Do you want to learn how to invest in foreclosed properties but don’t know where to start?

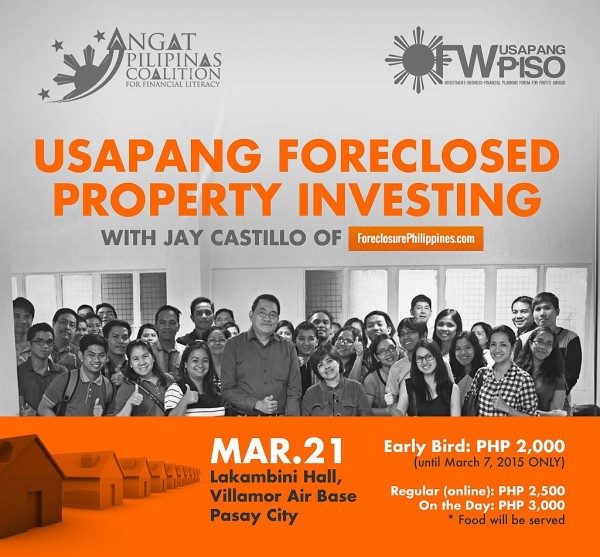

Here’s your chance to get answers. You are invited to the second batch of the “Usapang Foreclosed Property Investing” seminar which will be held on March 21, 2015 at the Lakambini Hall, Villamor Air Base, Pasay City, Philippines. This time we will have a bigger venue, and we will have more time for questions and answers. More details below.

The poster for the second batch on March 21, 2015, which shows the group picture of the first batch with 50 attendees.

Thanks again to Burn Gutierrez and his team for organizing the second run of this seminar and for inviting me back to speak. Thank you also to the OFW Usapang Piso Forum, and the Angat Pilipinas Coalition.

Here’s an outline of what I plan to cover during the seminar:

- Different kinds of properties that come from foreclosures and the pros/cons of buying each kind

- Reasons why I believe it’s best for beginning investors to focus on bank foreclosed properties

- Different ways of making money with foreclosed properties

- How to get started without quitting your job (please don’t quit your job to do this… not yet!)

- Case studies

- Question and answers*

*Note: Dinner will be served, and I believe we can continue with the Q and A while having dinner

Disclaimer: If done right, one can make millions with investing in foreclosed properties, but it can take a number of deals to achieve this, and there are a lot of factors to consider. This is not a “get rich quick” scheme, just wanted to make that clear. Anyway, I’ll cover this during the seminar.

Registration details

Early Bird (extended until March 15, 2015 only): PHP 2,000.00

Online: PHP 2,500.00

On the Day: PHP 3,000.00

Seminar date: March 21, 2015, 5:00pm to 9:00pm

Seminar venue:

- Lakambini Hall, Villamor Air Base, Pasay City, Philippines (the venue is bigger to accommodate more people) – Near Resorts World Manila/NAIA Terminal 3. Google Map to the Venue: https://goo.gl/maps/EOOuI

For more info/registration confirmation:

- Please call/text Angatph at 09178340426

To secure your slot(s), please visit the registration page through the button/link below:

Click here to register for the Usapang Foreclosed Property Investing seminar on March 21, 2015

Grab your tickets now at an online rate of PHP 2,500.00.

But wait… I need your help

Although I already have my outline for the seminar, I need your help. I need to make sure I will cover the most important topics with the allotted time.

Can you please take a few minutes to answer: What are your top two questions about getting started with foreclosed property investing that I absolutely need to answer in this seminar? (please keep in mind that this is a 4-hour seminar, so I’ll try my best to squeeze everything in there).

Thanks and I look forward to seeing you there!

Google Map to the venue

Added March 6, 2015

View in larger map: https://goo.gl/maps/EOOuI

Can you send me when is the next seminar, my email add is almu.spg@gmail.com

tnx

To everyone who attended the seminar, thank you so much, it was great meeting all of you! I apologize that we ran out of time, but as mentioned during the seminar, I hope you will let me make it up to you all through a follow-up webinar with no time limits. 🙂

If you have received an email from our friends from Angat Pilipinas asking for your preferred day/time for the webinar, please reply asap to them so we can schedule it accordingly. I am ready with everything, I just need the schedule where most attendees will be present. If you have not received an email from them, please let me know here.

For those who won’t be able to join the live webinar, don’t worry, I will post a replay afterwards.

Thanks and I look forward to seeing you in the webinar!

Hi Baby, sorry I just read your comment. Were you able to attend? If not, were you able to contact the organizers for a refund? If not, please let me know so we can work something out. Thanks.

Sir jay im an ofw im interested to join in this kind of seminar..tnx

Hi Rommel, we are almost ready for the online training. If you want to get notified when it opens, please subscribe to the early notification list at https://www.foreclosurephilippines.com/members. Thanks!

