While reviewing the home loan interest rates of BPI which I’ll use for a home loan/mortgage calculator I am developing for the Buena Mano property listings, I noticed they have just lowered their interest rates. I made a quick check for other banks and it turns out PNB and PSBank now also offer lower rates. p

While reviewing the home loan interest rates of BPI which I’ll use for a home loan/mortgage calculator I am developing for the Buena Mano property listings, I noticed they have just lowered their interest rates. I made a quick check for other banks and it turns out PNB and PSBank now also offer lower rates. p

Check out the home loan interest rates currently offered by BPI, PNB, and PSBank below, along with updates to our comparison chart that includes more banks and also Pag-IBIG.

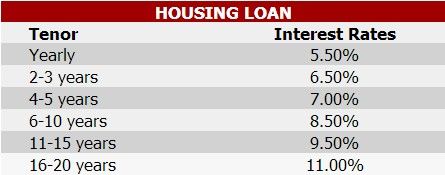

Updated BPI Housing Loan Interest Rates

The following are the updated home loan interest rates for BPI

Source: BPI website

I noticed that BPI’s interest rates have been lowered by 0.5% on the average and their payment terms (Tenor) is now up to 20 years. Though these are not the cheapest mortgage rates around, they are still quite competitive.

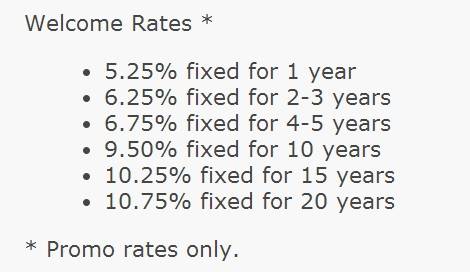

Updated PNB Home Loan Interest Rates

The following are the updated interest rates for PNB. Please keep in mind these are for new loans.

Source: PNB Website

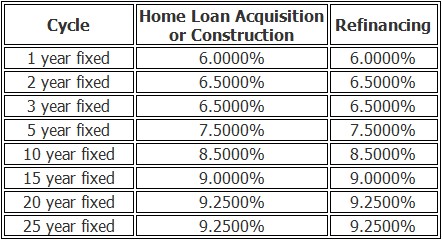

Updated PSBank Home Loan Interest Rates

The following are the updated home loan interest rates from PSBank.

Source: PSBank website

Reminders – Please read!

Interest rates quoted here are indicative only and are subject to change without prior notice. Always verify the current interest rates at the time of loan availment.

Home Loan Interest Rates Comparison Chart Updated

Because of the updated interest rates from BPI, I also updated the interest rates of other banks in our Home Loan Interest Rates Comparison Chart. Notable changes are as follows

- BDO no longer has promo rates listed on their website, their lowest rate is now at 7.75%

- PNB’s lowest rate is now as low as 5.25%, the lowest home loan rate for banks (Pag-IBIG still offers the lowest overall at 4.5%)

- HSBC updates their lowest interest rate to 5.5%. This was at 5.25% before.

- PSBank’s lowest rate is now at 6.0%. It’s also worth noting that PSBank offers the longest fixed term among banks at 25 years (Pag-IBIG still offers the longest term of 30 years). If you want to refinance your home loan, I also included PSBank’s refinance rates.

Anyway, you can compare and see who offers the best home loan interest rates on our list through the link below :

If you know of other banks that have updated their interest rates, please let us know by leaving a comment below. Thanks.

P.S. I have already released our very own home loan / mortgage calculator. Check it out here.

Image courtesy of Stuart Miles / FreeDigitalPhotos

Hi Sir Jay,

I was able to acquire my property last year because of you. So many thanks. I acquired my home thru unionbank and been paying the monthly amortization with 11% interest rate. Can i ask the bank to lower my rate? or Can i apply to another bank with lower interest rate?

Also, with bpi, they are offering 6.8% fixed for 5 years but my loan will be for 15 years. What does it mean? Can i still get the same rate after 5 years?

Congrats Joel!

You can try to ask but I would suggest that you just get a loan takeout to another bank.

