With so many banks and lending institutions out there, it would be nice if you can easily know which one offers the best home loans in the Philippines.

This has been a challenge for me when I’m asked which bank has the cheapest mortgage rates (and whether it is better to get a loan from a bank or Pag-IBIG) and I couldn’t give a straight answer. Not anymore!

After much research and effort, we finally have our very own mortgage and home loans in the Philippines with interest rates comparison chart which compares all available home loans and mortgage rates here in the Philippines (this is a work in progress… more on this later), including Pag-IBIG and other lending institutions (coming soon).

If you want to know where to get the cheapest mortgage rates and lowest home loan rates, just click on the “Lowest Interest Rate” column header below to sort from the lowest to the highest.

Go ahead, try it out. You can also click on the details to enlarge.

Home Loans In The Philippines Interest Rates Comparison Chart (as of June 04, 2015)

Note: We will update our amortization factor rates accordingly to ensure it includes all interest rates quoted above. Alternately, you can also use our mortgage calculator.

Are the lowest interest rates the best interest rates?

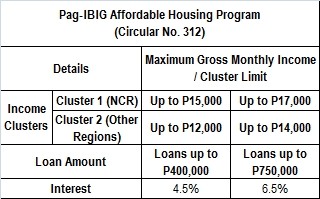

It depends. If you have played around with the chart above, you will notice that Pag-IBIG has the lowest interest rates for housing loans up to Php400,000, which is just 4.5% per year. However, what if you need a housing loan that’s more than that? Based solely on the interest rates, a number of banks beat Pag-IBIG for loans above Php400K. So it really depends on the loan amount, among other factors.

You need to check the details of what they are offering like fixing terms and corresponding interest rates (see the “Details” column), or just visit their website for more information (see the “Where to get more info” column).

Reminders about the quoted interest rates above

Please take note that the interest rates quoted in the chart above are indicative rates, which means they are subject to change without prior notice, and the actual interest rate will be the prevailing rate during the time of loan availment.

While getting the cheapest mortgage or home loan rates sounds great, there are things you should be aware of. The lowest rates usually come with yearly repricing, while fixed interest rates are often higher, but can help give you peace of mind that you won’t be affected by the next financial crisis. Learn more by reading the following article:

Updated home loan interest rates

Nope, this isn’t a one-time thing as we intend to keep this home loan and mortgage rates chart updated.

For now, these include banks and lending institutions that either have their interest rates published on their websites, or they furnished us with their interest rates. These are publicly available and can easily be verified.

In the future, we will update this to include interest rates for in-house financing offered by some banks for their foreclosed properties. We also plan to include interest rates for refinancing so that the best refinance rates can be seen at a glance. At the moment, the chart only includes interest rates for new home loan accounts/purchases.

Of course, we will also continue to add more banks and lending institutions, and information related to housing loans and mortgage rates being offered here in the Philippines, as they become available. We could also use some help.

Please help us keep this list updated

If you work for a bank or financial institution who provides housing loan products, and your bank/institution is not yet included in our home loan interest rates comparison chart (or if you have updated info, promos, etc.), please contact us and send us details so we can include your info here. The same applies even if you don’t work for a bank/lending institution, but you have information worth sharing here.

We value your feedback and inputs so if you have any comments and/or suggestions, just let us know by leaving a comment below. Thanks!

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Blog: https://www.foreclosurephilippines.com

Connect with us – Subscribe | Facebook | Twitter | Google+

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2013 All rights reserved.

Full disclosure: Although I am an accredited broker of BPI Loans, we included other banks/lending institutions in the chart above. My goal is to create a very objective and unbiased home loan comparison chart, and I intend to keep it that way.

Image courtesy: of ddpavumba / FreeDigitalPhotos

This is really helpful. Thank you!

The above interest rate tables are very informative, I am considering buying another unit using PSBank and I might try others if I will be able to negotiate a better interest rate just like in Union Bank. Thanks Jay for the post.

Hi, Sir Jay. Thanks for the posting these info. Very helpful. Do u know of an agent who could help us apply for a bank loan with our property as collateral?

This is very informative. Thank you.

Hi Sir Jay.. thank you for this… I am planning to invest soon and i needed this comparison chart…Looking to have 5 year home loan so I am choosing between BPI or PNB.. I am 25 y/o now and i have been a follower of your site i guess since i was 20-21yrs old… Godbless you sir…..

You’re welcome and thank you also Rus, God bless you too!

Allied Bank interest rates should be the same as PNB’s since they already merged a few years back. What’s listed on their website is outdated information.

PNB/Allied Bank current rates

Interest Rate Fixing period

5.25% fixed for 1 year

6.25% fixed for 2-3 years

6.75% fixed for 4-5 years

9.50% fixed for 10 years

10.25% fixed for 15 years

10.75% fixed for 20 years

(Source: Current Allied Bank mortgage)

Cheers!

