One of our real estate mentors, Engr. Enrico Cruz of Urban Institute of Real Estate and Construction, will be holding a Build and Sell Mentoring Course on 18 Saturdays, from May 18 to September 14, 2013, from 1:30 pm to 6:00 pm at the Jose Yulo Caseroom of the Asian Institute of Management (AIM) Conference Center, Makati.

In addition to the Saturday lectures, there will be 7 Sunday morning sessions at proposed, ongoing, and completed build and sell construction sites, in addition to related practical, hands-on activities.

In the Build and Sell Mentoring Course, students will learn the ropes – both theoretical and practical – so that they can immediately go into the Build and Sell real estate business and succeed in it.

I’m sure the course will be fun because participants will get to know and network with their classmates, who come from diverse educational and work background. There will be group field work for topics like appraisal of properties and inspection of properties to be purchased. There will of course be group discussions, group presentations, and group and individual assignments. Most importantly, students will get to be mentored by one of the most respected icons in the real estate industry today – Engr. Enrico Cruz.

Engr. Cruz is a real estate broker, real estate appraiser, and real estate consultant with over 35 years of experience as a real estate practitioner and businessman. He is a man of integrity, a man with genuine fatherly concern for his students and a sincere desire for them to succeed. All of his students are privileged to have been mentored by him.

What will you learn from the Build and Sell Mentoring Course?

According to Engr. Cruz in his email to us, participants will learn the following:

- How to become an effective integrator of different knowledge and skills to achieve a profitable and successful build and sell projects

- What project to put up on a given location or where to locate a proposed project. Which comes first, the project concept or the location?

- How to evaluate the marketability of your proposed project

- Valuation of vacant land and land with improvement and how to set your maximum buying price

- Financial studies related to buying, building and selling including Joint Ventures and Syndications

- To gain general information on the works and responsibilities of different professionals that would be involved in the build and sell business to be capable of double-checking their works in case they were hired

- The different alternatives on how to administer the project

- The different government permits and licenses and how to apply and secure them

- The different ways of marketing and selling your project

- A general view of all the legal aspects related to build and sell business including the important provisions that should be included in the contracts

- All taxation aspects related to build and sell, from buying the lot to selling the units

- Other topics which may arise and are deemed necessary during the course and seven (7) Sundays of fieldwork and visits to actual Build & Sell projects (proposed, ongoing and completed)

Who will benefit from this course?

I believe this course is perfect for:

- Those who already have vacant lots but don’t know how to maximize their profits from the use of such land

- Landowners who were approached by builders for possible a joint venture, but the landowners are not really sure if they are getting a fair deal

- Engineers and architects who want to use their knowledge and skills, and enter the Build and Sell business

- People who are interested in real estate investing and want to get into the Build and Sell business

What are the topics and schedule?

|

BUILD & SELL MENTORING COURSE |

|

|

SCHEDULE |

|

|

Day 1 |

General orientation & instructions |

| About handouts and reading materials | |

| About coverage | |

| About rules and procedures | |

| Selected topics on principles of real estate economics | |

|

Day 2 |

Plotting, Site Verification, Area Computation |

|

Day 3 |

Avoiding fraud through registration and documentation |

|

Days 4 & 5 |

How to Do It Yourself: Valuation of subject lots and lots with improvements |

|

Day 6 |

Evaluating the marketability of the proposed project |

| Determining what is the best project for the given location | |

|

Day 7 |

Legal aspects of buying and selling real properties |

| Sample documents | |

|

Day 8 |

Installment Sales and other financial techniques in build and sell |

|

Day 9 |

Mathematics of Investment made easy by using computers and financial calculators |

|

Day 10 |

Property Development Process – Build and Sell and Related HLURB Rules |

|

Days 11 & 12 |

The Administration Aspects of Implementation and Construction of Build and Sell projects |

