For the very first time, I am featuring a listing of properties to be auctioned in a foreclosure sale. During the past year (Yes, Foreclosure Philippines is already more than 1 year old), I have been featuring information and listings for the two most common types of foreclosures we can invest in here in the Philippines. These are bank foreclosed properties or acquired assets and real property being sold through tax foreclosure auctions.

Foreclosure sale auctions

This time around I want to introduce everyone to foreclosure sale auctions. Foreclosure sales are quite new to me which is why I have done my homework by trying to learn as much about them and I shared an overview through my previous posts about Act 3135 as amended by Act 4118.

Where to find notices of foreclosure sale auctions

As per Section 3 of Act 3135 as amended by Act 4118, “Notice shall be given by posting notices of the sale for not less than twenty days in at least three public places of the municipality or city where the property is situated, and if such property is worth more than four hundred pesos, such notice shall also be published once a week for at least three consecutive weeks in a newspaper of general circulation in the municipality or city.”

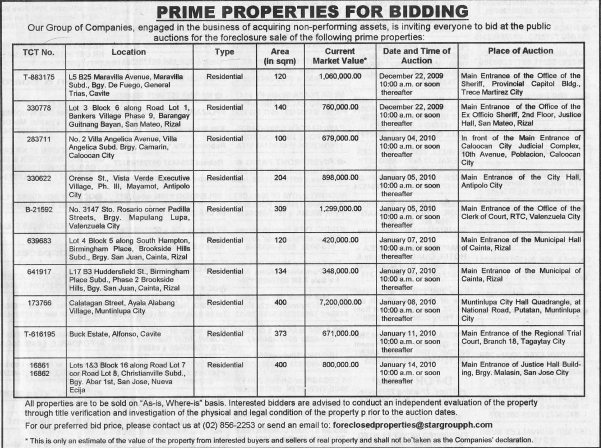

I usually find notices for upcoming foreclosure sales posted outside the Register of Deeds of Marikina City although I often see them after the auction date… bummer. Now however, I was finally able to find a public auction announcement for a foreclosure sale for prime properties through a newspaper ad and this appears to be from the Star Group of Companies.

Source: Manila Bulletin, December 20, 2009 issue

Foreclosure sale details

I would like to share the following information which I got by simply calling to inquire about one of the properties on the list:

- Payment shall be in the form of cash or manager’s checks for the entire winning bid. I believe the winning bidder has five working days to come up with the full payment.

- The creditor will be participating in the bidding and will make the minimum bid which is usually equal to the outstanding loan balance they want to recover. If there are no other bidders, the property will become their acquired asset or foreclosed property, which they will then dispose through a public auction or sell them through negotiated sale as banks normally do.

- The foreclosure sale will be conducted through a sealed bidding.

- The mandatory 12 month redemption period starts when the winning bidder facilitates the annotation of the Certificate Of Sale (COS) on the title of the subject property at the Register of Deeds

- The requirements to participate in the foreclosure sale are available at the office of the Sheriff

- Just in case the previous owner is able to redeem the property before the lapse of the 12 month redemption period, the winning bidder is entitled to earn interest with an interest rate of 12% for 12 months or 1% per month

Please bear in mind that I will have to confirm if the information above are 100% accurate by checking with the office of the Sheriff that covers the location of one of the properties on the foreclosure listing. I’ll post additional information as they become available.

—

To our financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Click here to contact me via E-mail

Mobile phone (Call/SMS): +639178843882

Follow me in twitter:http://twitter.com/jay_castillo

Become a Fan in Facebook:Foreclosure Philippines fan page

Text by Jay Castillo. Copyright © 2009 All rights reserved.

PS. If you are a new visitor, please start here to learn more about foreclosure investing in the Philippines.

PPS. If you feel that anyone else you know might benefit from this post, please do share this to them and don’t forget to subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. If your inbox is getting full, you may subscribe through my RSS Feed instead.

![Pag-IBIG Foreclosed Properties (April 2025) Online Public Auction/ Negotiated Sale Listings [Part 4] 3 pag-ibig acquired assets for sale 2025](https://www.foreclosurephilippines.com/wp-content/uploads/2022/05/pag-ibig-acquired-assets-2022-728x410.jpg)

. .elow sir. Can you please help me with this please?We have a debate in our Law subject and the question is Under Act 3135, which is a better remedy for a breach of contract of mutuum with real estate mortgage.Is it Ordinary Action for sum of money or Judicial Foreclosure of the real estate mortgage?My side is that through Foreclosure of the real estate mortgage.Sir how can I defend it.Can you please help me with this please and what are the legal back ups to defend it.I’m so sorry for t6he disturbance but I really need it.Please answer me through my email. Thank you so much sir and GOD bless you and your family always.

Interesting information! For sure it’s a great chance of making nice investments.

Pingback: Tweets that mention The Star Group of Companies invites everyone to a foreclosure sale of prime properties!