This is part 2 of a series on the “Matthew Effect”. If you have not yet read part 1, you can read it here : The “Matthew Effect” and how it applies to real estate investing (Part 1)

Imagine the time when a real estate investor finally nails his first deal. Can that be a stroke of genius, the result of sheer hard work, or just plain luck? I believe it all starts with what Malcolm Gladwell refers to as extraordinary opportunities in his book Outliers, and being the person willing to act upon these opportunities when they come.

For those who have, more will be given…”

I remember from way way back when I always looked at the Sunday edition of the Manila Bulletin (I still do) and looked at their acquired assets section. In fact, I had a big pile at my side table but never got to buying any foreclosed property, it seemed I could not find any that were worth a second look.

Does this sound familiar? Have you ever been in the same situation and had the same feeling?

Things changed however during the early part of 2008. It was during this time when my mentor Jon Abaquin a.k.a. “Doctor Rent”, gave me and my friends (there were three of us) an assignment. After explaining what to look for, we were tasked to find foreclosed properties and analyze them, with the goal of submitting offers, and eventually end up acquiring a property.

After a day or two, from the same pile of newspapers on my table, I found a 9-door apartment from a listing that I had previously looked at. I probably missed it the first time I read that listing because I did not know what to look for.

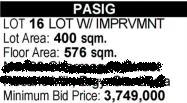

No, the listing did not mention it was a 9-door apartment, it only indicated it was a lot with improvement as seen below.

If you will notice, this had an unusually big floor area and it was most probably a multi-door property. I missed this before but I saw it the second time around and checked and found out I was correct. My mentor, along with his partners, owned a 24-unit property back then. I wanted a similar property.

If you will notice, this had an unusually big floor area and it was most probably a multi-door property. I missed this before but I saw it the second time around and checked and found out I was correct. My mentor, along with his partners, owned a 24-unit property back then. I wanted a similar property.

My offer for the 9-door apartment at Php1.9 M got approved but it turns out the owner was still living in one of the units and the deal is still pending, which is why I blotted out the address (this in itself is another story and I’ll write about it in another article).

Anyway, I believe that the skill of knowing what to look for is a perfect example of how the “Matthew Effect” applies to real estate investing. Once you have that skill, “more will be given” to you.

This is because you will begin to see more opportunities in the form of good real estate deals. The good deals did not really appear from nowhere, you simply could not see them before. They were actually there all along.

After “seeing” the property above, I began to see more good deals, they really exist!

More examples of extraordinary opportunities

From my own experience above, I can see two examples of extraordinary opportunities that went my way.

- I found a mentor. A mentor is someone who can say that he’s “…been there, done that, doing it tomorrow”. (How I found my mentor is another long story.)

- I learned what to look for because of my mentor

I am just thankful that I was given a chance to do so.

But how can one find those opportunities?

I believe one reason why we don’t see those opportunities that come our way is we are too preoccupied doing other things, or we simply let opportunities pass. We hear words like “I don’t have time to do that, I have too much work” or “I have to do this and that…”.

Let me try to explain something by asking the following 10 questions, the very same questions I asked myself before, some of which I still ask myself to this day:

- Have you really tried to make time, instead of complaining?

- Have you really decided to do something rather than just dream about getting out of the rat race through real estate investing?

- Have you taken the opportunity to analyze potential deals during your free time when you came home from work, instead of watching TV which is really just a waste of time? We have had no TV since early 2008, believe it or not!

- To begin with, have you even bought a newspaper or visited bank websites to seriously look for foreclosed properties? Are you just like those who dream of winning the lotto but never buy any ticket?

- Have you really tried to find a location which you can turn into your own niche? You need a niche where you can be an expert so you can easily spot good deals, provided you know what you are looking for.

- Have you tried to go to the banks to get updated listings or at the very least leave your calling card so they can contact you or send you their updated listings when they become available?

- Do you even have calling cards that let people know you are a real estate investor? This alone can open a floodgate of opportunities.

- Have you even tried to learn the whole process of buying a foreclosed property from banks? Even if you don’t have the money yet, start learning so that you will be ready when the time and opportunity comes.

- Have you even attended an auction? I believe attending not only gives you an idea of what goes on, you get to meet other real estate investors, and you also become a familiar face with banks and they will remember you and send you foreclosed property listings and even some deals.

- Have you grabbed the opportunity and took the time to learn from other real estate investors who have had success with real estate investing?

Are you beginning to see the big picture? If you answered yes to some of the questions above, I believe you have found and seized “small opportunities”.

If none, what are you waiting for, Christmas?!

A lot of these small opportunities are actually out there for just about everyone who are willing to grab them, and act upon them. They can lead to a “series of opportunities” and advantages.

This “accumulated advantage” can really help one get started with real estate investing.

But wait, there’s more! I believe the same applies even more when one already has a successful real estate deal.

After the first deal, more opportunities come

When you already have a successful deal, do you believe that even more opportunities will come your way? You bet!

Banks will look at you as a credible and serious buyer and may send good deals your way.

Other real estate investors who get to know you will be more than happy to network with you. You will be “in the loop” and you’ll know it when there are good deals where partners are needed, or other real estate investors simply might send good deals your way.

As your credibility grows, so does the number of people who are willing to work with you.

Aside from other real estate investors, this can also include passive investors, sellers, buyers, real estate brokers, contractors, lawyers, and other people who are involved in the real estate industry.

