A post by Cherry Castillo

In my earlier post, I noted that the BIR has been releasing issuances showing that they are keen on collecting more revenues from real property transactions by updating real property values. I also noted from the BIR’s Memorandum of Agreement with CREBA Land that the BIR’s target date for the updating of real property values is June 30, 2010. The BIR’s latest issuance, Revenue Memorandum Order (RMO) No. 41-2010 dated April 23, 2010 confirms this deadline date.

Basically, there will be three committees who will be working on the updating real property values, namely: the Executive Committee on Real Property Valuation (ECRPV), the Technical Committee on Real Property Valuation (TCRPV), and the Sub-Technical Committee on Real Property Valuation (STCRPV). The nitty-gritty work will be done by the STCRPV, which shall be composed of the following: the Revenue District Officer (RDO) as Chairman, the Assistant Revenue District Officer (ARDO) as Vice-Chairman, and the (1) Municipal/ Assistant City Assessor, (2) Local Development Officer (Office of the Mayor), and (3) Two (2) licensed and competent appraisers from a reputable association/organization of appraisers as members.

To learn more about the procedure for determining the updated zonal values, click here to get a copy of RMO No. 41-2010.

Annex A is the format of the invitation letter that the BIR will send to members of the committees(click here to download a copy of Annex A).

Annex B contains the Classification Codes which can be seen below (click here to download a copy of Annex B).

Annex C is the format of the Schedule of Recommended Zonal Values(click here to download a copy of Annex C).

ANNEX “B”

DEFINITION OF TERMS

RESIDENTIAL LAND/CONDOMINIUM PRINCIPALLY DEVOTED TO HABITATION. COMMERCIAL

LAND/BUILDING DEVOTED PRINCIPALLY TO COMMMERCIAL PURPOSES AND GENERALLY FOR THE OBJECT OF PROFIT. INDUSTRIAL DEVOTED PRINCIPALLY TO INDUSTRY AS CAPITAL. AGRICULTURAL DEVOTED PRINCIPALLY TO RAISING OF CROP SUCH AS RICE, CORN, SUGARCANE, TOBACCO, ETC. OR TO PASTURING, INLAND FISHING, SALT-MAKING, AND OTHER AGRICULTURAL USES INCLUDING TIMBERLAND AND FOREST LAND. GENERAL PURPOSE RAWLAND, UNDEVELOPED AND UNDERDEVELOPED AREA WHICH HAS POTENTIAL FOR DEVELOPMENT INTO RESIDENTIAL, COMMERCIAL, INDUSTRIAL, INSTITUTIONAL, ETC. MUST NOT BE LESS THAN 5,000 SQUARE METERS. VICINITY MEANS AN AREA, LOCALITY, NEIGHBORHOOD OR DISTRICT ABOUT, NEAR, ADJACENT PROXIMATE OR CONTIGUOUS TO A STREET BEING LOCATED. CLASSIFICATION LEGEND:

CODE CLASSIFICATION CODE CLASSIFICATION RR Residential Regular GL Government Land CR Commercial Regular GP General Purposes RC Residential Condominium I Industrial CC Commercial Condominium X Institutional CL Cemetery Lot APD Area for Priority Development A Agricultural PS Parking Slot AGRICULTURAL LANDS A1 Riceland Irrigated A26 Bamboo Land A2 Riceland Unirrigated A27 Peanut Land A3 Upland A28 Soy beans Land A4 Coco Land A29 Grape vineyard A5 Citrus Land A30 Pepper Land A6 Fishpond A31 Mineral Land A7 Swamp A32 Non Metallic mineral Land A8 Nipa Land A33 Coal Deposit A9 Cotton Land A34 African Oil Land A10 Cogon A35 Rubber Land A11 Abaca Land A36 Forest Land/Timber Land A12 Orchard A37 Horticultural Land A13 Pineapple Land A38 Salt Beds A14 Banana Land A39 Seashore A15 Pasture Land A40 Resort A16 Corn Land A41 Sandy/Stony A17 Sugar Land A42 Prawn pond A18 Tobacco Land A43 Sorghum A19 Cacao A44 Ipil-ipil A20 Lanzones A45 Kangkong A21 Durian A46 Zarate A22 Rambutan A47 Vegetable Land A23 Mango A48 Coffee A24 Mangrove A49 Mountainous / Hilly Areas A25 Camote/Cassava A50 Other Agricultural Lands

Salient portions

For me, the salient portions are the following:

“The determination of recommended market values shall be based on:

- Acceptable methods of appraisal of real properties;

- Records of most recent actual sales/transfers/exchanges of properties in documents filed in public offices, e.g., BIR, Land Registration Commission, etc.;

- Private records of banks, realtors, and appraisers in the locality;

- Records of provincial/city/municipal assessors;; and

- Other procedures and methods of appraisal.”

