Use this tool if you want to save money on interest. Generate your own amortization schedule with our amortization table calculator. It also calculates the required income, monthly interest/principal, total payments/interest for the loan. Details below.

Amortization Table Calculator

~

How to use our Amortization Table Calculator

Step 1: To create your own Amortization Schedule, just enter details from your home loan in the fields for data input:

- Home Price – This is the selling price of the property you want to buy

- Downpayment in % – This is the downpayment amount you intend to pay upfront in percent

- Length of Loan (Loan Term in Years) – This is the number of years you intend to pay the home loan

- Interest rate in % – This is the annual or yearly interest rate (get this from the listing or the bank/seller)

- Mortgage Start Date (mm/dd/yyyy) – Specify the start date of your loan to generate an amortization schedule that coincides with your loan. If you don’t specify any date, the default will be today’s date.

Step 2: Click the “Calculate” button and the results as well as the table/schedule of payments will show.

Step 3: If you want to have your own copy of the table, simply copy and paste the amortization table into an excel sheet or google sheet.

Explanation of Calculated Results

After entering the values, the following are automatically calculated and displayed:

- Beginning Principal Amount – This is the selling price less downpayment amount, if any. Can also be referred to as the loan amount.

- Downpayment amount – This is the calculated downpayment amount based on the downpayment percentage you entered, if any. This is equal to Home Price multiplied by Downpayment percent. Can also be referred to as the buyer’s equity.

- Monthly Payment – This is the calculated monthly amortization payments. I intentionally did not include any currency because the resulting table can actually be used with different currencies.

- Gross Monthly Income Requirement – This is the calculated Gross Monthly Income you need to have in order to qualify for a home loan. In the Philippines, the monthly amortization should not exceed 40% of the Gross Monthly Income, and Gross Monthly Income can be calculated by simply dividing the monthly amortization by 40%.

- Total Monthly Payments – This is the total monthly amortization payments for the whole loan term which include both interest and principal.

- Total Payment To Interest – This is the interest only portion of the monthly payments for the whole loan term.

- Amortization Table Schedule – This table includes the month, monthly payment, interest, principal, and principal balance. I’ll explain these columns below:

- Date – Includes the scheduled date of payments and starts with the date you entered under “Mortgage Start Date”. If no date is entered, this will start by default on the current day.

- Payment – This will be the calculated monthly amortization payment amount.

- Interest – This will be the portion of the monthly payment that goes to interest. At the start of the loan, the interest amount is highest since the principal is also at the highest. This is the annual interest rate divided by 12.

- Principal – This will be the portion of the monthly payment that goes to the principal. This is at the smallest at the start of the loan and will increase each month as the interest decreases. This is subtracted from the remaining principal from the previous month, which is why the balance becomes smaller with each monthly payment.

- Principal Balance – This is the remaining balance after a monthly payment is made. This goes down each month as the principal is paid until it becomes zero at the end of the loan term.

Applicable for real estate mortgages and other types of home loans in the Philippines

Use this amortization table for home loans, mortgage loans, and other types of loans and repayment plans available in the Philippines. This is actually applicable to any type of amortized loans that include principal and interest.

Installment payments through a Contract-To-Sell are also common in the Philippines, especially with buying foreclosed properties, and you can also use our amortization schedule calculator for these types of installment payments.

Use Cases For Amortization Tables/Schedules

1. As a home buyer getting a loan who wants to save on interest

If you are getting a housing loan, it would be wise to make sure that the monthly payments you make are accurate. This will also allow you to check how much is the remaining balance for your home loan for any given month (it feels great to see your loan becoming smaller and smaller).

Furthermore, you will see the interest payments per month, and more importantly, for the whole loan term.

This will show how much money goes to interest when you get a housing loan, and how much you can save by paying it off early*!

*Note: Paying off a housing loan early, also referred to as loan pre-termination, will usually incur a “pre-termination fee”. Always check if it will be worth it by comparing the pre-termination fee (plus other expenses the bank or lender might add) to the interest you can save.

