I was supposed to write a post about the Think Rich Pinoy Seminar which I helped facilitate last December 4, 2010 but it turns out that someone already did. I received an e-mail about what happened during the seminar from Larry Gamboa himself, and I would like to share it with all of you here. Anyway, let me spice it up a bit with some of the pictures I took during the event.

Think Rich Pinoy rocks Manila!

December 4, 2010 MANILA, Philippines – People from all over Metro Manila and some even flew in from different parts of the country to join the Think Rich Pinoy Wealth Seminar at Philamlife Center UN Avenue Manila.

The seminar started with Larry Cleto who spoke about wealth management tackling the Filipino’s inherent trait of not being comfortable in talking about money even with family. He shared that it causes needless rift when you keep mum about finances.

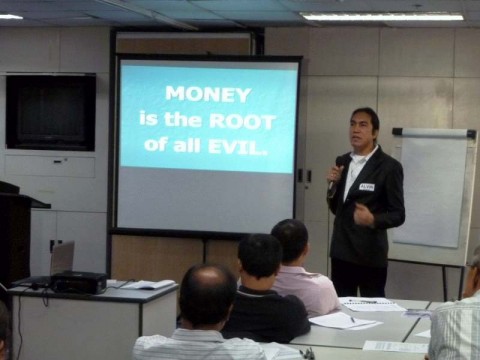

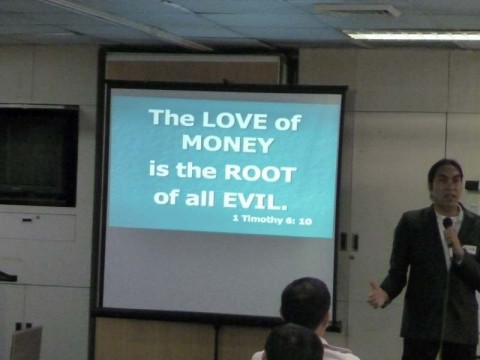

Alvin Barcelona, the “rocker preacher”, wowed the crowd on a different take on the theology of money by overcoming the giants – like nagging thoughts that it is hard to earn money and the absurd thought of losing our friends when we get rich – that hinder us from being wealthy.

Larry Gamboa was in his form when he discussed about the technology of money and what financial literacy is all about. Larry also shared with attendees his 13 secret lessons for success using the experience and journey of Manny “Pacman” Pacquiao as an example.

Aside from these foundation speakers, the attendees had the privilege of hearing Vic Gamboa discuss his expertise on property management and Victoria Lucker, the staging handy woman, who spoke about her passion for designing and renovation.

Also, real estate investors Eden April Alemania-Dayrit and Randy Manaloto gave true to life examples of deals that the participants can aspire for in the future.

Of course, the cashflow game was the runaway winner with the crowd. The attendees felt the joy of acquiring real estate deals and the frustration of getting downsized – at least in the game.

More pictures of people playing cashflow 101:

(All pictures shown here and more were uploaded to FIP’s facebook page, feel free to tag yourselves and those you know who attended the seminar. You need to “like” the FIP page in order for tagging to be available.)

All in all, people were satisfied to the brim and walked away inspired. With eyes and mind open, they are ready to take the next steps to secure their financial freedom.

I suppose this should give an idea of what to expect if you were to attend the Think Rich Pinoy Wealth Seminar. If you are interested in attending the next one, it will be on February 26, 2011. You may visit the following link for more details: https://www.foreclosurephilippines.com/events/think-rich-pinoy-seminar

Happy learning!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2011 All rights reserved.

PS. Change your mindset and start thinking like a real estate investor! Attend the Think Rich Pinoy Seminar on February 26, 2011. Click here to learn more!

PPS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Mailbox getting full? Subscribe through my RSS Feed instead!

Pingback: The risks of real estate investing and how to manage them

Thank you Sir!

