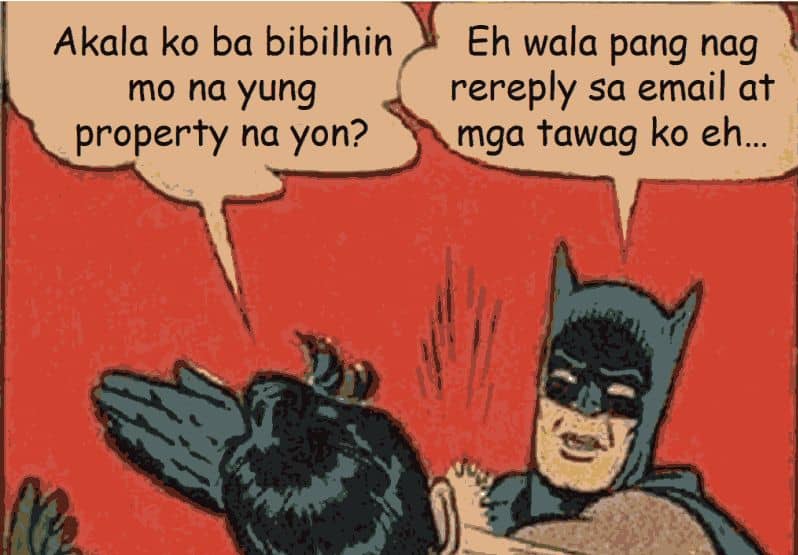

Ever felt frustrated because you inquired about a foreclosed property but never got a reply? I know I have, so I know exactly how that feels. But there’s hope… I’ll share with you what you can/should do, based on how I handled this problem in the past.

This is a step-by-step, along with a lot of tips that can help you get the information you need.

Yes, you need a lot of information before you can buy a foreclosed property as part of your due diligence.

Of course, it makes us all wonder why it’s hard to get property details, when anyone in their right minds would need the info before proceeding with the purchase right?!

So I’ll tackle this issue first…

Why is it hard to get complete details?

Before you get mad, let’s first try to understand what’s happening, so we can find the best way to solve this problem of not getting foreclosed property details.

Too many properties: a challenge for banks/lending institutions

From the perspective of banks, selling their foreclosed properties can be challenging because of their huge number, which can be in the thousands. Each property is unique and will have its own unique set of property details.

Just imagine, if a bank has thousands of foreclosed properties, they would have to maintain the records for all of these (copy of titles, tax declarations, lot area, floor area, description of properties, status, pictures, etc.). To begin with, they must compile all the data for each property… think of the manpower they need to do this, and the time it would take to complete the data.

Some properties actually have no pictures because they have not yet visited these properties. Get the picture? (no pun intended)

Now imagine if you were to inquire about just one of the properties, and it just so happens this was newly added to their inventory, then they might be in the middle of compiling property details. This means you might get the data after several days/weeks.

What if dozens of people are asking for details of dozens of properties per day, then the problem can really get out of hand, most especially if banks/lending institutions have limited manpower to handle them. There can be dozens to hundreds of inquiries per day.

So if we send an email inquiry (or if we fill-out an inquiry form), and if a few dozen other people do the same, then the inquiries pile up. Imagine if you were the bank officer and got 30+ emails in a day. For sure, it would take a long time to answer all of them, and it’s highly possible some might “fall into the cracks” and not get answered at all. Same applies to text messages.

If we try to call, and a lot of people are doing the same, then most likely we will end up with a busy signal. And if we do manage to get through, and ask for details, we might also have to wait for several days to receive the details.

If we go to the bank directly, and if we are patient enough to wait until they finish answering emails or the phone (see above), we might get property details, or only what’s available at that time. We might even get to schedule to visit the property (if it has no caretakers), which can be after several days because tripping schedules can fill-up fast.

Frustrating, I know, but I hope seeing the big picture will help us all find a solution.

What are the banks/lending institutions doing to solve this problem

One thing I can tell you is this, most banks/lending institutions are doing their best to serve their clients, given the situation of lack of manpower. Of course, they cannot just keep on hiring new staff, and they must cope with what they have. Most also accredited licensed real estate brokers to help them (except for Pag-IBIG, which has stopped allowing brokers to sell their foreclosed properties). Has this solved the problem? I’ll discuss this next.

Can accredited real estate brokers solve this problem?

I’ll wear my broker’s hat for a moment so I can answer this.

Problems solved right?

Not exactly. When I was still brokering foreclosed properties, I also encountered the very same problems above. And that means it can still take time for me to get the details needed by prospective buyers, and complete details can really take a lot of time to gather.

I remember that the only viable solution was for me to go to the banks almost everyday, to get details for buyers, most especially if there is an upcoming auction. This gets worse if you handled several banks. This was actually one of the biggest reasons why I decided to stop offering my services as a licensed real estate broker, it was just too stressful.