On a related note, you also need to check with the bank/lending institution for their policy on making pre-payments/advanced payments (whether it goes direct to the principal or it will just serve as advanced payment). As far as I remember, I had to specify that my excess payment should go direct to principal when I had a housing loan with Security Bank. For my Pag-IBIG loan, my excess payments automatically went direct to principal (this was almost 10 years ago).

2. As a real estate investor flipping foreclosed properties

If you are a real estate investor who flips properties with installment terms, most buyers will ask for an amortization schedule for the reasons stated above, and this tool will help you create one.

3. As a real estate broker/sales person

If you are a licensed real estate broker or agent (a.k.a. sales person), and the properties you are selling allows bank financing/installment, I’m sure you will get asked “Can I please have a sample computation?”, again for the reasons stated above.

That sample computation should always include an amortization schedule/table. Now it is so easy to create with this tool.

Of course you need to be able to explain how the data is computed. More on this below.

Amortization Table Example

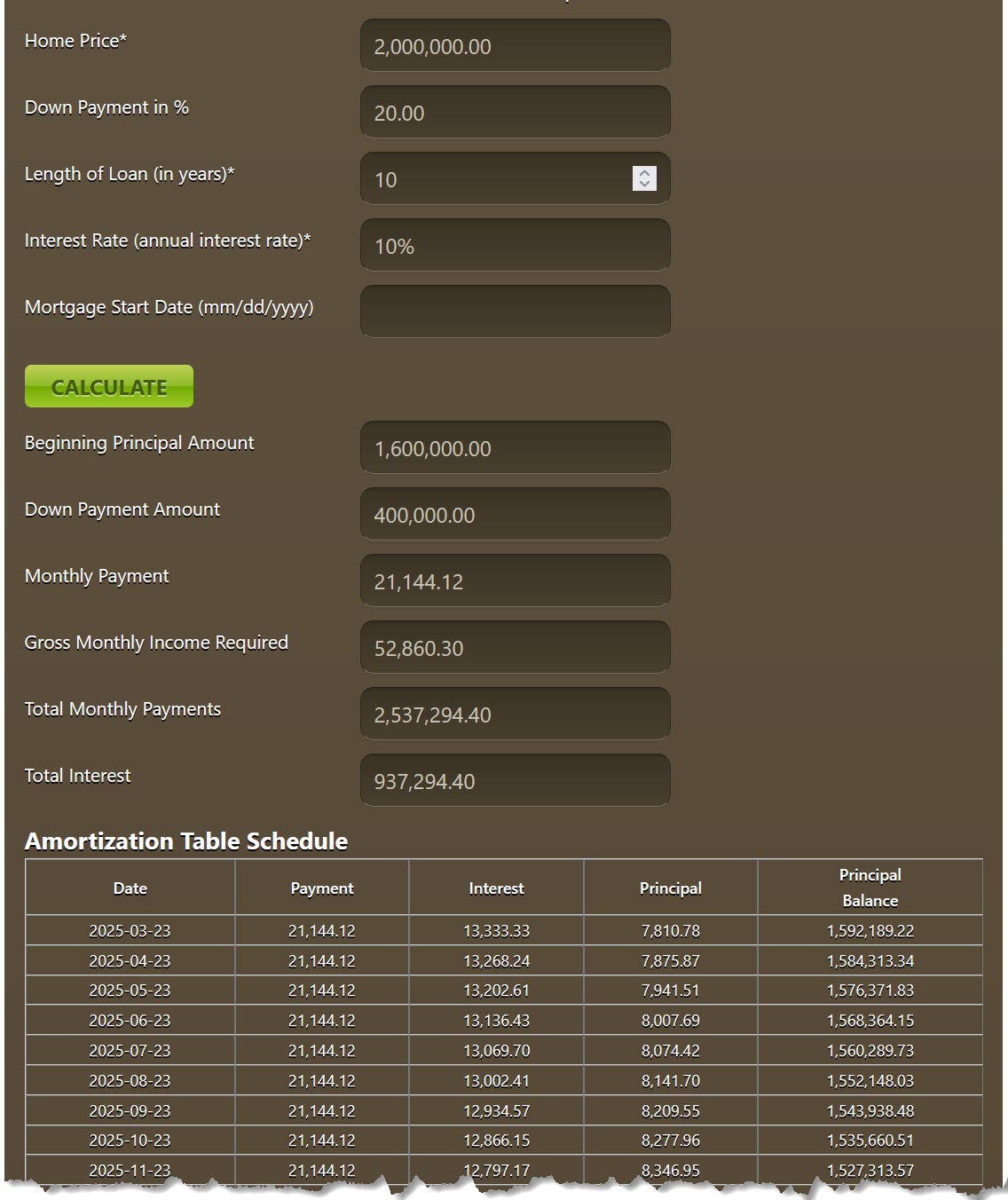

Sample property: You are buying a property through a mortgage loan, with a selling price of Php 2 Million, and the required downpayment is 20% of the selling price, with the balance payable for 10 years, at 10% annual interest rate.