Thanks for the inputs and for sharing!

Hi, I just heard from a BPI Family Housing loan manager about their 5-5-5 promo. 5% interest fixed for 5 years for a loan amount of 5M.

Yes this is true, we’ll add this asap. Thanks.

hello Jay.

I have an existing loan from Metrobank and it was fixed 5..5% (1st year), then after the 1st year, they now increase it to 7% (2nd year). I’m planning to have it refinance sa other banks with lower interest rate. What are the requirements and what are the fees these banks charging?

Any idea or inputs?

Pingback: Security Bank Fantastic Elastic Home Loan Offers 5.25% Interest Rate - Comparison Chart Updated

Greeting Mr. Jay, just give you update about my approved loan. Among 3 banks who approved my housing loan (RCBC, China Bank Savings & Union Bank). I finally close a deal to Union Bank.

UNION BANK final offer as of October 24, 2014 with combination of CROWNASIA PROMO

– Loanable amount increased to 90% from 80% (almost all banks up to 80% only)

– ONLY 6.50% fixed 5years

– FREE Bank Fees (php 98,000+)

hello everyone, as of Oct 07, 2014 offer I received

CHINA BANK SAVINGS

5.50% fixed 1 year

6.50% fixed 3 years

6.75% fixed 5 years

UNION BANK

6.50% fixed 3 years

15years term

Now, i’m waiting for RCBC & BPI

Thanks Ramil!

hi, i had a recent loan with RCBC Savings Bank and they have the lowest rate for housing loans and they have efficient loan officers.

1 year fixed at 5.50%

2 – 3 years fixed at 6.50%

4 – 5 years fixed at 6.88% ONLY!

hi Jay, which do you think is better? loan in bank or through Pag-ibig? What are the differences? pros and cons?

Thanks!

sir sa BDO pareho din po yung condition ng veterans fix for 5 years pero magasdjust sila base sa condition ng market after 5 years for the interest,tapos may mg promo din po sila,nakakuha ako loan sa kanila 10 years 7%lang interest for 1st 5 years then magadjust after 5 years.

jay, is it possible to apply pag ibig loan as well as bank housing loan for the same property?

Hi Marjorie, technically pwede, bale magkakaroon ng first mortgage and second mortgage, although bihirang bihara yan, kasi most banks/lending institutions require a certain amount of equity.

Hi Jay,Good work

i am one of you email subscriber, i am wondering if we can partner or help each other, i would like to invite you to post your blogs in our website http://bancrea.weebly.com/ , your content is surefire for our site visitors looking for ideal home. Please let me know how we can start.

Thanks

Roy Buen

Bancrea Team

bancrea@yahoo.com

http://bancrea.weebly.com/

Very timely and essentially informative, thanks J!

Hello, Mr Jay Castillo.. is there a law governing a developer to ask for processing fee for a in house financing to be refinanced thru HDMF Housing Loan.

Pingback: Philippine Veterans Bank's Home Loan, Free Home Promo - Can You Really Get Your House For Free?

SECURITY BANK

1 year: 5.25%

2-3 yrs: 6.75%

4-5 yrs: 7.00%

6-10 yrs: 8.00%

11-15 yrs: 10.00%

hi clarisse, we are applying for a home loan located at cambridge village. empire east is the developer. is these rates still available?

Thanks for the info! Quick question is it possible to transfer the bank loan to pagibig? Just asking.. I have mine this time but the rate is very high like 10% so I’m thinking if I can transfer it to pagibig.

Pingback: BPI, PNB, PSBank Offers Lower Home Loan Interest Rates - Comparison Chart Updated

hi mr.jay!!! im currently paying my home loan from bdo for almost 4 years now….im just wondering that if the time comes that i already pay it in full…will i automatically get the land title ready(already in my name)???? or do i need to process it by myself???? THANK YOU and GOD BLESS!!!!

hi sir jay! I would like to ask for your suggestion: is it better to get the fixed 1 yr rate of 5.25% than 3 yrs fixed rate of 6.25%?

Hi Marjorie, for me, I would go for the 3 years fixed rate, even if the interest is higher. They say interest rates are about to go up soon, so it’s better to be protected with the fixed interest rates, at least for the next 3 years.

No, It is always best to get FIX for the whole term. WHY? if the economy goes to crap then interest will climb and your payment could double, triple and there is nothing you can do about it! If fixed, you are guaranteed the same payment from beginning to end of your loan no matter how crappy the economy gets. If you go variable then you are taking a huge risk!!!! You will live a life of uncertainty!