Another issue with brokers is that they have to focus on certain properties within their area of focus/expertise or niche. This is actually smart for the brokers, because you simply cannot serve everyone. Imagine if you are based in Marikina but a prospect wants to go on a tripping for a foreclosed property in Cavite… or let’s say in Cebu… not something I would want to do.

The smart way is to focus, just like with real estate investing.

However, this might not be so good for some buyers if they are inquiring for properties outside the brokers’ area of focus/expertise. They might not get any assistance, or it could take time, as they have to prioritize those who are within their niche.

If you think about it, this can be addressed by working with other brokers/salespersons outside your area or niche, but you have to ensure that you are not working with any of those who do “unethical practices” (they will steal your clients, bypass you, not give your share of the professional fee, etc.). Which is why I would rather be the owner, not just the broker, because owners can never be bypassed.

Actually there are a lot more issues with brokering foreclosed properties but I’ll just continue in another article.

For now, I want to focus on solving the problems of the buyer, which is to get complete property details and visit the property(if initial checking says it’s worth visiting), which are needed for proper due diligence.

Step-by-step: How to get complete foreclosed property details

I’ll wear my buyer’s hat for this so I can give you step-by-step instructions. Here goes:

- Focus on your area of focus/expertise, and only ask for property details in that target area/location/niche. The property should be in a location you are familiar with, so you can easily find the property yourself, and know if it’s promising or not. Don’t waste your time, and the time of bank officers, or the time of their accredited brokers, by asking for details for a property that’s too far from you, or is beyond your budget, etc.

- Send an email or fill-out an inquiry form for your target property. If you get a reply in an hour or two with complete details, that’s good. If not move on to step 3. (Note: I suggest not asking for details through text/sms, it would be very hard to get complete details on your phone. Instead, you should also include your email address in your text/sms inquiry, so they can send details through email if needed)

- Call the designated bank officer/or their accredited broker. Make sure to call during office hours (Philippine time) to increase the chance that someone will answer. If you get a busy tone, just keep on redialing. Yes, I know, it can take dozens of tries, but until they have enough manpower to answer all calls, we just have to live with this. Once you get through make sure to ask all the details you need. By the way, You can also mention that you emailed/filled-out an inquiry form/or sent a text message earlier, but never got a reply, so that you will get prioritized (hopefully).

- Personally visit the acquired assets department. If they allow it (because of the pandemic, you have to check first), you will have to personally go to the acquired assets department of the bank (usually at the head office) to get the details yourself. You obviously cannot do this for ALL prospective properties you see, so only do this for the most promising properties within your target area/location/niche and is worth the effort.

- Get the services of a licensed real estate broker/salesperson accredited with the bank/lending institution. I put this here last to reiterate that you can actually ask a real estate broker or salesperson to do all of the above for you. Again, just make sure they are duly licensed (check with the PRC using this guide) and they are duly accredited by the bank/lending institution who is selling the property. Of course, having a license does not guarantee that you’ll get the best services, so choose wisely. There are definitely a few “bad eggs” out there that give professional practitioners a bad name, so be careful when choosing who to work with (I suggest you get someone referred by a friend/relative). Of course, treat brokers well and give credit where it’s due.

Bonus tip: Contact the seller/broker directly

Here’s a bonus tip: Make sure you are asking details from the correct people. For example, if you saw an advertisement in Manila Bulletin, you should contact the number on the advertisement directly, NOT Manila Bulletin! This may sound like common sense, but common sense is not so common nowadays.

So in my case, if you see a listing I have shared here in my blog, please contact the seller directly, don’t contact us as we no longer broker foreclosed properties as I mentioned above. Thank you for understanding.

Anyway, the fastest way to get details is to contact the seller directly, and this will avoid any wasted effort and delays.

How can an OFW do this?

Obviously, if you are an OFW, or if you are simply based abroad, it would be difficult, if not impossible, to do the things above (even working with brokers). You will have to delegate or outsource this to someone you trust here at home.

Another suggestion would be to schedule everything so that you can do this when you come home for your vacation, or just do this when you come home for good.

Conclusion

Foreclosed properties are not for everyone. Getting details for a foreclosed property can be difficult and frustrating. This takes a lot of diligence and patience. I suppose that’s the price you’ll have to pay to find prices that can be below market value.

If you don’t have enough patience for this, then maybe buying brand new properties is more suitable for you.

By the way, please remember that even if you manage to get property details, there is a possibility that the information you have is still incomplete. You will have to fill in the blanks, as part of due diligence.

Anyway, I hope my tips above will help you get enough details you need so that you can proceed with doing a reasonable amount of due diligence, before you buy that target property of yours.