- How much will be the monthly amortization payments and what will be the amount that goes to the principal and interest per month?

- How much will be my total monthly payment for 10 years?

- How much would be my lump sum payment if I want to pay in full on my 5th anniversary?

Solution: By entering the given data in the amortization table calculator above, we get the following answers:

- Monthly Amortization Payment is Php21,144.12 and the amount that goes to principal/interest varies per month.

- The total monthly payments will be Php2,537,294.40. Take note: the beginning principal amount (or loan amount) is just Php1.6 Million. This means the total interest is Php937,294.40 (total monthly payments less beginning principal amount)! This is how much you will save by paying cash instead of getting a loan! Of course, not everyone will have enough cash, so the next best thing would be to pay off the loan early.

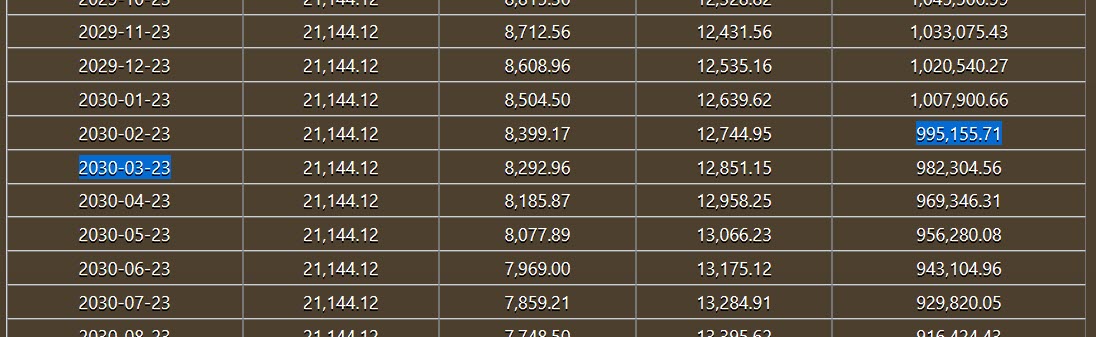

- To find the lump sum amount for full payment on the 5th anniversary, you just need to look at the principal balance for the month prior to the loan anniversary date (March 23, 2030 in this example). Looking at the the previous row, which is February 23, 2030, the principal balance is 995,155.71.

So with an amortization table calculator, all of the above questions can be easily answered. Refer to the screenshots below as reference for the source of answers for this sample problem.

