This is the third part of a series on Financial Literacy for Kids. If you missed the first and second parts, check them out through these links: Part I and Part II.

Now let’s move on to Part III…

Traditional Filipino education

It’s graduation season once again and so I would like to give my heartfelt congratulations to all new graduates and everybody who “moved up”.

Education is the No. 1 priority of Filipinos, but unfortunately, most of us study with the goal of getting a good job. Good school + good grades = good job ergo comfortable and happy life. I think this, in a nutshell, is what the average Filipino gets as financial education – our subconscious “money blueprint” as T. Harv Eker would say. It took me many years to realize that this kind of conditioning is not good.

Knowing now that the assumptions and goals are flawed, I have been thinking about what my idea of financial education is and what I need to unlearn and learn to achieve financial independence.

Knowing now too that a person’s subconscious money blueprint is set since childhood, I know that I need to set my child’s money blueprint to “high”.

A discussion on the “money blueprint” may be found in a short e-book entitled “Get Hardwired for Success: How to Reset Your Mind’s Money Blueprint to Create Automatic Wealth” which may be downloaded for free from http://millionairemindintensive.com/. Basically, the premise is that our subconscious sets the level of financial success that we can achieve, and our subconscious is influenced by verbal programming, modeling, and specific incidents from our childhood. If our “money blueprint” or thermostat is not set to “high” we must reset it. If we can set our children’s “money thermostat” to “high”, then they would have an easier time compared to us.

Of course, there are many more things that are more important than money and I have plans for those as well. But since our topic is financial education, I am sharing my realization that there are two main things that we need to do, namely:

1. Know what you want and how you intend to get it.

Our big problem is we don’t take time to really think this through. And because of this, somebody else tells us what to do! I used to get frustrated because I was so busy that even during my bathtime, eating time, waiting-for-the-fx time, and travel time, I was still thinking of what I needed to do at the office. You really need to set aside time for this.

As a guide, I used Bo Sanchez’s Life Dreams Success Journal.

Basically, you need to write down your Personal Life Mission. Just fill in the blanks:

“My mission is to use my [core gifts] ______ and ________ to ________ and __________ others to _______________.”

To determine your core gifts, according to Bo, ask yourself the following questions:

- What do you enjoy doing?

- What are you good at?

Then write down your Life Dreams in the following aspects of your life: Spiritual Life, Family Life, Work Life, Financial Life, Physical Life, Emotional Life, and Intellectual Life. Next, write down your goals for the current year for each of the said aspects, and how you intend to fulfill them.

I can give my son a copy of the Life Dreams Success Journal but since he is only 8 years old, I honestly don’t know how he will be able to formulate his own goals at this point. The best we can do as parents is to be a good example and guide, since children get their subconscious money blueprint and goals in life based on what they see from their parents.

Every now and then we can talk about goal-setting, and give our children ideas of what could be twenty years or more down the road. We can talk about our childhood and what we did that led to what we are now. We can talk about relatives with inspiring rags to riches stories. We can read about the lives of successful entrepreneurs, the challenges they faced, and how they triumphed against all odds.

The story of John Gokongwei, Big John, is a good book that would inspire children to dream big and plod on inspite of challenges and setbacks. You can buy it at National Bookstore for P125.

2. Practice self-control.

Think about these two major personal finance equations:

Net worth = Assets – Liabilities

Cashflow = Income – Expenses

(Fellow accountants, I ask you to suspend your accounting knowledge regarding cashflow as I am making this discussion as simple as possible.)

Logically, to increase net worth, one should increase assets and decrease liabilities. To increase cashflow, one should increase income and decrease expenses. In order to do all these, self-control is a must.

- You need to have self-control to “do what you have to do” – work harder to get more active income.

- You need to have self-control to set aside money for investments that would give passive income, and to allocate money to the different “money jars”.

- You need to have self-control to pay off debt and not incur bad debt.

- You need to have self-control to lessen expenses and spend less than what you earn.

