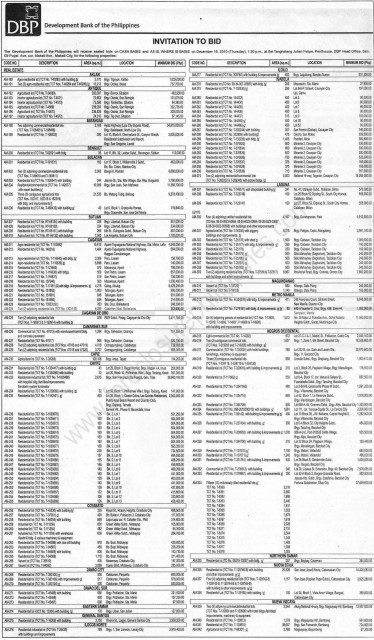

The Development Bank of the Philippines will be having a public sealed bidding of foreclosed properties and/or acquired assets on December 16, 2010, Thursday, 1:30pm, at the Tanghalan Julian Felipe, Penthouse, DBP Head Office, Sen. Gil Puyat Avenue, corner Makati Avenue, Makati City, Philippines.

The DBP foreclosed properties and/or acquired assets are for sale on CASH BASIS. As usual, these are also for sale in an “AS IS, WHERE IS” basis. The complete list of properties for sale can be seen below.

DBP foreclosed properties for sale through sealed bidding on December 16, 2010

Click here to download a copy of page 1 in PDF format

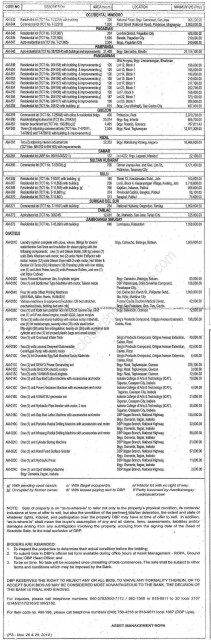

Click here to download a copy of page 2 in PDF format

Source: Philippine Star, November 29, 2010 edition, page B-18 – B-19

Reminders: Please read!

- Don’t forget to take note of the status of the property you might be interested in. A legend of the status codes can be seen at the bottom of page 2 of the list, along with instructions for bidders.

- The telephone numbers which you can call for inquiries are indicated at the bottom of page 2 of the list. Please call them directly if you are interested in any of DBP’s foreclosed properties on the list.

- I am neither connected nor accredited with the DBP Asset Management-ROPA. I am just posting this list as a public service to readers and subscribers of www.foreclosurephilippines.com

Happy hunting!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter:http://twitter.com/jay_castillo

Find us in Facebook:Foreclosure Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Mailbox getting full? Subscribe through my RSS Feed instead!

![Pag-IBIG Foreclosed Properties (May 2025) Online Public Auction/ Negotiated Sale Listings [Part 1] 2 pag-ibig acquired assets for sale 2025](https://www.foreclosurephilippines.com/wp-content/uploads/2022/05/pag-ibig-acquired-assets-2022-728x410.jpg)

![[Updated] 754 BDO Foreclosed Properties in April 2025 List (Negotiated Sale+Bidding) 3 BDO foreclosed properties list for April 2025 now available](https://www.foreclosurephilippines.com/wp-content/uploads/2025/04/bdo-foreclosed-properties-2025-april-728x410.jpg)

my mom has decided to settle their housing loan with DBP. the original loan was 12k way back in the 1970’s. my sister went to have it computed last week and they said it’s already about 242k. can we negotiate for a discount or penalties to be waved? or is it better to wait for it to be foreclosed then buy it thru bidding? i need your reply ASAP so i could instruct my sister what to do, btw, i’m overseas so i can’t do this myself. thanks so much.

Hi Baby51, sorry for the late reply. Yes, there’s no harm in trying to get a discount or waive any penalties/interest incurred, I believe everything is negotiable as long as the end goal is to have a win-win solution for everyone. Better to negotiate before the bidding as other people might have already bought the property by then, especially if it is a bidding for properties that have already been foreclosed by the bank and the redemption period has lapsed. If the bidding you are referring to is an extra judicial foreclosure sale, you still have one year to redeem it.

Pingback: Tweets that mention DBP foreclosed properties for public sealed bidding on December 16, 2010