Hi Jay. What are your thoughts on Veteran Banks’ promo of 20-year loan term with the guarantee of a 100% return of the principal loan (www.pvbhomeloans.com)? WHat could be the catch?

Hi John, we called up PVB and this seems to be legit. Will share what info we gathered in the next few days. Thanks!

Thank you Jay. This is just too good to be true so I’m very skeptical about it

Pingback: Low Home Loan Rates - What You Need to Know Before It's Too Late

Pingback: BPI, PNB, PSBank Offers Lower Home Loan Interest Rates - Comparison Chart Updated

sir/ma’am,

it would help perhaps if you can write about mortgage redemption insurance?thanks and more power

Hi Lara. What a coincidence, I just gave a short talk in UP Diliman about the importance of insurance, which includes MRI. 🙂

I’ll publish this within January 2014. Thanks for dropping by!

Pingback: Our Top 10 Real Estate Investing Blog Posts For 2013

Sir Jay your site is indeed helpful thanks so much!

i have an existing loan with pag ibig. pag ibig funds has a program called risk-based interest rate wherein the borrower could apply for a 3-year fixed interest rate of about 7%. after 3 years, the interest rate will be based on the market rate. would appreciate any thoughts or advise on this. thanks in advance and more power!

You’re welcome and thank you also EVP! Thanks also for the comment, I just realized the update for this article is long overdue.

With regard to your loan, it sounds good as you will have peace of mind for the next 3 years at the very least. But do you have the option to get another term with a fixed rate before the 3 year term ends?

Thanks for your quick reply sir Jay!

Accdg to pag-ibig before the 3 yr term with a fixed rate ends, automatically,

a new fixed rate will be applied every 3 yrs, until the end of the loan term.

is this a better option than a 25-yr with fixed interest rate of 10.5%?

my concern is the risk/possibility that the interest rate (based on market rate)

may be higher than 10.5% after 3 or 6 or 9 yrs? is there a projection on interest rates?

again, thanks in advance for your advise.

hi jay!

i see that you are an expert! thank you for this info.

i have 2 questions for you.

1. do you recommend i choose fixed or variable loan?

2. lets say i bought a condo amounting to 3 million. ill be paying 20% to the developer and 80% with financing. is the appraised value 3 million or the 80%? i dont know what to put in the mortgage calculator.

im sorry, im new to this.

thank you.

1. Fixed – variable is dangerous! If economy goes then you go! Your payment will climb double – triple or more then you cant pay and you lose your home. Fix is guaranteed through the whole life of the loan no matter if the whole country crashes. I suggest 5 year fixed or 10 year fixed depending on your budget.

2. 3m – 20% = 2.4M now take that and punch it into the loan calculator here http://apps.finra.org/Calcs/1/Loan You already paid 20% so of course that would not be part of the loan. The loan would be based on the 80%. so lets say you got a 10 year loan fixed (recommended) You put amount 2.4M then interest rate of loan say 7% and then months so 12 months in a year times 10 years is 120 months. then click calculate. Out pops your estimated monthly.

Pingback: Which bank has lowest housing loan interest? - Page 2

Thanks Sir for posting this! More power and God bless.

Sir, just a quick query, what is the difference between foreclosure sales which indicate under NEGOTIATED SALE vs. AUCTION SALE? I always see this on bank notices of foreclosed properties.

foreclosure sale pertains to those properties which were foreclosed by creditors such as banks or other private persons/entities. They were offered for sale so that the amount of the sale or the proceeds of the sale will be used to satisfy the amount of credit obtained by the debtor. In such a case, a negotiated sale involves a sale by these creditors where in you can negotiate directly with them and you can fix or stipulate on the amount which you are willing to pay but subject to some conditions such as price ceilings. On the other hand, an auction sale occurs when there is a public offering by the bank which invites interested buyers to post their bids on a certain property which is subject to foreclosure. In the same concept the highest bidder will be the one to acquire the property and the proceeds of the sale will be used to pay the credit of the debtor. All of which is still subject to conditions pertaining to interest rates which the creditor may impose and other charges for applications. I hope this makes sense.

Hi sir jay. I just want information on how much cost for mortgage registration, MRI, insurance..BPI is now on process of my loan. Please reply.

Thank you.

Regards,

Rey

Hi,

Mind sharing the Home Loan Rates for Metrobank as well? Thanks 🙂

informative!keep us posted this next quarter with further helpful infos..thanks

Thanks Jay for this wonderful post.

Very nice and informative.

I would like to know whether it is a good idea to transfer a current home loan from bank A with fixed 8.75% int yearly for 2 years to bank B with only 5.25% fixed int for first year.

Will bank B still going to charge the applicant for the application fees, appraisal fees (if any), mortgage registration fees, taxes (DST for the mortgage), insurance premiums, and other miscellaneous fees?

