I remember hot topic at sulit.com.ph which asks about which investment vehicle is better to invest in, real estate or stocks? Of course you would expect me to have a bias towards real estate, but before you make up your minds, let me first try to objectively state the advantages and disadvantages for both, based on what I know.

For the first part of a series, I will only be focusing on one aspect, leverage.

What is leverage?

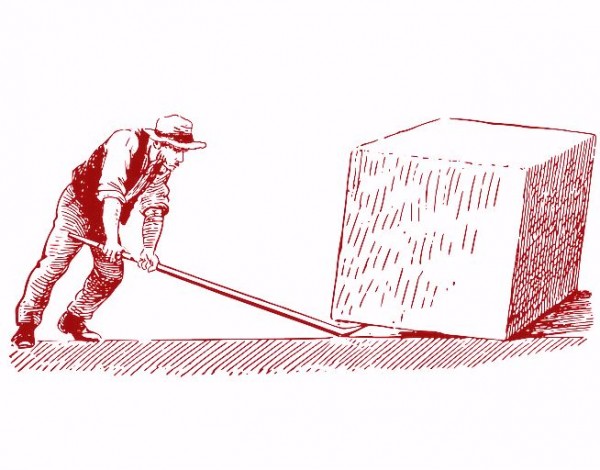

Leverage generally refers to the use of loans or debt to increase a person’s purchasing power. Let me illustrate further below.

If I had Php100,000 cash, how much real estate would I be able to buy?

Most people would answer I can buy a property worth Php100,000, which is true.

However, It is also true that I can actually purchase a property worth Php1,000,000 at 10% downpayment with only Php100,000 cash. The Php900,000 would be covered by taking out a mortgage loan from banks.

Some would say that this is not possible for all types of properties but I can assure you that this is at least possible for all the foreclosed property auctions I have posted in this blog for the past 2 months.

This illustrates how you can use leverage to buy more real estate.

Can I use leverage for stocks?

For stocks however, how much stocks do you think I would be able to buy?

The answer of course is I would only be able to buy exactly Php100,000 worth of stocks.

Can’t I apply leverage for stocks?

Well, I could try to take out a loan to buy stocks but if I did, the bank officer would probably laugh at me or get mad at me for wasting his time, depending on his mood. It is a known fact that no bank in their right mind would ever lend money to anyone to buy stocks.

Why don’t banks give out loans for stock purchases? There are a lot of factors I can think of and I’ll discuss these in the next part of this series.

In the meantime, what are your thoughts about this? Do you invest in stocks or real estate?

Pingback: Finding Dream Tenants and Dealing With Horror Ones

Pingback: Why Is Investing In Real Estate So Much Better Than Investing In Stocks? (Part 3: Control)

Pingback: To all OFW’s: Need To Earn Passive Income And Come Back Home For Good? Try Foreclosed Property Investing! — Foreclosure Investing Philippines

Pingback: Real Estate Investment Trusts (REITs) – The next big thing in real estate

Hi Jay,

Maybe this post is already bit off topic hence it has been almost a year now since the last post.

In this post, you tackled the advantages and disadvantages of stocks vs real estate on the “leverage” per se.

While it is true that banks do not lend you money specifically for stock trading, your stock brokerage firm however, will or maybe willing to give a “margin account”.

Of course, this depends on your credibility as a client (i.e. if you are paying on time – remember the T + 3 rule and how much your account value.)

Using stock leverage, the 100,000.00 Php you used as an initial investment, using a 500:1 leverage would mean that you will be able to buy a stock amount to 500,000.00Php.

This subjects to some agreement though.

You may want to find out the truth about this, you can always try to call your stock brokerage.

Peace.

Oman

Pingback: Secrets Revealed: Investing in Foreclosures

Hi nightwatch, I would also consider investing in stocks if it was a bullmarket. I am currently applying money cost averaging on a certain stock in the PSE as as experiment of mine and also as a form of diversification. =)

One thing worth noting however is that an investment in stocks can POSSIBLY appreciate in value in a short time but we really can’t be sure of this. In foreclosed real estate however, buying a property at a price below market value and introducing improvements (fixing it up or painting it, etc), that will bring the property to move-in or even good as new condition, will certainly allow one to sell it very near or at present market value of comparable properties.

Hi Jay, my answer to this is timing. If it is a bull market, I will choose stocks because of liquidity. That 100,000 can possibly double or triple in a short time in a bull stock market. For real estate 100,000 will jut be the downpayment for a 1M property (if we’re lucky that banks still give this 10% down). Also, 100,000 is just the downpayment, still have to add expenses for repairs.

I would probably park my money in a bull stock market while looking for good investments in foreclosures.

Good Day Sir, I just want to share my opinion.

Real estate Is better than stock in real estate based on my own experience, the value of the property gets increased as time goes by but i think in stocks, you have to maintain and managed and takes a lot of hardwork to earn profit.