“The schedule of recommended zonal values shall contain the following:

a. The three recommended values from the BIR, the private appraisers, and the provincial/city/municipal assessor; and

b. The final recommended value which is the average of the two (2) highest recommended values.

In case there is no available private appraiser in the locality and/or in case of failure of any or all of the members of the STCRPV to attend the meeting called for and/or submit their respective recommended market values as requested within ten (10) calendar days from the date of the concluding meeting of the STCRPV, the Chairman of the STCRPV shall:

i. Execute an “Affidavit” to that effect;

ii. Proceed with the establishment/revision of the schedule of zonal values based on the average of the two (2) highest recommended values or best data/values available; and

iii. Submit to the TCRPV the Schedule of Zonal Values together with copies of letter of invitation with waiver duly received by the members (Annex “A”), Affidavit, Maps, Minutes of Meeting, and all other documents relative to the establishment/revision of zonal values.”

The guidelines look fair and the procedure is quite clear-cut. I really think that the schedule is too tight though. It’s really the BIR and the municipal/city assessors who will be working hard on this as my understanding is that the private appraisers can decline the BIR’s invitation for them to join the STCRPV. On another note, it’s good that there will be public hearings, the schedules of which should be disseminated in newspapers and notices to the public.

Cherry Castillo

Cherry is my wife. She is a certified public accountant (CPA) and lawyer.

Jay’s thoughts

So what does this mean to us not just as investors but also as property owners, why should we be concerned?

We should be concerned because if the revised zonal values exceed the market values of our properties, this would mean a corresponding increase in the applicable real estate taxes that we pay.

As mentioned in my article: How I estimate the market values of foreclosed properties, market value is defined as “the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion.” In other words, a buyer and a seller who have no compelling reason or special circumstances to buy and sell, respectively, agree on this price.

Market value is not the same as the technical term “fair market value” (FMV) which is used for taxation purposes, and is based on the zonal value of a property.

Public hearings announced in Makati

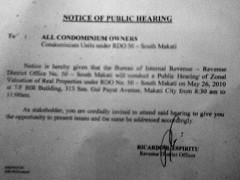

In the condo where we are renting right now for example, we saw a “Notice of public hearing” (please see picture on the left, sorry some portions might be unreadable as my camera phone stinks… hehe) and the hearing will be conducted by the BIR.

In the condo where we are renting right now for example, we saw a “Notice of public hearing” (please see picture on the left, sorry some portions might be unreadable as my camera phone stinks… hehe) and the hearing will be conducted by the BIR.

Unit owners of this particular condo in Makati were invited to attend the said hearing to be able to have the opportunity to present issues and the same be addressed accordingly. I believe helping ensure that the zonal values/fair market values be really “fair” is one such issue. Let us all help and do our part given the same opportunity.

We would really appreciate your thoughts on this. Thanks!

—

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in twitter:http://twitter.com/jay_castillo

Find us in Facebook:Foreclosure Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Are you a new visitor? Click here NOW to start learning more about foreclosure investing in the Philippines

PPS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Inbox getting full? Subscribe through my RSS Feed instead!

Pingback: Paranaque adopting revised schedules of real property values?

thanks for the info guys..yeah i hope that the Gov will also help in making use of the revenues…First, let’s define the term ZONAL VALUE or Zonal Valuation:

Zonal Valuation – is an approved zonal schedule of fair market values on real property used by the Bureau of Internal Revenue as basis for the computation of internal revenue taxes.

Zonal valuation is used primarily:

basis for computing the fair market value of the property

computation of internal revenue taxes

Pingback: What you need to know about BIR Zonal values

Hi Jay,

That would definitely affect everything. In particular to auctioned properties the BIR already imposed the collections on CGT based on the zonal value and not on the bid price.

Hi Jun, thanks a lot for the comment, I just hope that the new government makes good use of the additional revenue this will generate. I look forward to meeting up with you and Bryan soon!