an income-generating property is worth buying at the price being offered. I know that economic life and depreciation are also factored in, to come up with the present value to assess if the property is worth the purchase. Can you point me to a resource that will help explain? Thank you!

Thank You JAy. this is my first time to visit your site, and i’m happy that i found a mentor here in the philippines. I really love real estate. i’m passionate about this craft. but i dont know how to start investing through foreclosed properties, what are the things i need to consider first. I’m a full time real estate broker and i want all my commissions na my mapuntahan, and i want to invest it through real estate. What are things i need to consider first?

Thank you very much and i look forward to hear from you.

This is very informative and detailed, your years of training is shared in these simple steps. You are very generous, thanks Jay!

Pingback: Tweets that mention How to compute for Net Operating Income or NOI

Hi Jay!

Could you please share from your experience: how do you optimize taxes from rental properties here in Philippines?

Is it possible to use straight line or accelerated methods of depreciation? For how many years cost of the building can be prorated? And it is quite obvious, that rental business for the sole purpose of it existence will encounter some business-related expenses ( management fees, insurance , maintainance, advertisement and marketing, mortgage interest ).

Can these expenses be deductible from taxable amount?

Thank you again !!!

Hi Jay!

Talking about rental property it is crucial as i understood , to correctly estimate gross rent collections per unit per month. And when applying for the loan, collateralized by rental property only the real rent roll will prove actual rental income, right?

Which form is acceptable by banks : is it actual lease agreement between landlord and tenant, does it have to be sealed by Notary Public ? Is there any additional documents usually banks require to prove monthly rental income ?

Thank you !!!