In October 2014, I read in the news that the Bangko Sentral ng Pilipinas (BSP) will set a cap on real estate loans at sixty percent (60%) of their collateral values. I did not write about it then as I was not able to research yet on the actual BSP document. I thought of the repercussions of this policy, if true – necessarily, for a person to get a loan, he/she needs to be ready with forty percent (40%) equity (also known as downpayment). Thus, for a person to be able to purchase a P1 million property, he/she needs to have P400,000.00 ready in cash. How many people will NOT be able to purchase a property because of this policy? A lot.

Is the cap for housing loans really 60%?

The Monetary Board approved on October 29, 2014, BSP Circular No. 855 Series of 2014. It embodies the Guidelines on Sound Credit Risk Management Practices. The Media Release on the said circular, which is a little bit easier to understand, can be found here.

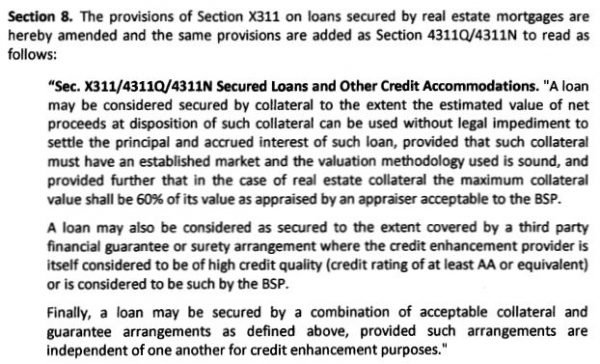

Here is the exact portion of BSP Circular No. 855 which mentions the 60% collateral requirement:

My understanding is that the loan will be considered secured only to the extent of 60% of the value of the real property used as collateral. It does not mean that the banks are allowed to lend only up to 60% of the value of the collateral. If the bank, based on its internal policy and evaluation of the borrower’s cash flow, credit history, and capacity to pay, among others, believes the borrower will be able to repay his/her loan, the bank may still lend an amount in excess of 60%. The amount in excess may be secured using other arrangements or may probably be considered unsecured, for which loan loss provisions may be made, to properly reflect the financial position of the bank.

I believe my understanding is in line with the BSP Media Release on Circular No. 855:

The BSP clarified that the cap on REM collateral value is not the same as a loan-to-value ratio limit imposed in some jurisdictions for real estate lending which is synonymous to a minimum borrower equity requirement. Under both existing and revised rules, the minimum borrower equity requirement is bank-determined internal policy. Current industry practice is a minimum equity requirement reportedly averaging around 20 percent. However, under the enhanced guidelines such internal policy will be subject to close regulatory scrutiny as to whether the borrower equity requirement of a bank is prudent given the risk profile of its target market.

In other words, the equity requirement will depend on the risk profile of the bank’s target market.

My husband has noted that in the sales of BDO foreclosed assets, they now require forty percent (40%) equity while the sixty percent (60%) may be loaned. I believe this is because their requirements for “in house” loans for foreclosed asset sales are not as stringent as the regular loans.

What if the banks would require forty percent (40%) equity?

It is possible that banks would be conservative and require forty percent (40%) equity/downpayment, meaning a downpayment of P400,000.00 for every P1,000,000.00 worth of property. If this is the case, then many people will not be able to purchase a property and will just rent. This is favorable to lessors/real estate investors.

Another option would be for investors to lend at higher rates to those who will not qualify for bank loans, or to offer seller financing schemes. These may be considered as shadow banking which the BSP seeks to monitor.

As for developers, they can stretch the downpayment period so that the monthly downpayment will be affordable. If people will still not be able to buy, I believe the developers can offer some units for lease instead of for sale. This is already being done by at least one developer.

Is this Circular good for the country?

Definitely, this Circular is good for the country because it clearly spells out the details that banks need to look into when granting loans. The main purpose of the BSP is to make sure that our banks are stable and will not be unduly exposed to unmanageable bad loans that may lead to a bursting real estate bubble.

How about you, what do you think?

Is there a law that protects purchasers from delayed turnover? I have been religiously paying my monthly downpayment but I feel shortchanged because sometimes, when I miss the date of payment, I had to pay a corresponding penalty.

The Real Estate company announced two years ago that the turnover date of the units is on April 2016. Unfortunately, I don’t really know the exact reason, now it seems the turnover will be sometime in January 2017.

Can I charge the developer liquidated damages for the delayed turnover? As far as I know, our government had been so useless to look into the welfare of the buyers and I am not aware of such laws.