| Architect’s services and fees | |

| How to secure Bldg Permits Bldg Permit | |

| Project Administration | |

| Notes on Construction Details | |

|

Days 13 & 14 |

Buying and Selling Techniques |

| Distressed Properties and How to Find Bargain Properties | |

| Setting up your own selling network | |

| After-sales responsibilities | |

|

Day 15 |

Notes on Joint Ventures and How to Apply them in Build and Sell |

| Sample Computation of Sharing | |

|

Day 16 |

Tax Aspects of Build and Sell |

| As Lot Buyer | |

| As Developer | |

| As Seller | |

| As Lessor | |

|

Day 17 |

Property Taxation |

| Sample Tax Computations | |

| Managing your properties | |

|

Day 18 |

Evaluating risks in build and sell |

| Setting up your company: Sole proprietorship vs. Corporation | |

| Additional Notes and Pointers | |

| Summary | |

| Graduation | |

| FIELDWORK AND SITE VISITS | |

|

SITE Day 1 |

Date to be decided by the group members |

| The Uncompleted Townhouse for appraisal | |

| Neighborhood and Community Evaluation | |

| Valuation of the usable improvement | |

| Preliminary Project Concepts | |

|

SITE Day 2 |

Date to be decided by the group members |

| A vacant lot being offered for sale or joint venture | |

|

SITE Day 3 |

Fieldwork. Date may be after Day 5 as decided by class |

| Site evaluation | |

| Checking comparable properties/projects | |

|

SITE Day 4 |

Date to be decided by the group members |

| Back to uncompleted townhouse | |

| Final evaluation of the proposed plans and drawings | |

| Reviewing estimates and specifications | |

| Apply for building permits | |

|

SITE Days 5 & 6 |

Date to be decided by the group members |

| Ongoing construction site observation tours | |

|

SITE Day 7 |

Date to be decided by the group members |

| Observation and participation in actual townhouse marketing activities | |

| NOTE: Participants are free to regularly visit the actual projects and marketing activities until completion and sold. | |

| Above schedule may be changed as needed. | |

How can one register for the course?

The Build and Sell Mentoring Course will start on May 18, 2013.

The learning investment is P38,000.00 inclusive of VAT, venue (with coffee but no food) and handouts. Significant discounts are available for those who pay early, those who register and pay as a group, and those who graduated from Urban’s Real Estate Broker Review course from 2011 to 2013.

Please take note of Urban’s Build and Sell General Conditions.

For more details and inquiries, please text Urban Institute of Real Estate at

cellphone numbers 0916-426-9174 or 0939-137-9242

or send an e-mail to info@urban-institute.com

~

Cherry Vi M. Saldua-Castillo

Real Estate Broker, Lawyer, and CPA

PRC Real Estate Broker License No. 3187

PRC CPA License No. 0102054

Roll of Attorneys No. 55239

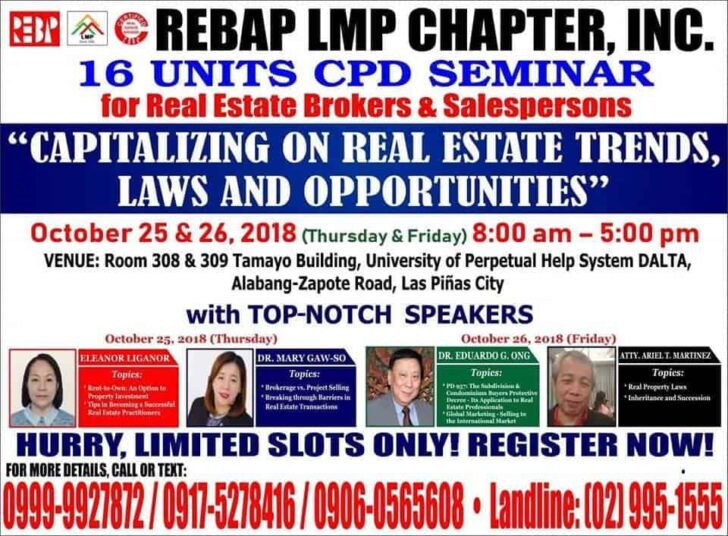

2013 Internal Education Head, REBAP-LMP

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2013 All rights reserved.

Full disclosure: Nothing to disclose.

Picture of Engr. Cruz from Facebook

Hi..

Your build and sell mentoring course sounds very interesting but very costly too!!

Well if the course is worth taking and attendees are guaranteed successful venture while following what was taught religiously then of course the fee is next to nothing.

Just wondering if you have attendees in the past that are now successful applying what was learned from you … is there any link with recommendations and success stories?

Thanks,

Yllen

Hi,

Agree on what Yllen said….. the course fee is too costly….. I am an OFW who is not is this field or on this business of buy and seling too…. but more interested to be in this bussiness… I am an OFW who just want to invest on property for the hard earned money – buying a foreclosed property which i am thinking that i can get them at cheaper price that those from developer…

Another question, how this seminar will change my view or change my interest on putting up an investment into properties, I spent money for seminars and training which I attended during my past vacations… just few of them are useful and some are just like an information…. This seminar sound interesting too but its cost is not an easy one to spent. But investing for seminars and training is not a big deal to me for as long that is worthy. I appreciate receiving the linked from you for those who attended this seminar to get some points…

Appreciate hearing from you soon….

regards,

ed