So in a nutshell, venturing into the real estate business does entail a lot of homework to do! It’s not as easy as 1, 2, 3 as I thought it to be! 🙂

The concepts and theories presented in your articles are so tempting for a green horn like me to start the investment right now! But just like in any other businesses, there’s much work load to hurdle.

But with positive attitude, coupled with determination, persistence, Sipag at Tiyaga, one will surely succeed.

May you continue to inspire the young generation like me through your dedication in your chosen craft.

GOD Bless!

Citizen Patrol

You’re welcome! That’s a pretty accurate way of looking at it. I like how you put in the positive note. 😉

Thank you also for the encouraging words. Good luck and may God Bless you too!

Hi Jay,

I found your articles very informative, insightful, and enlightening! Keep up the good work! As I browsed through your articles, there is one topic I think that you have not yet written about. You’ve focused on the good side of investing in real estate, but can you come up with a write-up that focuses on the risk of venturing into this business? The opportunities that you highlighted do sound and look promising but I sense there are also risks involved. These questions cropped up when I read some of your articles: Do I need to take this ‘business’ full-time?, because you have lots of homework to do, and maintaining an 8-5 job can take so much of your time; buy and hold strategy looks lucrative but the challenge is looking for tenants, which sometimes take time, and if you get tenants, you have to make sure they are prompt/regular payers; the increase of interest in the bank loan after the fixed-rate period may also be a challenge, and other questions. I hope you can make a write-up which summarizes the risks when venturing into real estate. thanks

Hi Citizen Patrol,

Thanks for the comment. yes, there are definitely a lot of risks involved which is why due diligence is a must, among other things one should keep in mind to minimize risks.

As to the need of doing this full-time, I can say the answer is “no”. Real estate investing can be done part time and I for one have done this.

Looking for tenants is not a problem if one is able to buy a property at a right price (more on this later).

As for increases in monthly amortizations, the answer is getting a fixed rate for the whole loan duration.

Here are a few other things beginning investors should keep in mind and avoid:

1. Risking it all – It is unwise to risk everything for one deal. When i say risking it all, it means risking one’s entire life savings, with little room for mistakes like cost over-runs, unexpected expenses, delayed completion of repairs which can lead to delayed selling/renting of a property etc. Sometimes people make the ultimate example of risking it all, when they resign without first having enough successful deals that produce income that can replace one’s salary.

2. Not doing proper due diligence – This can lead to paying too much for a property where it is virtually impossible to sell it for a profit, or have it tenanted with a nice positive cashflow. Another example of lack of due diligence would be if incomplete checking is done on the legal condition of a property and problems arise later on that can lead to the property being not sellable(for example, the title has problems), or has unexpected costs (arrears for electrical, water, real property taxes, etc.) that will wipeout any profits and lead to losses. Other problems lead to a longer time to get the property ready to be sold or tenanted (for example, repair duration is under estimated).

3. Tenants from hell – One may fall into the trap of getting anyone as a tenant by not screening them, and tenants from hell not only fail to pay on time, they may also destroy the property and turn a would be cashflow generating property into a money pit.

Most of the points I have raised above are mentioned in this article on How NOT to invest in foreclosures: https://www.foreclosurephilippines.com/2009/10/how-not-to-invest-in-foreclosures.html , although there are more risks that one should consider. I’ll write more articles about these in the future.

Thanks again for the feedback!

Pingback: Tweets that mention Think Rich Pinoy rocks Manila!

hi jay, i’m a seaman. do you know when is the next seminar after feb 26. i really want to attend the seminar, but i’m still working right now. my vacation will be on march 7 – may 7. so hopefully there will be a seminar at those times. you might also know, the next seminar of think rich quick by Mr trace trajano. thank yo so much..

Hi Jon, based on previous schedules, the next TRP seminar should be around the last week of May. They do this quarterly.

As for Trace Trajano’s seminars, no definite schedules have been announced at the moment.