(Because the table is very long, I’ll just show the screenshot for the top with a few rows from the amortization table)

To find out how much would be my lump sum payment if I wanted to pay in full on the 5th anniversary of my loan, I just have to look at the principal balance before the 5th anniversary, which in this example is on March 23, 2030. As you can see, it is 995,155.71

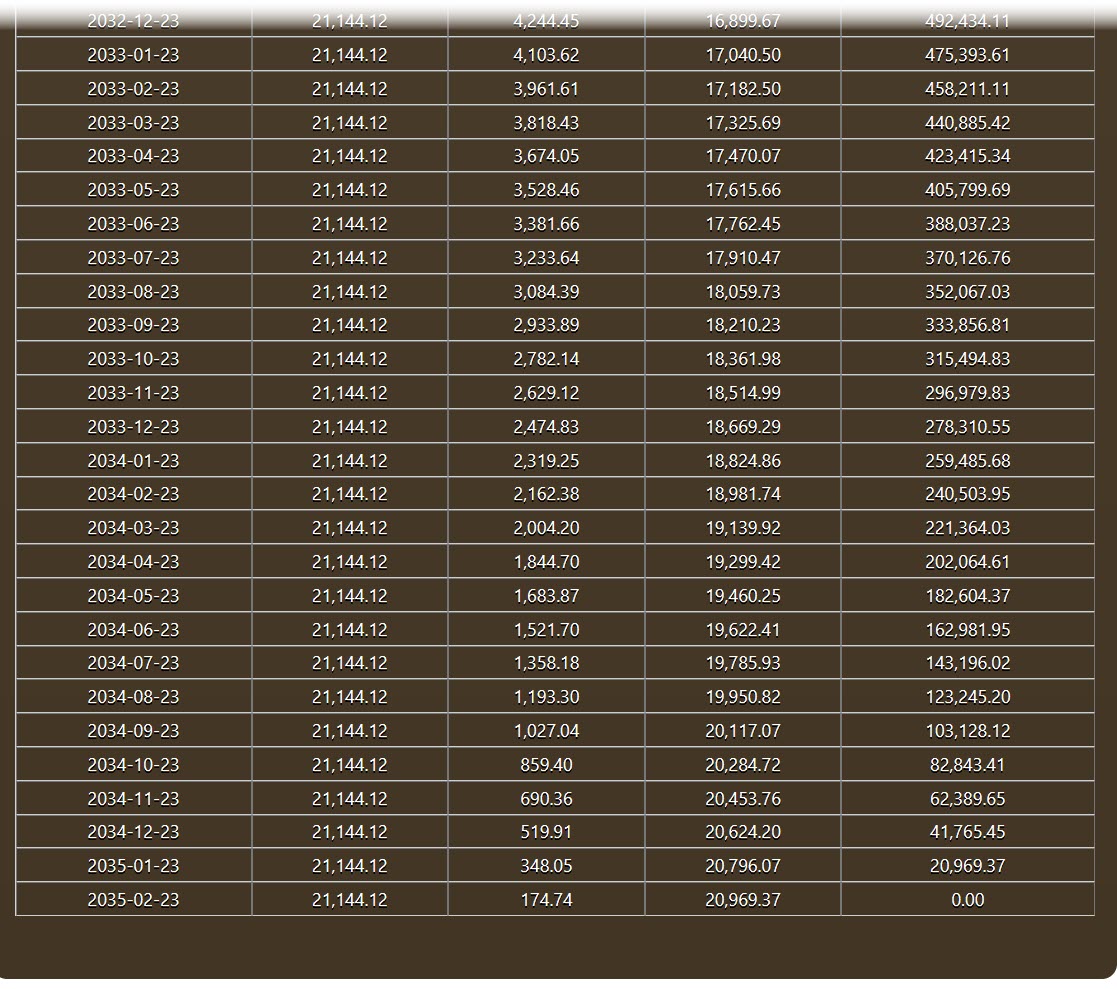

This is the bottom part of the example amortization table. Take note of the Principal Balance column which becomes zero with the last monthly payment.

