This post is a contribution from Pinnacle.

We took some time to look at the lending levels and distressed debt levels in the Philippines banking sector to see if we could identify any distressed debt opportunities. In summary, the conclusion is…

While some opportunities do exist for traditional alternative asset and real estate debt and equity players; with Philippine’s distressed debt levels at 15 year lows there are limited opportunities for conventional NPL players.”

Here are our findings:

Opportunity

Distressed Debt Opportunities wrap up:

Universal and Commercial Banks (Total Distressed Debt is 3.86%) – Limited Opportunities and shrinking. (15 Universal Banks, 36 Commercial Banks). With Non Performing Loans (NPL) ratios (1.82%) and Real and Other Properties Acquired (ROPA) levels at 15 year lows, NPL portfolio opportunities are limited.

The Distressed Debt level is at 201.2bb (4.55bb USD) with ROPA at 97bb PHP (2.19bb USD). Here is what we have seen:

- There are some one off opportunities for single borrower credit sales

- Almost all banks have regular and reoccurring auction style ROPA sales at the ”retail level”

- There have been a few recent ROPA and NPL portfolio sale transactions notably by Planters and RCBC Bank to an IFC led group

These sales are quite effective and help quickly clean up the bank’s balance sheets. Strategically, now is the best time to clear any excess and get the Non Performing Asset (NPA) levels even lower and clear out any skeletons in the closets while fundementals are strong and bad news or losses will not be noticed among the flury of all the good news.

With the strong economy and a still buoyant real estate market, banks are less willing to sell at distressed prices and there is a significant bid ask spread in most negotiations. NPL buyers face tight negotiating margins.

Rural and Thrift Banks (Total Distressed Debt is 19.21%) – Opportunities Exist and are growing but with caveats and small deal sizing. (516 Rural Banks, 31 Thrift Banks). While in theory there are opportunities here, the debt levels compared to the overall finance system are not significant (Rural Banks represent 2.4% of system).

Also dealing with mostly “family owned” type banks with attachment to their assets is sometimes fruitless. Distressed Debt in the Rural/Thrift sector is at 26.02bb PHP (591mm USD) of which 8.2bb (190mm USD) is ROPA.

This sector is undergoing some turbulent times with ALL debt measures levels increasing to highs. The Philippine Deposit Insurance Company (PDIC), the government depository insurance and regulatory agency, has closed more than 166 Rural and Thrift banks since 2008.

While the NPLs are increasing, this sector is shrinking and under immense pressure to restructure, consolidate, and clean up the balance sheets. This pressure is not just stemming from domestic agencies but from the IMF and World Bank in their Financial System Stability Assessments.

Some banks are very proactive in their distressed debt mitigation practices by hiring professional asset managers or, if margins and budgets allow, building in-house teams.

Government Agencies- Opportunities Exist. We are just throwing this in there as some of the housing and quasi housing agencies have significant ROPA or loan portfolios.

Government statistics are not covered in this commentary but there are opportunities for patient investors with large amounts of capital who are willing to go through the sometimes very administrative steps in working with some of the agencies.

Others/Non Finance Sector- Mixed Opportunities. There are one off mixed (performing, non performing and real estate) deals from the private sector and developers. These include Accounts Receivable factoring, monetarization of Contracts to Sell, Hospitality development opportunities, and the sale or repositioning of core real estate assets. There are also some aged NPL portfolios formed under the SPAV Law for a secondary sale but the asset mix is usually the bottom of the barrel remaining assets.

Banking Statistics

Let’s take a look at the banking statistics from the Banko Sentral ng Pilipinas (BSP):

Universal and Commercial Banks

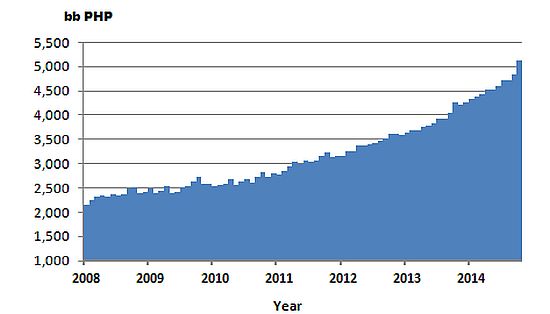

Total Loan Portfolio

Total Loan Portfolio – Since 2008, Total Loan Portfolio (TLP) has risen 105% from 2,502bb PHP to 5,117bb PHP. This huge growth was accompanied by a significant lowering of both absolute and relative levels of distressed debt.