For BPI, it means your loan will be subject to repricing after 5 years, and the rates would depend on the current market rates.

Good day, we are from bank of makati

We would like to solicit accounts for bank financing

Hi Mr. Dave, do you mean you want to advertise here to get clients?

Thanks Mr.Jay Castillo.

You’re welcome!

Jay, thank you for the forum. I am an American with a Filipina wife and Filipino son. My wife is already in The Philippines, and I will join her when my property in The States sell (approx. 6 months or so) We have found a very nice 1000SQM lot for a residence in Alfonso, Tagaytay. We will be paying cash for the lot in my wife’s name of course for around 800K with an estimated market value of 1 to 1.2M. I will then have approx. 500k to start building a 150SQM house. My income is net 120K per month from my US benefits. My question is, can we get a mortgage for the balance of the home, approx. 1.7M? (approx. estimate value of house 3.5M+) On another note I would like to have a bank that can offer checking, savings, debit card etc. along with the home loan. I will deposit another 500K into the savings account. I appreciate any advice.

Kelly

P.S. Should I hire an attorney to guide me through the financial and property issues I may have such as title work, loan documentations etc. and I would also like to General the construction of the house with a forman or engineer.

Hi,

I am a American building a house in Philippines. I was able to obtain a construction loan from a bank. I am not sure if they have requirements about how long the foreigner has to reside here before they can make a loan.

The bank cannot loan you money until the lot is titled to your wife’s name. In addition your name need to be annotated on it too if you are relying on your earnings. Some times this can take years depending on the property. I paid extra cash and got mine done in 4 months. I have an Aunt in law she been waiting over two years. It was in a development I am not clear what the problem is.

Another problem is all loans have to be paid off in the year of your 65 birthday. If the income pension is based in your name then they can not loan past your 65th birthday. You may be able to get a finance company to do it but it is really high interest rate.

When you purchase the lot make sure the seller gets you a Certified True Copy of the deed to make sure you they dont have any leans and that they are in fact the legal seller. Fraud is common here.

Attorney would certainly do all this for you. The engineer that puled my permit did mine because he new everybody in the past and new exactly how to follow up. We did not use an attorney.

We started the build with out a bank. Our house was 60% done when we first got our loan. I think that helped It took the bank three months to process even though they said it only takes one. That is pretty common to take three months. If your wife or her family knows someone personally that is big help.

During the second half of our build i decided to General the finish my self because I wanted American style. You will need to talk to you Engineer who files for the permit and ask him if he will allow. It is his decision as he is legally liable if something goes terribly wrong. During the first half we were allow to provide our own foreman and crew and our engineer just checked in every day.

Our house is near Cebu City in Talisay

Hope this helps.

Wow, thanks for sharing all of this Randy!

Sir,

I ask ko lang if pwede iparefinance sa ibang bank with lower interest rate my current mortgage from a specific bank?

nice website.

Thank you Mark!

Ask ko lang po pwede po ba i foreclose ng banko ang bahay kahit di pa tapos young years of contract. Thanks

hi sir good day.. cno poh pwede kausapin para sa mga foreclosed n house kc d nman macontact ung number n nakalist.. want k kc ung sa may console, bgy dita.sta rosa laguna

Pag BFS po, eto po yung numbers:

756-6330

756-6376

756-6230 local 303, 332, 385, 388, 479, 490, 510, 543, 546, 551, 582

Good day. i would just like to ask if you could assist me in selling my SM Condo in Tagaytay. I have 2 units, one is RFO, studio unit fully furnished at 5/F of Tower 2 while the other is 1 bedroom with balcony facing Taal located at the 8th floor of Tower 1, RFO by 1st qrt of 2014. Thanks & God bless

How much?

Hi Ms. Marie Ann, I’ll contact you directly through email.

Hi sir Jay. we are currently having our house mortgaged at BDO. how soon can we have our loan refinanced by another bank, just in case BDO puts their sky high rates?

Hi Dins,

I believe you can have it refinanced with other banks anytime. Just make sure to confirm if there will be pre-termination charges with BDO. Let us know how it goes. Thanks.