Use for home loans from any bank/lending institution (not just those in the Philippines)

You can use our home loan calculator to double-check estimates/sample computations from any bank/lending institution in the Philippines.

Simply change the interest rate and loan term that is being offered to you by the bank/lending institution so you can quickly compare and check.

This is exactly how I was able to understand the monthly payments I was making for the foreclosed properties we purchased.

How did I make this amortization table calculator?

Since I know how to make an amortization table in excel, and I also know how to generate amortization factors based on the loan term and annual interest rate, it was simply a matter of finding a way to put everything into a calculator that tabulates the results.

No, I did not use any AI tools to create this calculator. I am using a WordPress plugin called Calculated Fields Form (Developer Edition).

Let me share how the data in the columns of the amortization table are computed:

1.The monthly amortization is simply the principal amount multiplied by the amortization factor rate that corresponds to the loan term and annual interest rate. This does not change for the whole loan term.

For more info on the calculation for amortization factor rates, check out this article: Amortization Factor Rate Calculator (Quickly Compute For Monthly Payments).

2.For the monthly interest amount, it is equal to the principal balance multiplied by the monthly interest rate (which is the annual interest rate divided by 12months/year). Since the principal changes after each payment, the monthly interest amount also changes each month. At the start, the principal balance is actually the whole loan amount.

3.The monthly principal is simply the monthly amortization less the corresponding monthly interest.

4.Lastly, the principal balance is the remaining balance less the principal payment for that month. This will become zero at the end of the loan term.

I know it can be hard to visualize and understand this, and it would be better for me to share a video on how I create this table in excel, which is exactly the same data displayed in my amortization table calculator.

I’ll record a video for this as soon as possible so I can share in my YouTube channel.

Want me to add something?

Since I made this Amortization Table Calculator myself, I added more to it so it can include info important to me (ex. total interest paid, required gross monthly income, etc.).

This is actually based on the simple mortgage and home loan amortization calculator I made years ago, but I always wanted to update it so it can also create an amortization schedule/table.

Is there anything you want me to add? Of course, I don’t want to over-complicate this tool.

Just to give you an idea, the original version of this included a column for the mortgage redemption insurance or MRI. I removed it however to make it simpler. Also, properties purchased via a contract-to-sell do not have any MRI, so it won’t be applicable.

Or is there any other real estate calculator you want me to make? Or do you any have questions?

Let me know through the comments below. Thanks!

FAQ

Q1. Why would would you need an amortization table/schedule?

A: With a loan amortization table/schedule you can easily see how much of your monthly payment goes towards interest and principal.

Knowing how much interest you pay each month and the total for the whole loan term gives you a clear picture of how much money you can save on interest if you buy through cash basis instead of getting a loan, or the potential savings if you pay off a loan early.

To pay off a loan early, you need to know how much is remaining balance, which you can pain in a lump sum. This is equal to the remaining loan balance with each monthly payment. With our amortization table, this is on the right-most column. Refer to the example.

Q2. What’s the difference between principal and interest in loan amortization?

A: The principal is the amount that you borrowed, while interest is the additional charges or fees you will have to pay for borrowing that amount of money. For amortized loans, most of the monthly payments goes towards the interest at the start. Over time, more goes towards the principal which makes the balance become smaller each month, until it becomes zero at the end of the loan term when the loan is paid.

Q3. What is the difference between an amortization calculator and amortization table/schedule?

A: An amortization calculator is a simple tool that computes for how much your periodic payments (often on a monthly basis) will be for an amortized loan, like a real estate mortgage or a car loan. One example is the mortgage calculator I created years ago.

An amortization table/schedule includes more data by including how much of your monthly payment goes to interest, and principal. Furthermore, the remaining balance for the principal for each monthly payment is also shown. All of these are displayed in a table which is easy to understand.

Disclaimer

The amounts you will get above are for reference purposes only. Always get the actual amount from the bank/lending institution. As always, our standard site disclaimer applies.