Let me know how it goes, or if you have any other suggestions / experiences you want to share, please do so by leaving a comment below. Thanks!

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Blog: https://www.foreclosurephilippines.com

Connect with us – Subscribe | YouTube | Facebook | Twitter

Hi Sir,

Would like to ask, Can a bidding possible if ever the property we have applied for increased its selling price? Last May 2021 we applied for a property with price of 1.035M. After 3 months of waiting for their response, they said that we are approved yet the property increase to 1.170M. Also, we are still checking if the Land Title is already bank-owned or still under the name of the 1st Owner. Hope you can suggest on what to do.

Thanks!

Hi Aleta, was your offer below the listed price? A similar thing happened to a client before (when I was still active as a broker). The bank was re-appraising their properties and they informed my client with the price increase and she had an offer for the original selling price, and they asked if she wanted to improve her offer to meet the price increase (which she did). Are you in a similar situation?

Thank you so much.

You’re welcome Robert, thanks for dropping by!

Concern,

Greetings!

Since 2013 nabili po namin ang unit ky GUILLERMO LUMACTOD Jr. Blk-18 Lt-8 Phs 2 Hermis St. Sunrise Place , tres Cruses , Tanza Cavite, as far as we know this unit was already forwarded to HDMF, I am Interested to Take out the unit, me and my fiancee are both OFW can you give some information how to take this unit? plaese give us proper advice regarding this issue. still hopping for your kind understanding and consideration.

God Bless and more power!

Best Regards,

Lorrie Grace G. Supe

Hi Ms. Lorrie,

Linawin ko lang po, nabili niyo po yung unit, pero bakit po kaya naforward sa Pag-ibig?

Anyway, dapat po maverify niyo kung totoong Pag-ibig property napo siya, tawag po kayo sa hotline nila para malaman saan at sino ang dapat niyo kausapin. Nasa website po ng Pag-ibig ang telephone numbers : http://www.pagibigfund.gov.ph

Im sorry but this is not to join the discussion but to seek some answer from Mr J Castillo. This is about six (6) property lots with 1,014 sq.m. each, which is part of the inheritance from my grandparents and distributed by my parents and his brothers. One of these lots were sold to a corporation based in San Juan MM in 1983 but for unknown reason, the land was never used and abandoned up to this time. Sometime in 1987 one family composed ask permission from my parents to allow them to build a makeshift house inside the premises. The parents died while their children grew and continue to dwell and occupy a portion of the lot. These “children” marries and build their own makeshift house adjoining their deceased parents house but recently, they build semi-permanent home and a store in front of the lot claiming that they have the blessings of the corporation and that they claim to be their “tenant” (in a residential lot?). We tried to stop them but they insist that they have authority from the corporation that owns the lot. Very recently again they started fencing the property which I tried to stop asking them to present document or authority legitimizing their occupancy and color of “ownership” as they claimed to have already paid sizable amount of land tax (which they could not show) just a mere lip service claim. As the heirs of the original owner of the lot wanting to repossess this abandoned lot, we diligently search the corporation that bought the property as well as its officers but we found out that the said company is not registered with SEC, neither with city that it is based. Other information relative to the whereabouts of the corporation (or its officials) proved futile. BEING THE ORIGINAL OWNER, WHAT IS THE BEST ACTION WE CAN DO TO REPOSSESS AND PREVENT THE PRESENT OCCUPANT TO YIELD ITS POSSESSION? CAN YOUR COMPANY DO SOMETHING ABOUT THIS PROBLEM AND HELP US? We are willing to make a deal if there is a legal way to repossess the property. The property is a prime lot in Daet, Camarines Norte located in front of a learning institution. Please advise

Hi Mr. Ramon. I would suggest a thorough background check of the property and our friends from OMI Land Title Services should be able to help you with this. You may call them up and look for Mr. Hardy Lipana or Ms. Rose Cruz, and mention you got their number from me. Here are their contact details:

Hardy Lipana – Business Unit Head

hlipana@omilandtitle.com

884-11-06 loc. 556

Rose Cruz – Marketing Officer

rcruz@omilandtitle.com

884-11-06 loc. 525

Here’s their office address:

20/F LKG Tower

6801 Ayala Avenue

1226, Makati Philippines

Great tips! Hope you can write soon about why you stopped brokering foreclosed properties.

Thanks OJ! Thank you also for dropping by.

As to why I stopped brokering foreclosed properties, yes, I will write about that soon. This post already gives clues as to why I stopped for now. 🙂

Hi OJ, just in case you haven’t read it yet, here are the top reasons why we stopped brokering foreclosed properties: https://www.foreclosurephilippines.com/reasons-why-i-stopped-brokering-foreclosed-properties/

Thanks Jay! I just read your post. Makes sense. Glad you’re back to doing what you love!

You’re welcome and thanks OJ!