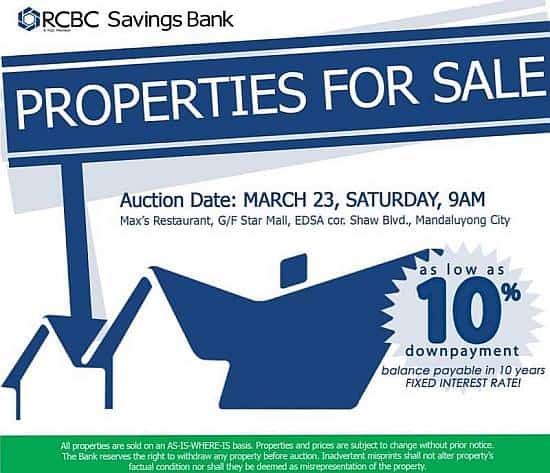

The next RCBC Savings Bank foreclosed properties auction will be held this coming March 23, 2013, Saturday, 9:00am, at Max’s Restaurant, G/F Star Mall, EDSA corner Shaw Boulevard, Mandaluyong City, Philippines.

Interested bidders are reminded to come early to have enough time to register.

This month’s auction includes foreclosed properties from Metro Manila, Northern and Southern Luzon, with fewer properties from the Visayas and Mindanao Areas.

As stated on the auction announcement above, properties can be acquired for as little as 10% downpayment, with the balance payable up to 10 years, at fixed interest rate.

RCBC Savings Bank foreclosed properties listing

Just click on the following link to view the list of foreclosed properties included in the March 23, 2013 public auction.

On the link above, you will also find related forms for buyers, bidding terms, payment terms and interest rates, auction process overview, frequently asked questions, contact details, and more.

Reminder: Please submit all inquiries through the inquiry form which can be found through the link above. Thank you!

Happy hunting

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Connect with us – Facebook | Twitter | Blog RSS | Google +

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2013 All rights reserved.

Full disclosure: I am an accredited real estate broker of RCBC Savings Bank.

PS – Don’t forget to subscribe to e-mail alerts to get notified with updates on upcoming auction schedules, updated listings of foreclosed properties, and real estate investing tips!

![Pag-IBIG Foreclosed Properties (April 2025) Online Public Auction/ Negotiated Sale Listings [Part 4] 2 pag-ibig acquired assets for sale 2025](https://www.foreclosurephilippines.com/wp-content/uploads/2022/05/pag-ibig-acquired-assets-2022-728x410.jpg)

Hi jay

Thanks a lot for this reply. The bank was very accommodating and have suggested the same procedure. The thing is the property is a steal given the price and the actual condition of the property looking from the outside. Thanks again sir.

Hi Sir,

i saw an add from RCBC savings, tried to call the bank and told me that the current owner still occupying the property and it will be the buyers responsibility on how to get rid of the occupants. What will be my difficulties \ risks in case i engage a deal with the bank? do you have experience buying a foreclose with occupants? please share your thoughts. Thanks a lot.

Hi Alfonso, that’s the reason why we chose to exclude occupied properties on the list we published, we do not recommend people to purchase them, unless they know the occupant/former owner.

Our stand is we will not buy an occupied property unless we can have a written agreement with them, before we proceed with buying from the bank.

If you buy an occupied property, you risk spending money with no certainty on when you can make use of the property, unless you reach an agreement with the occupant/former owner beforehand as stated above.

Thanks for the info Mr. Jay. I was able to check the Unang Hakbang prop and there are occupants but I am still interested. If ever I win in the bidding, who will handle evicting the tenants, me or the bank. Thanks in advance and more power!

Hi Belle, you as the buyer will be the one to handle eviction. I highly recommend that you have a written agreement with the occupant before you bid for the property. Please let me know if you want me to discuss this further by filling up the contact form located at https://www.foreclosurephilippines.com/rcbc-savings-bank-foreclosed-properties-for-sale with your phone number. Thanks.

I saw two properties that interest me #158. Basilio St, Sampaloc property and #237.Unang Hakbang St. Q.C property yesterday in the list but now its gone. Does it mean someone got it already through sealed bidding even before the auction day on March23? Pls enlighten me Sir.Thanks!

Hi Ms. Belle, those properties are still available but they have special concerns (they are occupied and/or have legal impediments) and many people who have inquired were frustrated to find out that the property they wanted were occupied, especially after I explain the possible consequences of buying such properties. People suggested that I remove the occupied properties for now and I agree, and I removed them, but I included the update on top of the table.

Sir please advised me, I have a house which is sold to me before foreclosed. I paid the rights in full to the original owner and we make settlement under the supervision of National Home Mortgage. The NHMFC advised me saying before transferring the title under my name there will be litigation and I paid litigation fees. And it is almost 1 year now since payment was made and there is no letters or memos receive from them. Sir can you give me ideas how to deal and proper procedure to acquire property NHMFC. Hope you can help me the matter.

Thank you very much.

Hi Gerry, sorry but I have no first hand experience with NHMFC as of now. What I can suggest is for you to verify as soon as possible the status of the case. From there you will know what would be your next step. Also, don’t rely on them to update you, you will have to be the one to actively do follow-ups to ensure things are moving along as they should.