Hi Jay, i like this seminar. You can still make this without resigning your present job. I myself made 7 figures last year doing real estate foreclosed selling as sideline..

Wow, that’s awesome Laurence! I know it’s possible and you are another one who is living proof. We should meet and catchup soon! Thanks for sharing here!

hi sir jay, off topic but id like to ask regarding my condo unit.

I started paying for a condominium from Century Properties last year June 2014, i paid the reservation fee (25,000) and monthly amortization of (32,000) i also have a payment benefit from them last october of (300,000), so so far, i have paid off 12% of the unit. the unit will be turned over this october 2015, but i cannot continue with my payments anymore. whats the best thing for me to do? Can i find a buyer who will continue the monthly payments and the turnover balance or will i be able to get any refund from the amount that i have paid? Thanks and i am hoping for your response.

Hi Gee, sorry to hear your situation. Unfortunately it cannot qualify under the Maceda Law to get a refund because it does not meet the minimum 2 years payment period. You can try to sell it by assigning to another buyer, but I have no experience doing this with Century Properties, and since this is very urgent, someone who specializes in this (handling resale through assignment of units from that particular real estate development) would be your best option.

Hi Jay,

Some of my suggested topics may be too obvious for some. As

we all have different level of experience and knowledge in this field, some

might find it useful.

*Real Estate insurance – Guidance and recommended companies

*Purchasing and loans – Guidance on how to calculate

costs, fees, renovation and affordability.

It’s often easy to come up with the deposit and can be hard

to keep up the monthly amortization. Specially when circumstances change.

What to take into consideration so your property doesn’t end up being foreclosed – “Don’t bite off more than you can chew” so

to speak.

*What to watch out for when choosing property, sign of structural problem or issues with neighbours etc

Thanks

Excellent suggestions Martin, thanks! I’ll include these topics as well.

Good Day Sir Jay,

Will there be seminar like this in Cebu? Are there any?

Hi Jay, I registered last night mar 8, 2015 for the seminar to be held on mar 21, 2015, my question is, how will i know if I’m already reserved a seat once I pay, I’m asking because from previous seminars I attended they have a phone number which I can call to confirm the reservation. Pls advise. thnx. Warlito Bautista

Hi Mr. Warlito,

Thanks and I look forward to seeing you on March 21. Here’s the number I got from AngatPh to get assistance with registration: 09178340426

Actually they are editing the registration page to add several phone numbers but I’m not sure when it will be finished. Anyway, I have updated the info above with the details I already have.

Thanks again and we’ll see you on March 21!

Hi Jay, I just registered for the seminar, so see you on the 21st. By the way, how do I download the 60-item due diligence checklist? I already subscribed to your site. Thanks!

Hi Nok, thanks! Looking forward to seeing you and everyone on March 21!

With regard to the due diligence checklist, did you receive a confirmation email after you subscribed? Once confirmed, you will then receive a Thank You email with the download link. Let me know if you haven’t received the download link so I can resend. Thanks again!

hi Jay,

i can’t register, is there a number that i can call? Thanks.

Hi Julie, I’m really sorry about the trouble. I already informed the organizers last night that there are a number of you who are unable to register (based on the comments at the registration page). I’ll follow up and come back here with their telephone number for assistance.

Hi Ms. Julie, please call this number so someone from Angatph can assist you: 09178340426

Please let me know if you need further assistance. Thanks and sorry again for the problem. I think it’s a problem with PayPal.

Hi,

I want to know what are the banks that provide an updated listings of their foreclosures online? Some bank when called just say that the property is not available anymore. But i believe PS bank is one who has the most updated online database

Hi Zandro, your question is very hard to answer because it depends. Even the bank you mentioned has properties that are “awarded” (meaning no one else can buy them anymore), but the properties are still on their lists and they don’t remove them until the transaction is closed/booked.

My take on this: the most accurate listings are bank listings sold through an open auction because you can be pretty sure the properties on the list are available until the auction is over, and you will know immediately which properties were sold during the auction. As for properties that are for negotiated sale, you will often encounter the situation you described where a property on the list is not available anymore, and we only find out when we call. For sealed biddings, you will have to wait until the sealed bids are opened to know which properties were actually sold and who were the winning bidders.

Thank you so much Jay for your very helpful reply, May Our Lord Bless you more bro

Hi Jay. Is it possible to include in your topic the pros and cons of engaging a property manager to manage the assets? Say there is a family with 5 rental properties titled under names of 5 children. To do away with hassles of individually applying for business permits etc., would it be advisable for them to put up a corporation in the business of property management? Will BIR tax both the owner and the property manager? What kinds of taxes will they be subject to? Will the benefits of having a property manager outweigh the costs? Thanks in advance and more power to you!

