After writing 1,011 articles in this blog about foreclosed properties and real estate investing, I’d like to do something a little bit different.

I thought it would make sense to actually ask you what you want to learn about foreclosed properties.

If you could take just 5 minutes and tell me what is the single biggest challenge that you’re struggling with when it comes to foreclosed property investing, I would really appreciate it!

Most importantly, I’ll be able to use your answers to give direction to the blog and what I’ll publish next. In other words, this will help ensure that I’ll publish topics you specifically want.

Please tell me how I can help you by answering the short survey below:

Click to answer the survey – https://goo.gl/wjhjvf

Thank you!

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Blog: https://www.foreclosurephilippines.com

Connect with us – Subscribe | Facebook | Twitter | Google+

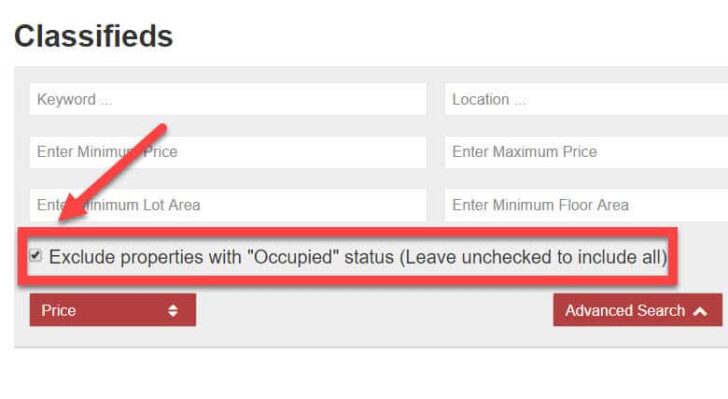

P.S. – I already responded to a common issue I noticed from the survey, which is the difficulty in getting foreclosed property details. Checkout my answer here: Are You Frustrated With Getting Foreclosed Property Details? Here’s How To Do It…

Hello everyone, I moved the survey to it’s own page, so please answer it through the following link:

https://www.foreclosurephilippines.com/survey/

Instead of this blogpost, please leave your answers in the page linked above. Thanks! I’m now closing this thread.

Thank you, Jay (and to your wife) for being generous in sharing your real estate experience and knowledge. This site is a great source of information regarding real estate investing.

Here are some of the questions that I have;

1) Is there a tax law or rule in the Philippinnes like the “1031 Exchange rule” in the U.S.?

2) Real estate investment is a long-term investment. Which has more advantage or a better way to invest (in terms of taxes, liabilities, bank loans, protection, overall cost, insurance, etc);

A) put up a corporation and invest using its name? Or

B) invest under your own name?

Thanks! And looking forward to your online course!

Cheers!

Ton DC

Rizal

You’re welcome and thank you too Ton for sharing your 2 top questions! I’ll get back to you asap…

Hi Ton,

The closest we have to the 1031 is the CGT exemption from the sale of one’s principal residence, although they are still very different. You can check out my wife’s article about it here: https://www.foreclosurephilippines.com/capital-gains-tax-exemption-sale-of-principal-residence/

As for which is better (invest under a corp or as individual), of course using a corp is better protection wise, but you should not let having no corp stop you from getting started. You can always setup a corp later… just my 2 cents.

Doing this via phone so Ill keep it short ftm. Will take brokers exam this may. Thanks to your blog i found rebap seminar. When I pass, ill give inputs and would like to learn more from you. Your blog is a handy resource and i love your writing style. Im a fan and im thinking, when i pass, ill be more frequent here. Ty and God bless you.

Thank you Daniel! Good luck and I look forward to seeing your name on the list of topnotchers!