From those who have nothing, even what they have will be taken away”

In contrast, someone who does not yet have this “accumulated advantage” and still has “nothing” to show for it yet (in reference to his attempt at real estate investing), and may have difficulty finding the opportunities that I have described above.

This can even lead to a downward spiral as the beginning real estate investor, because of the lack of results which happens because of what seems to be the lack of opportunities, simply loses interest.

Another example of having “nothing” which can lead to circumstances where “what they have will be taken away” would be the lack of integrity. As Peter Scotese said:

Integrity is not a 90% thing, not a 95% thing; either you have it or you don’t.”

In real estate investing, or in any business for that matter, would you deal with someone who has no integrity? I don’t think so. And with that, I believe that in a way, all opportunities will be taken away, not by others, but rather by one’s choice to act without integrity.

We always have a choice

In the end, I believe it all boils down to the choices that we make. Yes, we always have a choice. I believe this is the essence and deeper meaning of being proactive.

The choices we make dictate if we will have opportunities and be given even more, or end up with nothing, and even what we have, be taken away.

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Mailbox getting full? Subscribe through my RSS Feed instead!

Image courtesy of scottchan / FreeDigitalPhotos

Great content…informative. Thanks Jay for coming up with this site!

Thank you Dennis for the feedback and for dropping by!

This is very enlightening Jay, thanks for this post. Jay I have a question, how do you know if the property is undervalued or not? Like what I’ve read before it says not all foreclosed properties offered by the banks are undervalued how do I find out if it is or not?

Pingback: Weekly Wrap: A long line that moves slowly and is utterly pointless

Spot on, Jay! Great insights, great content. Your site just keeps on getting better and better.

where can i find a mentor? i want to learn and have financial freedom..

Happy New Year Jay,

I’m a neophyte in real estate buying and foreclosure investing. I appreciate tha things that i’m learning from your regular emails. However, i’m still apprehensive on how to go about it.

May i request that you give me the date of one email/article where in you discussed in detail the whole process ( documents needed, important details to validate, tips on the ocular inspection etc.)of the abovestated subject. I can no longer find it in my inbox.

Thanks and more power…

AMY

Pingback: FIP’s best of 2010 to help you get you started on 2011

In every simple thing that we do, there’s already an opportunity for all of us. In that opportunity, you can learn something new that can be used to gain success. That’s the power of willingness and courage to do everything to reach your goal. That’s the way a real estate investor motivates himself.

Thanks for the post, its true by doing nothing, nothing will ever become of it. Once a decision is made to do something, then you start towards reaching the goal

Happy new year

Jay happy new year

thanks for this information that motivate me, I always looking for investor but till now no one did. Opening your sites motivates me.

Thanks and more power!!!

Hi jay. been reading your article and it inspires me to dream bigger. what is ur opinion about preselling condotels? they seem to be promising because of the return of investment. we have just purchased one. u think this is a good investment? thanks 🙂

Happy New Year Sir Jay, Millionaires pala nakalaro ko sa Cash Flow Game! Its a pleasure to meet you. Nakakainspire po ang posts nyo dito. I like reading it. Thank you for sharing it to us.

thanks so much Jay. I will have to look for simpler deals hehe.

Hi Jay!

I like the fact that the universe operates in a spiral. Shells in the ocean, the DNA, the solar system and of course, our life. We either spiral upward or spiral down. The Bible verses ‘from glory to glory’ and ‘whoever has will be given more’ speaks about this universal principle.

Indeed, it’s a choice. And choices are a habit… either good ones or bad. I like what Darren Hardy said about “having more” in his new book The Compound Effect, “Success is not doing a thousand things half a dozen times. It is doing half a dozen things a thousand times.”

God bless you even more bro!

thanks for the post jay.

it made me realize a lot of stuff.

i might have made some steps, but i was procrastinating on taking bigger steps into achieving my goals….

happy new year to you and your family.

Pingback: Tweets that mention How to find opportunities and get started with real estate investing via Foreclosure Investing Philippines -- Topsy.com

Hi Jay, this is very timely indeed. Everyday, I immerse myself in things related to real estate investing, like listening to audio books, looking for properties for sale, and then asking questions. One, I found out, was pre-selling, which I am not interested in. And then, this one came. I think I have found a motivated seller. He bought this direct from the developer. He has already given the down payment and is paying the monthly amortization for about a year now. It has never been occupied so it is draining his cash flow. He wants to sell this below the contract price. His girlfriend has offered to take me tripping. I am excited but at the same time, I am so scared! What if I offer a certain amount and it gets accepted? What do I do next? Please enlighten. Thanks.

Hi Daryl, thanks for dropping by! In my case, I only deal with banks so my offers are contingent to their approval of my loan. Of course, if I find partners, I have the option to pay cash, although I have yet to do this.

In your case, my suggestion would be for you to make a non-exclusive option to purchase so that if they accept it, you can wholesale it to other investors, or even to end-buyers. If the options lapses, you only lose your earnest money, if any. Another option would be to find investors who are willing to finance the deal. This is more complicated as you have to make sure the numbers make sense and present it to prospective investors, then you need well written contracts to protect you and the investor, then closing. Of course, I have not done this yet myself.

Goodluck and happy New Year!

Thanks for this one Jay, very nice article. I am still looking for the right opportunities and the questions that you posted will be a great help for me.

Thanks Dan! You said the most important thing “the right opportunities…”. I believe you know what to look for. Cheers and Happy New Year!

Cheers to more wealth this 2011!!

Happy New Year bro!!! Here’s to more deals and true wealth in 2011!