Hi Ellen, yes, I’ll include the topic for property management. It’s an absolute necessity when you have at least 4 properties (in my opinion), and should cost anywhere between 3% to 15% of the monthly rentals. For setting up a corporation and taxation, these are the forte of my wife Cherry, but I’m not sure if she is willing to talk about this during the seminar. Let me try to convince her and get back to you. I’m sure she has seen your message as each comment on this blog is emailed to her but she was mum about this so far since last night and this morning. As early as now, I can say setting up a corporation in your case would be a good option, but you will need an accountant. And the BIR will tax EVERYONE who receives income in one way or another…

Hi Jay,

I think it’s best if you have a downloadable version of your seminar to reach more audience like me who is an OFW.

I’m interested to learn a lot about real estate investing but the problem is that this kind of seminars are not available for the people who are outside the country.

Hi Oliver, as mentioned in an earlier comment, this is exactly the reason why I created an online training course last year (it is ongoing right now, but registration is closed).

I was supposed to re-open last December 2014, but it was deferred due to health reasons (I WAS considered as a pre-diabetic, but thankfully, I am now okay!), which means I will re-open it very soon.

The only thing is, the ongoing training has morphed into something huge as it covers just about every aspect of buying foreclosed properties, it might not be suitable for everyone (think of information overload), so I will spin-off a shorter online training course very similar to this live seminar. Thanks for asking!

1. Investing in foreclosed properties with less capital

2. How to join an auction – a thorough step by step process

Thanks Don, I’ll cover these for sure, thanks!

Good day Mr jay, i just registered to join the seminar, the thing is my tagalog isnt much , will the seminar be in English also?, and can you cover on the ways to get a mortgage loan approval from banks or any mortgage financing institutes possible to be able to start with the real estate business. thanks

Hi Ribhi, thanks! No worries, I prefer to use English when giving seminars. Thanks for letting me know, I will also translate any tagalog questions and answer in English. Yes, I will cover mortgage loans as it is one of the default ways to finance the purchase of a foreclosed property.

i really want to attend but I’m here in Dubai

Hi Elvin. This is exactly the reason why I created an online training course last year (it is ongoing right now but registration is closed). I was supposed to re-open last December 2014, but it was deferred due to health reasons (thankfully I am now okay!) so I will re-open it very soon. Since the online training has morphed into something big (it’s like a whole semester as it covers just about every aspect of buying foreclosed properties), it might not be suitable for everyone, so I am considering to spin-off a shorter online training course very similar to this live seminar.

I am from Cebu and I dont know if there are seminars like this in here. When will this online course start,sir jay?

Hi Bryan, if I am able to address technical issues, this will be open before end of March 2015. You can subscribe to our early notification list at https://www.foreclosurephilippines.com/members/

Thanks.

Thanks din po!…..

Hi Jay:

I am recently busy with acquiring a property for residential sue but because I have been going around and finding out, I would also like to know how I can invest or make profit from selling real estate or possibly build a career in it. Any information which you can share prior to attending this seminar

Thanks for your help.

Nina

Hi Nina, the most basic and highly recommended way is to acquire suitable foreclosed properties that generate rental income, but you will need to choose wisely, you can’t just buy any and “hope” you can rent it out. There are measures of return that can serve as a solid basis for your decision to buy a certain property. You also need to factor in costs for renovations, etc. As to building a career out of it, I would rather say you can build a business out of it. If an IT manager who was avoiding real estate can do it (that’s me), so can you.

Hi Jay,

Thanks for your feedback, I really hope I get to attend the seminar by winning the free ticket but I still would want to join even if I don’t win, I will try to free my schedule for the seminar.

I hope it will cover extensive guide especially for beginners like myself. Yes, it is a good business and I would like to make good money out of it too.

Thanks again

Hello, I just registered. But am not familiar with the area. Can you post directions on how to get there (and which entrance if there are multiple)? Thanks

Hi Chris, thanks! Here’s a link to the venue in Google Maps: https://goo.gl/maps/EOOuI

I’ll also embed this in the article above. Thanks for reminding me.

Hi Jay, can you include in your topic, firms that support investors in performing the due diligence check list for a foreclosed property? if there are any.

Hi Louis, I’ll tackle this when I reach the due diligence portion. I’m pretty sure Orion Maxis Inc. (OMI) can handle doing due diligence. (Disclosure: we outsource our title transfer needs to OMI, and they are also one of our banner advertisers), although you will have to get a quotation from them to get an idea of the cost. FYI, we still giveaway our 60-item due diligence checklist to our e-mail subscribers for free(you are emailed a download link when you confirm your subscription), but I’ll discuss the non-negotiables during the seminar.

i am interested

Di po ako OFW. Can i still join this forum?

Yes Ms. Reya, everyone is welcome. Thanks for asking!

Thanks for your reply sir. I’ll join the next batch. God bless po 🙂

You’re welcome po!

Let me start the ball rolling with these 2 questions I am often asked:

1. How can an OFW invest in foreclosed properties?

2. Is it even possible for an OFW to invest while abroad?