Hi Ian, the book is still up for grabs but you should search for the UCPB auction listing in this blog, which should be very easy as there has only been 1 auction from UCPB. =)

Hi Jay,

Just found your interesting site. You have big heart for sharing info and tips. Very noble.

It may not longer be time for Christmas gifts, but I still want to give this a try

“The Php900,000 can be paid off through monthly amortizations. At an annual interest rate of 11% and 10 years to pay, the monthly amortization would be Php12,397.50. A big expense at first glance but the key is finding properties whose rentals can cover not just the monthly amortizations but also the property taxes, insurance, and other expenses on a monthly basis. A real life example can be found in properties listed in a recent UCPB auction. With 1M, you can actually buy 2 properties that would fetch a conservative Php16,000 in total monthly rent. Can anyone tell me which properties I am referring to? The first subscriber to answer here through a comment correctly will receive a free book about investing in foreclosures, including shipping to anywhere in the Philippines. This would be my Christmas gift to you!”

In case still unanswered, send me a copy of that UCPB auction, so this beginner here looks at solving this matter. Email me at gleceper(at)gmail(dot).com

Who knows, it might add to my gifts this coming Christmas. lol 😉

Ciao!

Ian

Hello Jeffrey, mabuhay ka rin and salamat, Happy Investing for the New Year na rin! In addition, investing in large areas of land would be great as a long term investment if it lies right smack in the middle of the direction of growth, it’s like land banking which is being done by big developers. For example, in our recent trip to Baguio, I saw vast tracks of land in nueva Ecija(I think)which had signages of Ayala Land. I could be mistaken but looks like land banking to me. For beginning investors however, I wouldn’t recommend this.

Yes, very interesting points. I’ll follow your advice. Have a great day and mabuhay ka! 🙂

Ok Jeffrey, let me try to give my opinion on the said property. A couple of months ago, I met a fellow investor from Antipolo who has advised me to start investing there because there is still a lot of room for growth, as compared to Marikina where I am currently based. Though I disagree with him because I believe Marikina still has a lot of room for growth, both of us do agree that properties with improvements or structures like houses and apartments, etc. in Marikina and Antipolo are great investments and we shy away from land only. This is because land cannot be made profitable immediately, you can’t rent it out, you will have to develop it(have provisions for water, electricity, sewage, etc) if you want to sell it, or you may need to subdivide it to be attractive to buyers, or you may have to find a developer to partner with. Though it is promising, whatever strategy you may choose to apply, it would take months or years before you get any returns on your investment. Our family is in a similar situation like this right now in Caloocan. In contrast, if you wisely bought a property with improvements or with structures like a house or an apartment in a fairly good condition, you can rent it out immediately, or you can introduce improvements like painting, a little renovation/updating and you can sell it for significant profit. In summary, if you buy land, your money will be tied up for a long time, while with properties that have improvements, you can get your returns in a short amount of time. Did I answer your question?

Happy to know that. 🙂 Thank you.

What are your initial thoughts (without having seen the site) of large properties (thousand sq. mtrs) auctioned at relatively low low prices? Are these necessarily good deal? If otherwise, what are your foreseen problems/condition of this property? For instance, a 2,000 sq. mtr. property in Antipolo auctioned at about 2M, will this ever catch your interest? Thanks in advance.

Sure Jeffrey, I’d be glad to help!

very good insight Jay. Is it possible to get your comment whether a foreclosed property have a good deal? i am a newbie here and im not really well versed in real state. Thanks.

Thanks Bloggista. Actually there are a lot of great deals out there. In fact, in the past 2 months alone, there were more than 20 properties listed in the auction listings I posted in this blog which can be considered as great deals. As you said it would take some good effort to spot them. The method for this would be my focus in the next coming posts in 2009. Thanks for visiting my blog and Happy New Year!

A very insightful post bro. I am not well versed with investing, especially on real estate and stocks. However, I do know that there are some good opportunities with foreclosed real-estate, but it takes some good efforts to spot which properties would give a good return.

The Php900,000 can be paid off through monthly amortizations. At an annual interest rate of 11% and 10 years to pay, the monthly amortization would be Php12,397.50. A big expense at first glance but the key is finding properties whose rentals can cover not just the monthly amortizations but also the property taxes, insurance, and other expenses on a monthly basis. A real life example can be found in properties listed in a recent UCPB auction. With 1M, you can actually buy 2 properties that would fetch a conservative Php16,000 in total monthly rent. Can anyone tell me which properties I am referring to? The first subscriber to answer here through a comment correctly will receive a free book about investing in foreclosures, including shipping to anywhere in the Philippines. This would be my Christmas gift to you!

How about the 900K loan? How do you pay for it? Instead of earning money youd end up very deep in debt?!