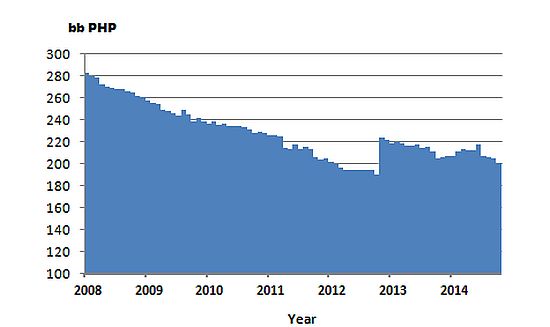

Distressed Assets

Total Distressed Assets- Consisting of NPL, ROPA and other loan provisions Total Distressed Debt ended 2014 at 201.1bb PHP (4.5bb USD) 3.86% of TLP. This is lowest level since the post Asian crisis peak of 29.6% in June 2002.

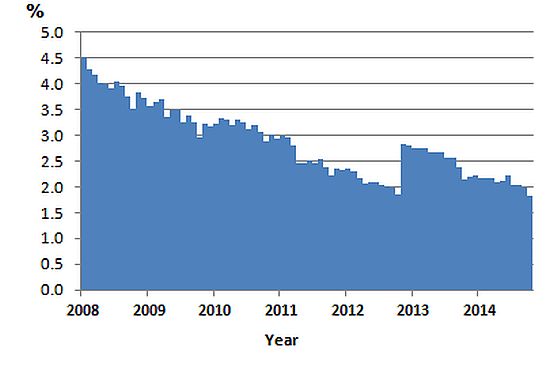

Gross NPL Ratio

Gross NPL Ratio – NPL Levels are at a 14/5 year low ending 2014 at 93.05bb PHP (2.1bb USD) 1.82% of TLP. This is a 14 year low from the 18.1% peak in 2001. The level has been consistently decreasing with the exception of an uptick in 2013.

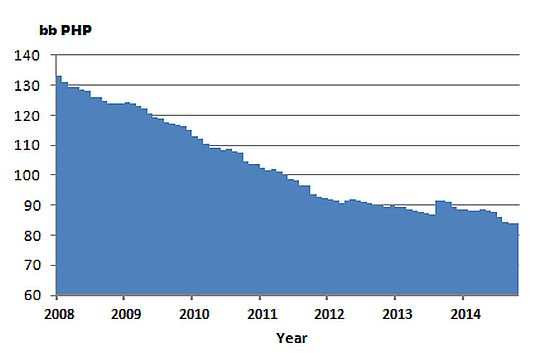

ROPA

ROPA– 84.11bb PHP (1.9bb USD)- decreasing trend assisted by a strong real estate market and bank ROPA auction programs.

Rural and Thrift Banks

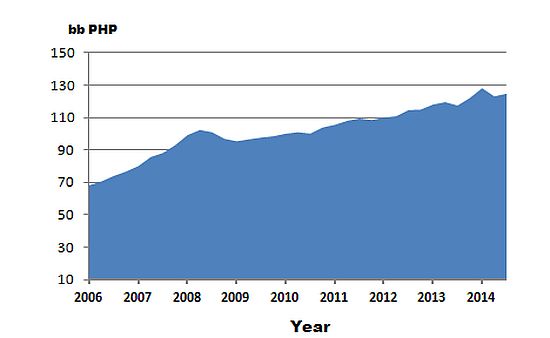

Total Loan Portfolio

Total Loan Portfolio – Since September 2008 Total Loan Portfolio (TLP) has risen a modest 24% from 100.8bb PHP to 124.5bb PHP over 6 years.

