Notices for the foreclosure sale of tax delinquent properties in the Philippines always indicate that the sale or auction is being done by virtue of sections 260 and 263 of RA 7160 otherwise known as the Local Government Code of 1991. Rather than include sections 260 and 263 of RA 7160 with every notice of auction sale that I find, I’ll just post them here and link the new notices to this post. You may read sections 260 and 263 after the jump.

The following are sections 260 and 263 of RA 7160 in relation to the tax foreclosure auction of delinquent real properties in the Philippines:

“SECTION 260. Advertisement and Sale. — Within thirty (30) days after service of the warrant of levy, the local treasurer shall proceed to publicly advertise for sale or auction the property or a usable portion thereof as may be necessary to satisfy the tax delinquency and expenses of sale. The advertisement shall be effected by posting a notice at the main entrance of the provincial, city or municipal building, and in a publicly accessible and conspicuous place in the barangay where the real property is located, and by publication once a week for two (2) weeks in a newspaper of general circulation in the province, city or municipality where the property is located. The advertisement shall specify the amount of the delinquent tax, the interest due thereon and expenses of sale, the date and place of sale, the name of the owner of the real property or person having legal interest therein, and a description of the property to be sold. At any time before the date fixed for the sale, the owner of the real property or person having legal interest therein may stay the proceedings by paying the delinquent tax, the interest due thereon and the expenses of sale. The sale shall be held either at the main entrance of the provincial, city or municipal building, or on the property to be sold, or at any other place as specified in the notice of the sale. acd

Within thirty (30) days after the sale, the local treasurer or his deputy shall make a report of the sale to the sanggunian concerned, and which shall form part of his records. The local treasurer shall likewise prepare and deliver to the purchaser a certificate of sale which shall contain the name of the purchaser, a description of the property sold, the amount of the delinquent tax, the interest due thereon, the expenses of sale and a brief description of the proceedings: Provided, however, That proceeds of the sale in excess of the delinquent tax, the interest due thereon, and the expenses of sale shall be remitted to the owner of the real property or person having legal interest therein.

The local treasurer may, by ordinance duly approved, advance an amount sufficient to defray the costs of collection thru the remedies provided for in this Title, including the expenses of advertisement and sale.

SECTION 263. Purchase of Property By the Local Government Units for Want of Bidder. – In case there is no bidder for the real property advertised for sale as provided herein, or if the highest bid is for an amount insufficient to pay the real property tax and the related interest and costs of sale the local treasurer conducting the sale shall purchase the property in behalf of the local government unit concerned to satisfy the claim and within two (2) days thereafter shall make a report of his proceedings which shall be reflected upon the records of his office. It shall be the duty of the Registrar of Deeds concerned upon registration with his office of any such declaration of forfeiture to transfer the title of the forfeited property to the local government unit concerned without the necessity of an order from a competent court.

Within one (1) year from the date of such forfeiture, the taxpayer or any of his representative, may redeem the property by paying to the local treasurer the full amount of the real property tax and the related interest and the costs of sale. If the property is not redeemed as provided herein, the ownership thereof shall be fully vested on the local government unit concerned.”

~~~

To our financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in twitter:http://twitter.com/jay_castillo

Become a Fan in Facebook:Foreclosure Philippines fan page

Text by Jay Castillo. Copyright © 2010 All rights reserved.

Can a private property declared as a road by the owner and duly annotated by ROD as such & has a provision that it CANNOT BE SOLD EXCEPT BY ORDER OF THE COURT, be subjected to Section 260 & 263 of RA 7160?

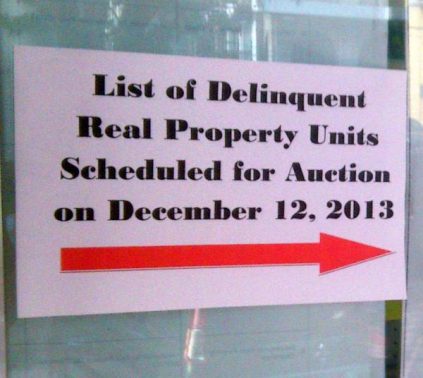

Pingback: No Real Estate Tax Relief For Quezon City - Auction set 12-DEC-2013

Pingback: July 4, 2013 Auction Of Quezon City Tax Delinquent Properties Slated - ForeclosurePhilippines.com

Pingback: Quezon City Tax Delinquent Properties Auction Slated On April 4, 2013 - ForeclosurePhilippines.com

Pingback: Quarterly Quezon City tax delinquent properties auction slated on July 5, 2012 - ForeclosurePhilippines.com

Can an agricultural tenant be able to exercise his right of redemption of his tenanted farmlot under RA 3844, which was foreclosed by the government through tax delinquency of the tax declared owner-lessor.?And if there is such a right, is there a period provided by law to exercise the same?

Pingback: Quezon City Tax Delinquent Properties auction slated on April 12, 2012

Pingback: San Juan Tax Delinquent Real Properties auction slated on February 9, 2012 — Foreclosure Investing Philippines

Pingback: Quezon City Tax Delinquent Real Properties auction slated on December 8, 2011 — Foreclosure Investing Philippines

Pingback: Four tips for investors who plan to invest in tax delinquent real properties in Quezon City — Foreclosure Investing Philippines

Pingback: Caloocan tax delinquent real property foreclosure auction slated today

Pingback: Tweets that mention Sections 260 and 263 of RA 7160 otherwise known as the Local Government Code of 1991

Pingback: Foreclosure auction of tax delinquent real property in Quezon City slated on April 6, 2010