I was pleasantly surprised when I read a series of e-mails from one of my favorite bank officers, from one of my favorite banks, who consistently sends us their updated listings of foreclosed properties for sale. At first I really wasn’t sure what it was all about, but it sure got my attention. When I finally found out, I just had to say “Wow!…”.

I was pleasantly surprised when I read a series of e-mails from one of my favorite bank officers, from one of my favorite banks, who consistently sends us their updated listings of foreclosed properties for sale. At first I really wasn’t sure what it was all about, but it sure got my attention. When I finally found out, I just had to say “Wow!…”.

The big surprise is revealed after the jump…

Hmmm… the first teaser said “Watch out for something new…” in 2012! I wondered what that could be…

And then their next teaser mentioned something about “Changes…” which would make investing easier?! Now this really got a lot more interesting, especially for real estate investors…

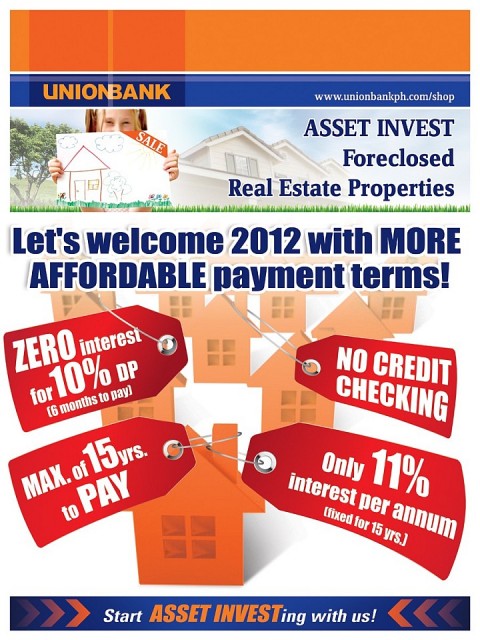

I finally knew what it was all about when I opened the email that had the poster below…

I still remember myself saying “Wow! This can help make real estate investing easier in 2012!…”

Enough of the suspense, checkout UnionBank’s new payment terms for 2012 below!

If that didn’t sink in, let me repeat what was written on the poster:

- “Zero interest for 10% down payment (6 months to pay)”

- “No credit checking”

- “Max. of 15 years to pay”

- “Only 11% interest per annum (fixed for 15 years)

Sample computation

As requested in the comments section, here’s a sample computation which aims to illustrate the differences between the old and new payment terms:

| Assumptions:

-Selling price is Php1M -Monthly amortization starts immediately |

Old payment terms:

-10% DP -13% fixed interest rate per annum for first 3 years -15% fixed interest rate for next 12 years |

Remarks for old payment terms | New payment terms :

-10% DP payable in six months -11% fixed interest rate per annum for 15 years. |

Remarks for new payment terms |

| Month 1 cash-out for DP | 100,000.00 | The whole 10% DP is payable in month 1 | 16,666.67 | The 10% DP is payable in 6 months, so you only need to pay 1/6 of the DP on the first month |

| Month 1 monthly amortization | 11,387.17 | Based on 13% per annum for 15 years on first 3 years | 10229.37 | Based on 11% per annum for 15 years |

| Total cash-out for month 1 (DP and monthly amortization) | 111,387.17 | Cash-out in month 1 is about 11.14% of the selling price | 26,896.04 | Cash-out in month 1 is only about 2.69% of the selling price |

*Please take note that there are other expenses that should be considered like maintenance, property management, repairs, etc. The above sample computation is only for illustration purposes and only considers the expenses related to the downpayment and monthly amortizations.

Based on the sample above, if you bought a foreclosed property with a selling price of Php1M, your cash-out on the first month with the new payment terms would only be Php26,896.04. With the old payment terms, your cash-out on the first month would have been Php111,387.17. Obviously, paying only Php26,896.04 instead of Php111,387.17 is so much better, especially if you are targeting positive cashflow and better ROI.

Now this is definitely something I look forward to in 2012! The only thing missing is finding those real estate deals whose numbers really make sense. I can’t wait for the next listing of foreclosed properties from UnionBank!

Don’t be the last to know, subscribe now and get alerted when new listings of foreclosed properties from UnionBank and other banks in the Philippines are posted here in https://www.foreclosurephilippines.com.

One last thing, I hope other banks will follow UnionBank’s lead and this (better payment terms) becomes a trend!

Happy investing!

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines Facebook Page

Text by Jay Castillo and Cherry Castillo. Copyright © 2011 All rights reserved.

Full disclosure: Nothing to disclose.

PS. Thanks again to Mr. Lance Yadao of UnionBank for sharing this with us.

Only 11% hey…Ouch!

Before it was as high as 15%. 🙂

Hi! Im really not a real estate person. Hope you won’t mind if I ask how to compute for the monthly amortization for year 1-15? Let’s say the TCP is X. Thank you 🙂

Use MS Excel’s PMT formula to compute the monthly amortization.

PMT=(interest rate per annum/12, number of years to pay * 12, balance)

Finally, Unionbank woke up. Those interest rates have killed my appetite that I no longer care to look at their list. Now, I think it’s worth checking again.

This is super WOW talaga! Thank you so much for sharing this Mr. Jay! Thank you po God for helping us. And of course, Unionbank!

Pingback: First UnionBank foreclosed properties auction with new payment terms slated on January 28, 2012 — Foreclosure Investing Philippines

My goodness! This is what I had been dreaming of, WOWOWOW…!!! Downpayment payable strecth to 6months! And NO CREDIT CHECKING!!! what can I say?

It had been for 2 or more more years Mr. Jay I kept on checking thru my subscription from you, finding properties which can somehow allow our budget especially the downpayment.

I wish the properties this 2012 will be what we’re looking for too.

Thank you Sir Jay for this update!

This is what I’m awaiting for. Just like what others said “WOW” and super WOW. I hope I’ll be able to find a property with Union’s next listing within my budget.

Thanks Jay, Happy New Year!

Hi Jay! Does this new payment scheme apply to all properties? Hope so, and not only to the dregs of the portfolio. 11% now from 15%? doesn’t this indicate how big the profit margin used to be? perhaps, it’s high time to temper the appetite for profit to finally sell. No credit checkings? smacks of the sub-prime credit crunch? do hope Unionbank does not intend to securitize these types of CTS later!

Sir Jay , can you do some comparison from their previous and their current deal para naman maging aware kami sa advantages na nadagdag sa latest promo nila. Thanks.

Hi jay, are you the same Jay Cruz who used to be my officemate?

Anyway, I have added a sample computation above which compares the cash-out for the first month using the old and new payment terms. I hope it helps!

Sir Jay:

Thank you for your continuous support….

Happy Holidays!

Thanks…this sounds interesting!

You can say that again Delia! Combine these new payment terms with a good deal and you’re all set… 🙂

this is super great Jay! exciting!

Yes, very exciting!

Nice update Jay!

Thanks for this! 🙂

You’re welcome DJ!