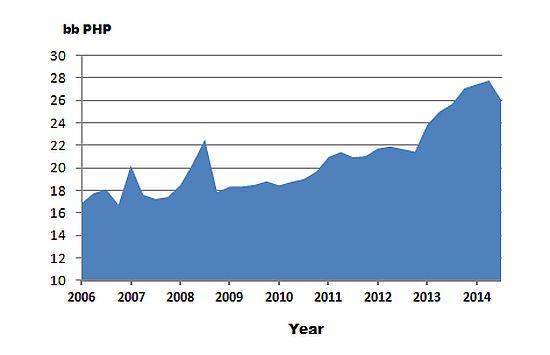

Total Distressed Assets

Total Distressed Assets- Ended Sep-2014 at 26.06bb PHP (591mm USD) with a 19.21% ratio. Levels are alarming with over a 40% increase the last 5 years. This is a trend which needs to be carefully watched by regulators.

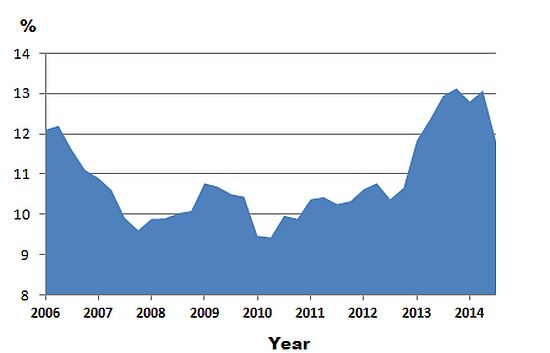

Gross NPL Ratio

Gross NPL Ratio- NPL’s ended Sep-2014 at 14.69bb PHP (330mm USD) 11.8%. Again alarming increases requiring close monitoring and keeping the PDIC quite busy.

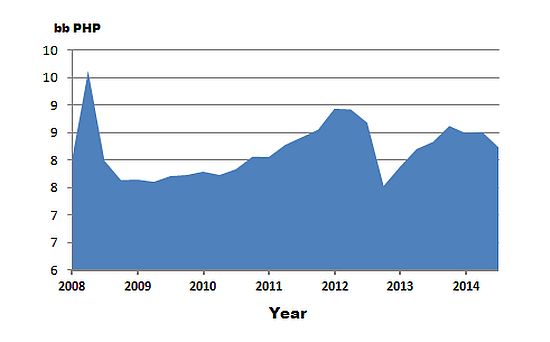

ROPA

ROPA- ROPA ended Sep-2014 at 8.23bb PHP (190bb USD). Progress made in 2013 to reduce levels has been reversed in 2014 and ROPA in fact are at higher levels than when the IMF called for structural reform in this sector in 2010.

Conclusion: “A Tale of Two Cities and white elephant hunting”

The Philippines Banking sector is the classic “Tale of Two Cities” with a handful of strong city banks on one spectrum and a multitude of distressed rural and thrift banks in organized chaos on the other. There should be “No worries” though about the rural and thrift banks. Given the relative size of the rural bank/thrift sector (2.4%), their distressed debt issues will have minimal spillover effect into the overall banking sector. The easing of Foreign Bank ownership rules (RA 10641) paving the way to the entry of new foreign banks might increase competition and bring in greater connectivity with ASEAN and global markets.

Given the still robust real estate market, strong bank balance sheets and positive economic outlook in the Philippines, conventional NPL players will need to search hard and accept tighter spreads to source any deals. While distressed opportunities seem bleak, there are opportunities in a few other sectors. Opportunistic investors should look for yield plays where Cap rates can go north of 10% or a few one off opportunities in hard asset transactions, development deals or hospitality with levered returns. For the brave, of course there are the government agencies but they are like hunting great white elephants.

Pinnacle Real Estate Consulting Services, Inc. provides a full range of services to buyers, real estate lenders and investors. A team of experienced professionals is dedicated to enhancing the value of clients’ investments throughout the Philippines.

Hi Jay, Thanks for sharing this article. It seems that if you based investing on this article, you might be disheartened as there is a small compelling need for large banks to sell at lower prices. In spite of this, given the training you gave a few weekends ago, deals can be found. What is the news on the proposal to lower the loanable amount to only 60% of assessed value? Is this coming soon? Thanks and more power to you.

Hi Greg, sorry for the late response as this is a post from our friends at Pinnacle (I think I forgot to configure comment forwarding to them).

Anyway, were you one of the attendees in the Usapang Foreclosed Property investing seminar (and webinar follow-up?)? If yes, thanks for coming!

I believe the BSP directive will take effect in 2016 to give banks more time to prepare. I think this will further spur the demand for loans prior to the effectivity of the directive.

Thank you also for dropping by!