I am thinking that the savings you could get for transferring will only goes to these above-mentioned fees.

Thanks.

Hi, Thank you for this information. I would like to ask if the interest rates for the Housing Loan and Housing Construction are the same for Pag-ibig? I already have my own lot and we are planning to get a loan from pag-ibig for the housing construction.

Thank you in advance for your answer.

Thanks God i found this site, its full of clear and simple info that I couldn’t get from my broker during a month of negotiations. I understand better now and congratulations Jay I’m sure dealing with you would be very smooth.

Anyway I have a question that most people may not realize but I wonder why is this way.

In your post (Low home loan rates – what you need to know before it’s too late) there is a guy saying that he already pay 700k for a property to the developer but he has yet to apply for a bank loan. The developer gave him the “go” signal to move in but how can be this way? I’m sorry for my ignorance but in Japan where I’m based or in my home country (Latin America) or i can say in the USA too or wherever logic is used you first get an estimated purchase contract, bring it to your bank, have it screened to see if you qualify for the loan then and only when your bank approve your loan you can comeback and purchase the property to the developer.

If the developer approaches you selling a property, first thing they do is to provide the paperwork for you to apply for a house loan before making any contract with you, of course you don’t have to pay anything until the loan is approved.

So in the guy’s case above he is asking too about the time line for applying to a bank loan after the developer gave him the “go” signal. (You answered is 3 months and if he fails, he have to re-apply all over again) so my questions is:

What if the bank deny your loan no matter for what reason? what do you do then? I mean in this guy’s case he already pay 20% DP 700k what happen then?

I really cannot understand this way to purchase a property in the Philippines where you pay the developer first to find out later if your bank will approve the loan and i believe it should logically be the other way around. I find this manipulative, abusive, incorrect and in total disadvantage for the buyer but if I’m wrong please help me to understand.

Thank you.

Hi Jay,

Thanks for posting ! Its very informative and a great help to know.

God bless your Mom and your family.

Regards ,

Beth

You’re welcome Beth, thank you also. My mom is now undergoing rehab (too early if you ask me!), although I now have a cold and I have to stay at home and I can’t visit her. I guess I need to rest too.

This is great! Specially getting updated every quarter! 🙂

nice work Jay! thanks

You’re welcome Shaun, thank you also for dropping by. By the way, I noticed you’re website is offline.

I havent been able to visit my own website lately so I didnt know lol, that website doesnt bring in cash anymore so I guess I’ll just let it go. thanks

Thanks Sir Jay! This would help buyers decide the best for their housing loan.

You’re welcome Jerome, thanks for dropping by!

Prices are going up and mortgages down.. humm scary!

Anyone has the number of how many are being paid cash and how many finance?

The number of loans to construction is also going up quickly.

I think that is still early and the prices compared to other countries are not that high, but the bubble might be on the way.

Hi Dalamar, we don’t have public figures, but for our clients, around 1 in 10 would pay in cash, the rest would get bank financing.

I’m still optimistic and confident that there won’t be a bubble caused by defaulting home loans. I can see banks are still very strict.

How do you track the changes in prices? Is there any public figure? Do you think that some areas are performing much better than others? Or there are just big increases in prices in general? I see that prime properties are going up quite a lot and the best locations, is that happening also in other areas?

Thanks!

Thanks Sir Jay for this very informative inputs. I love tables anyway and you did. Cheers! and God Bless.

You’re welcome Janiero, God Bless you too!

Just to share, be careful in picking the bank with the lowest interest rate offer. They may give the lowest interest rate but the “after-sales” service can suck. I found this the hard way. I went with the bank with the lowest rate, and after paying my monthly payments diligently for 5 years, I discovered that the bank has not done the paper work related to the mortgage with the Register of Deeds. Also, getting simple documents from the bank, such as summary of payments or copy of the Mortgage Contract, is such a difficult and stressful experience. I would rather go with the bank with a higher interest rate but with better service.

Hi Vim, thanks a lot for sharing your experience, although it was not a pleasant one. I just hope all is well now. Anyway, your experience should serve as an eye opener for those about to get a housing loan. It’s really not just about the lowest rates, there are a lot of other factors to consider. Thanks again for dropping by!

Nice Jay! Been waiting for a post like this. Thank you! God bless to you and your family!

Hi Chuckkk, Your’re welcome and thank you also. God Bless you too and your family!

Thanks for the initiative Jay. Can you include other bank charges as well?

Best Regards,

Maloy

i-Brokers International

0917 838 8019 / 964 3283

Hi Maloy, you’re welcome. Yes, we will include bank charges like application fees, appraisal fees (if any), mortgage registration fees, taxes (DST for the mortgage), insurance premiums, and other miscellaneous fees in the next update. Thank you also for dropping by, cheers!