The Quezon City Treasurer’s office will be conducting a tax foreclosure auction of properties certified to be delinquent in the payment of real property taxes on December 6, 2012, 10:00am, at the Ground Floor,Taxpayer’s Assessment and Payment Lounge, City Hall Complex, Quezon City, Philippines. This is by virtue of the provisions of Section 260 and 263 of RA 7160 otherwise known as the Local Government Code of 1991.

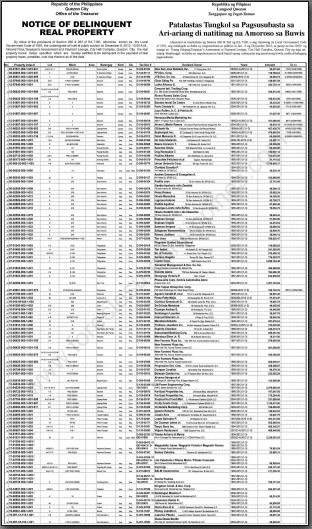

The complete list of delinquent real properties can be found below.

Notice of delinquent real property (auction on December 6, 2012)

Sorry this list is quite big (the PDF file has a size of 4.76MB). Any attempt to make it smaller would make the list unreadable so I hope you won’t have any problem downloading big files such as this. Anyway, you can just click on the image preview below to download the list…

Or just click on the following link:

Rules, regulations, and conduct of auction sale

Most answers to questions about tax delinquent property auctions can be found in the auction guidelines and I have a scanned copy for one of their past auctions (July 2009) that I have attended in Quezon City below. Take note that the scanned copy is NOT the current guidelines, but it can be a good reference for those who might want to learn more about the upcoming auction. A copy of the current guidelines should be available at the Quezon City Treasurer’s office.

Tips for real estate investors

I have previously written tips for real estate investors interested in joining tax delinquent property auctions in Quezon City and they can be found through the following link:

Heads-up: As part of due diligence, we get a copy of the title of a target property right? This can be a challenge for properties in Quezon City. Just recently, I went to the Land Registration Authority (LRA) at East Avenue to get a certified true copy of the title of a foreclosed condo and I was surprised to learn it would take one week for them to release a copy. Before it only took a day or two, but now, it takes seven (7) days to get a certified true copy of a TCT or CCT! I’ll write more about this another post.

Quezon City Treasurer’s Office Announcements, 2013 Payment Deadlines

In related news, here’s a list of announcements (including the auction above) and payment deadlines from the Quezon City Treasurer’s Office as posted in QC’s official website.

Take note that in Quezon City, you can get a 20% discount for your real property tax if you pay on or before March 31, 2013 (in addition to the peace of mind that your property won’t be included in any of their list of tax delinquent properties for public auction). Here’s the list of announcements and deadlines:

- December 6, 2012, 10:00 AM –Auction sale of delinquent Real Properties (Land, Building and Machineries)

- December 28, 2012 –Deadline for payment of Real Estate Tax for the 4th quarter of 2012

- Every 20th of the month –Deadline for payment of Amusement Tax

- Every 20th of the month –Deadline for payment of Market Fees

- January 20, 2013 –Deadline for payment of Business Tax for the 1st quarter of 2013

- January 31, 2013 –Deadline for payment of Professional Tax for 2013

- February 28, 2013 –Deadline for payment of Individual and Corporate Community Tax Certificates

- March 31, 2013 –Deadline for payment of Real Property Tax for the 1st quarter of 2013.

- Avail of the 20% discount if you pay your 2013 Real Property taxes in full on or before March 31, 2013.

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License No. 3194

Connect with us:

Facebook | Twitter | Blog RSS | Google +

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2012 All rights reserved.

Full disclosure: Nothing to disclose.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Mailbox getting full? Subscribe through my RSS Feed instead.

Hi Mr Jay, I went to the last bidding that transpired this July 2013.

Upon checking with RD and LRA, some properties were either ‘not existing’ or ‘cannot be found in the system’. are these safe to bid at?

How about burned titles? Are they safe to bid at as well?

When the redemption period lapses, what are the next steps to undertake? How much more will it cost?

I will appreciate your reply directly to my email ad. Ty

Pingback: Quezon City Tax Delinquent Properties Auction Slated On April 4, 2013 - ForeclosurePhilippines.com

Hi sir, just saw in today’s paper (Philippine Star) that the next auction for tax-delinquent properties in quezon city will be held on april 4, 2013. Would you know where and how I can get a copy of the listing? Thanks.