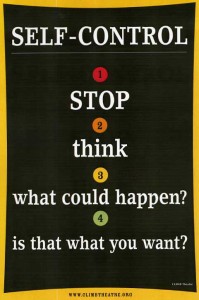

But how does one practice self-control? I got this idea from Bo Sanchez’s talk last Sunday – give yourself the gift of the “gap”. Common sense – think before you act. You’ve got to admit, we are all guilty of acting first then thinking later.

So, before doing (or not doing) anything, think about what will happen ten or twenty years later if you indeed do (or not do) whatever it is you are thinking of doing or not doing, and whether the end product will be in line with your personal goals. If it will be bad for you in the long run, or if it would bring you farther from your goals, the mere thought of the consequences should stop you from doing the act altogether.

For example, before spending your money on a gadget you don’t need and not investing it for the future, think about its effects twenty years down the road. Perhaps you may realize that twenty years down the road, the gadget would be worthless (probably just after a year or two from purchase). Furthermore, twenty years down the road, you may be needing money for medicines, surgery, or daily expenses, and you would have had enough money had you invested the money instead. These thoughts should help you control yourself and make you do the right thing.

I realized that you need self-control for everything, not just money matters. If you are dealing with many problems and thinking of ending your life, do this exercise and I believe what you need to do will be clear to you.

Now, how do we teach self-control to kids? I believe we have to formulate activities that would help them practice self-control in little ways, a la MegaSkills by Dorothy Rich (which I highly recommend, by the way).

Wow, a little googling led me to Self-Control in a Box, somebody actually already thought about this (so much for my bright idea).

“The 100 cards in this game teach children how to keep their cool and persevere, even under difficult circumstances. The cards will show children how important it is to learn self-control and give adults practical ideas on how to work with impulsive children.”

Of course, we don’t need to spend money to give lessons on self-control.

Children make decisions on many things on a daily basis, and any action they take leads to natural consequences if parents do not shield them from such. Take for example, doing or not doing assignments. If a child is unable to control himself to do his assignments, he will get a grade of zero on the said assignment. As parents, we can help him process and mine the situation to make him realize that the zero grade is a consequence of his lack of self-control, and if he does not want it to happen again, he needs to do what he needs to do – which is to finish his assignment.

Personally, I struggle with self-control everyday. I envy those who have mastered and internalized this. I noted that usually, control comes from external forces – you will do something because you are “forced” to, otherwise you will be fired, you will fail, you will go to jail, etc. But if you are able to make yourself do something without any external force, and due only to your internal desire to succeed and fulfill your goals, that is really something. The lack of self-control can really destroy a person, and the presence of it can propel a man to the greatest heights. Surely it is worth our while to inculcate self-control in our children.

“Like a city whose walls are broken through is a person who lacks self-control.” ~ Proverbs 25:28

“He who controls others may be powerful, but he who has mastered himself is mightier still.” ~ Lao Tzu

What do you think? We would love to hear your comments and suggestions.

~~~

Cherry Vi M. Saldua-Castillo

Real Estate Broker, Lawyer, and CPA

PRC Real Estate Broker License No. 3187

PRC CPA License No. 0102054

Roll of Attorneys No. 55239

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2013 All rights reserved.

Full disclosure: Nothing to disclose.

*Self-control photo from http://www.leer-leren.com

*Self-Control in a Box photo from http://www.childswork.com/

Pingback: Financial Education for Kids Part VI: Have a Role Model - ForeclosurePhilippines.com

Pingback: Financial Education for Kids Part V: Getting Used To A Simple Lifestyle - ForeclosurePhilippines.com

Pingback: Financial Education For Kids Part 4: Summer Activities for 2013 - ForeclosurePhilippines.com

Very nice article Cherry!

Thank you DJ! Let’s meet sometime! We would love to learn from you.

Sure Cherry! Il be having a money seminar for Red Cross Youth this April, i’ll see how it works for them 🙂

Many thanks Cherry and Jay, I learned a lot here.

Thanks Ian!