The initial list was published in this morning’s Philippine Star, pretty sure Jay will post it here. Had the chance to browse it – a lot of condo units included.

Interesting are items 413 and 414 – two lots delinquent since 1985 registered to someone from Batac, Ilocos Norte who goes by the name Ferdinand E. Marcos.

Hi John, thanks for the heads-up, we’ll post the list asap.

Interesting indeed, it appears they are going to auction properties of the late President Ferdinand Marcos…

Thank You for taking time to get back on me Jay,i appreciate it..

when the attorney said the following:

“that the property be divided (equivalent to the number of our the heads living in the property which was around 10)”

They were proposing that the property be developed or be divided(land only) by the winner into 10 which corresponds to the number of our families living in there..and pay it back to them in terms..

Regarding establishing our position,it was a dead end i guess,neither our grand parents knows not a single bit of real land details… the only reason why they where here before was,it was an excess of part of a titled land before they where taking care of for someone.which was sold by the owner..and was forced to move to this excess which no one claims…

i checked on the other land details and it refers to a developer that dont exist anymore..

thank you very much Jay..

You’re welcome Louie. One thing that came to mind was the applicability of the Free Patent Act (RA 10023) on your situation but I realized that since the property had 30 years of tax delinquency, it won’t help establish your position as owners, along with the fact that the property was already sold through auction. I suppose it won’t hurt to find out the details of the winning bidder’s offer.

Great Blog u have here, I have been reading ur blog for no more than a year now..looking for a piece of property i can call my own.. until i came across this part..

i have to tell u frankly,im on the other side of the fence regarding this issue..which u can refer to as the occupants leaving in a certain property in qc (not ours,no title or paper what so ever,its just that it has been with us since 1986 0r 87 not sure)…

until a note last year around nov came to us that the property will be included in the dec 2011 auction in quezon city hall..the note came in with a total tax pertaining to 30years of unpaid dues to the goverment..i have check with the list who the owner was,and i pertained to the developer that is not existing anymore..

Not sure on what to do cause we have no proof to tell it was ours. members of our extended fam ,senior to me,or the ones running the property did nothing…. so i went on to join the auction,thinking it was the right thing to do(brought enough or just right money)–unfortunately,i came in 8 properties late,from the part they were pertaining to us(our location)..and somebody did just got ours for a dirt cheap tag of 100k..

2 months ago they requested for a meeting (with the auction winner and an attorney which holds office in qc,and they, from my point of view ,knows each other for so long and had been doing this together ahead of us before)

Attorney tells us to hold talks(with the winner) to agree on (if we like) that the property be divided (equivalent to the number of our the heads living in the property which was around 10)…

i suggested the we buy back the property and all i had was a smile from both of them..

I suggested that we leave right away and did so ,and left them with a polite notion that we are not interested on their offer and we will look for better options than talking with them..

i will ask you sir..where do i (we) stand here..

i will appreciate any advise you can give me..thank you for reading this..

Hi Louie, I’m really sorry to hear about your situation. I suppose the only option right now is to negotiate with the winning bidder. At least it was not the government who ended up with the property because once the redemption period lapses this December 2012, your chances of getting the property back from the government will be very very very slim. If you are talking to an individual, you have time to negotiate beyond the one year redemption period.

By the way, when the attorney said the following:

what did they mean exactly?

Another thing, what were the circumstances when you and your family started living in that property in 1987? You really need to find someone in your family who knows this to help establish your position.

Hi Jay,

Is this the final list then? or can they still settle the balance until Dec 6?

Thank you.

Hi Miel, the final list will be the list of remaining properties on December 6, 2012, just before the auction. As stated in the notice, tax delinquent property owners can settle their delinquencies anytime up to the auction on December 6, 2012. Thanks for the question!

hi if ever i won the bidding then after a year how can i transfer the title into my name do i need to go to the court and need a lawyer or something or is it too costly.

Hi Che che, yes you need to go through the courts. It should not be too costly.

Hi Jay,

I have a follow up question with regards to Che che’s question. For example you were able to transfer the property to your name but the previous owner or tenants would not vacate the properly? what would be your next course of action?

For properties that were stated as improvement only. Does that only refer to the house and not the lot?

How would you got about in acquiring that property? Won’t there be problems in acquiring those properties?

Thanks,

Hi Andy, in that case, you will have to eject them with the help of a sheriff, something not for the faint of heart.

Yes you are right, properties that are improvement only means the land is excluded, which is something you should stay away from if you ask me, unless your relative owns that land. It’s hard to own a house but not the land it lies upon, it can get really complicated down the road.